Minimum Wage Reduces Solo Self-Employment

ResearchStudy on Behalf of the Minimum Wage Commission

Especially for low-wage earners, solo self-employment provides an important alternative to regular employment or unemployment. At the same time, however, this also provides a way for employers to get around having to pay the minimum wage, since the minimum wage does not apply to the self-employed. Solo self-employment has decreased since the introduction of the statutory minimum wage in 2015, even in sectors with a high share of solo self-employed individuals, such as janitorial or repair services. “Overall, workers have not been increasingly forced into solo self-employment by their employers despite the minimum wage,” concludes Moritz Lubczyk, researcher in the Research Department “Economics of Innovation and Industrial Dynamics” at ZEW Mannheim.

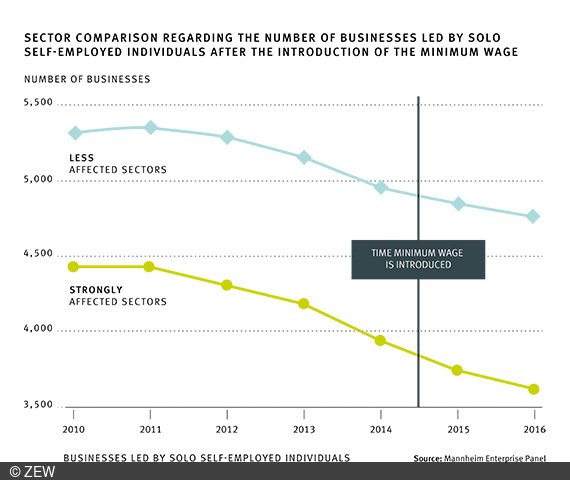

These findings contradict fears that employers would push a great number of employees into self-employment in order to avoid having to pay the minimum wage. At a sectoral level, the overall picture shows that the number of solo self-employed individuals was 7.4 per cent lower in 2015/16 than before the introduction of the minimum wage. These are the results of a recent study of ZEW Mannheim and the Institute for Employment Research (IAB) in Nuremberg on behalf of the Minimum Wage Commission.

“Even before 2015, there was already a trend towards less solo self-employment in Germany. There was much discussion over the question whether the introduction of the minimum wage would put a stop to this trend. The opposite is true: The minimum wage seems to have reinforced this trend,” emphasises Martin Murmann, researcher in ZEW’s Research Department “Economics of Innovation and Industrial Dynamics” as well as the University of Zurich and co-author of the study. Does this mean that the minimum wage should be further increased in light of the coronavirus pandemic and the increasing concerns of the solo self-employed? “Some sectors, in particular the service sector, have seen a rise in solo self-employment as a result of the minimum wage. These are sectors that are also particularly affected by the coronavirus pandemic,” explains Moritz Lubczyk, adding: “This is why it is crucial to carefully analyze this crisis situation and combine measures that take into account the different effects across sectors.”

Database Mannheim Enterprise Panel (MUP)

The study is based on data of the Mannheim Enterprise Panel (MUP) compiled by ZEW, covering firm-level data aggregated at regional and sectoral levels. The MUP is the most comprehensive firm-level panel database for Germany outside of official statistics. Within the framework of the study, the authors measured the causal relationship between the introduction of the minimum wage and the development of solo self-employment by comparing the average hourly wage rate across different regions and sectors. For this purpose, they distinguished between wage rates that were below and those that were above the minimum wage before the introduction of the statutory minimum wage. For wage rates above the minimum wage level, the introduction of minimum pay should not lead no any major changes, while lower wages should automatically see a rise to the minimum wage level. By comparing these sector-specific and regional differences with regard to the effective impact of the minimum wage, the researchers were able to measure the causal effects over time.