Improvement Expected, But at an Extremely Low Level

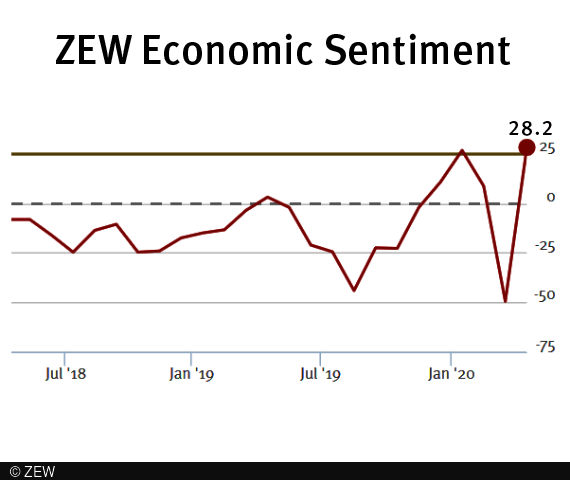

ZEW Indicator of Economic SentimentThe ZEW Indicator of Economic Sentiment Stands at 28.2 Points

The ZEW Indicator of Economic Sentiment for Germany has risen by 77.7 points in April 2020, now being valued at 28.2 points. The assessment of the current economic situation, however, has worsened dramatically, with the corresponding indicator dropping to a new reading of minus 91.5 points, 48.4 points lower than in March. This constellation of values currently witnessed for expectations and the assessment of the current situation roughly corresponds to that seen in April/May 2009 during the financial crisis.

“The financial market experts are beginning to see a light at the end of the very long tunnel. The results of the special questions on the coronavirus crisis included in the survey show that the experts do not expect to see positive economic growth until the third quarter of 2020. Economic output is not expected to return to pre-corona levels before 2022,” comments <link en team awh external-link-new-window>ZEW President Professor Achim Wambach on the experts’ predictions.

Financial market experts’ sentiment concerning the economic development of the eurozone has also considerably improved, bringing the indicator to a current level of 25.2 points for April, 74.7 points higher than in the previous month. By contrast, the indicator for the current economic situation in the eurozone declined by 45.4 points, falling to a current reading of minus 93.9 points.

Although inflation expectations for the euro area have risen by 23.0 points, they are still well in negative territory, currently standing at minus 23.9 points. A further decline in the inflation rate is therefore expected for the next six months.

More information and studies on the ZEW Indicator of Economic Sentiment and the release dates 2020 (as PDF file, 28 KB) and the historical time series (as Excel file, 81 KB)