ECB Inflation Target Will Be Missed by Far by 2024

ResearchThe inflation rate in the eurozone is likely to exceed the ECB’s inflation target of 2.0 per cent in the period 2022 to 2024 by a greater margin than previously assumed. Median inflation rates of 7.5 per cent, 4.5 per cent and 3.0 per cent are expected for 2022, 2023 and 2024, respectively. In May 2022, the corresponding forecasts were still 6.3, 3.5 and 2.5 per cent. In particular, the developments in energy and raw material prices as well as wages in the eurozone, but also the ECB’s monetary policy, led to the higher inflation expectations. Only the economic development in the eurozone is currently seen as having a dampening effect on inflation. These are the results of the special question included in the ZEW Financial Market Survey in August 2022, in which the respondents were asked about their assessment of the inflation development in the eurozone for the years 2022 to 2024.

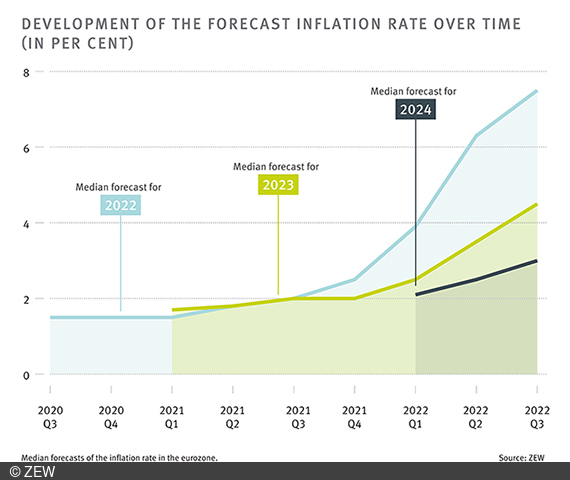

In August 2022, the financial market experts expect median inflation rates of 7.5, 4.5 and 3.0 per cent for the years 2022, 2023 and 2024, respectively. Compared to the last two special questions on inflation in the eurozone in February and May 2022, the forecasts are significantly higher. In May 2022, for example, median inflation rates of 6.3, 3.5 and 2.5 per cent were still expected for the years 2022 to 2024. In February 2022, the corresponding forecasts were 3.9, 2.5 and 2.1 per cent.

Developments in energy and raw material prices as well as wages in the eurozone are driving inflation

In particular, the developments in energy and raw material prices as well as wages in the eurozone led to the increased inflation expectations. Around 77, 63 and 66 per cent of the financial market experts surveyed said that they had raised their inflation forecasts due to these developments.

The respondents also think that the ECB’s monetary policy is too expansionary and is thus driving inflation. While only about 25 per cent of the experts have adjusted their inflation forecasts downwards due to monetary policy developments, about 43 per cent said they had raised them strongly or slightly as a result. The remaining 32 per cent said that the ECB’s monetary policy had no influence on their inflation forecasts.

According to the assessment of some financial market experts, the development of the economy in the eurozone has been putting a brake on inflation in the last three months. Around 38 per cent of the respondents said that they had adjusted their inflation forecasts for the period 2022 to 2024 downwards as a result.

“Financial market experts continue to expect inflation to slow down in the next two years. However, the experts’ forecasts have been moving further and further away from the ECB’s target of 2.0 per cent for several quarters. The sharp rise in inflation expectations is largely due to price increases for energy and raw materials. For about 43 per cent of the experts surveyed, however, the ECB itself contributes to inflation by pursuing an overly expansive monetary policy,” says Dr. Frank Brückbauer, advanced researcher in ZEW’s Research Unit “Pensions and Sustainable Financial Markets”, commenting on the results.