Germany Risks Losing Its Attractiveness in International Tax Competition

ResearchMannheim Tax Index of the ZEW Measures Effective Tax Burden of Companies in Europe

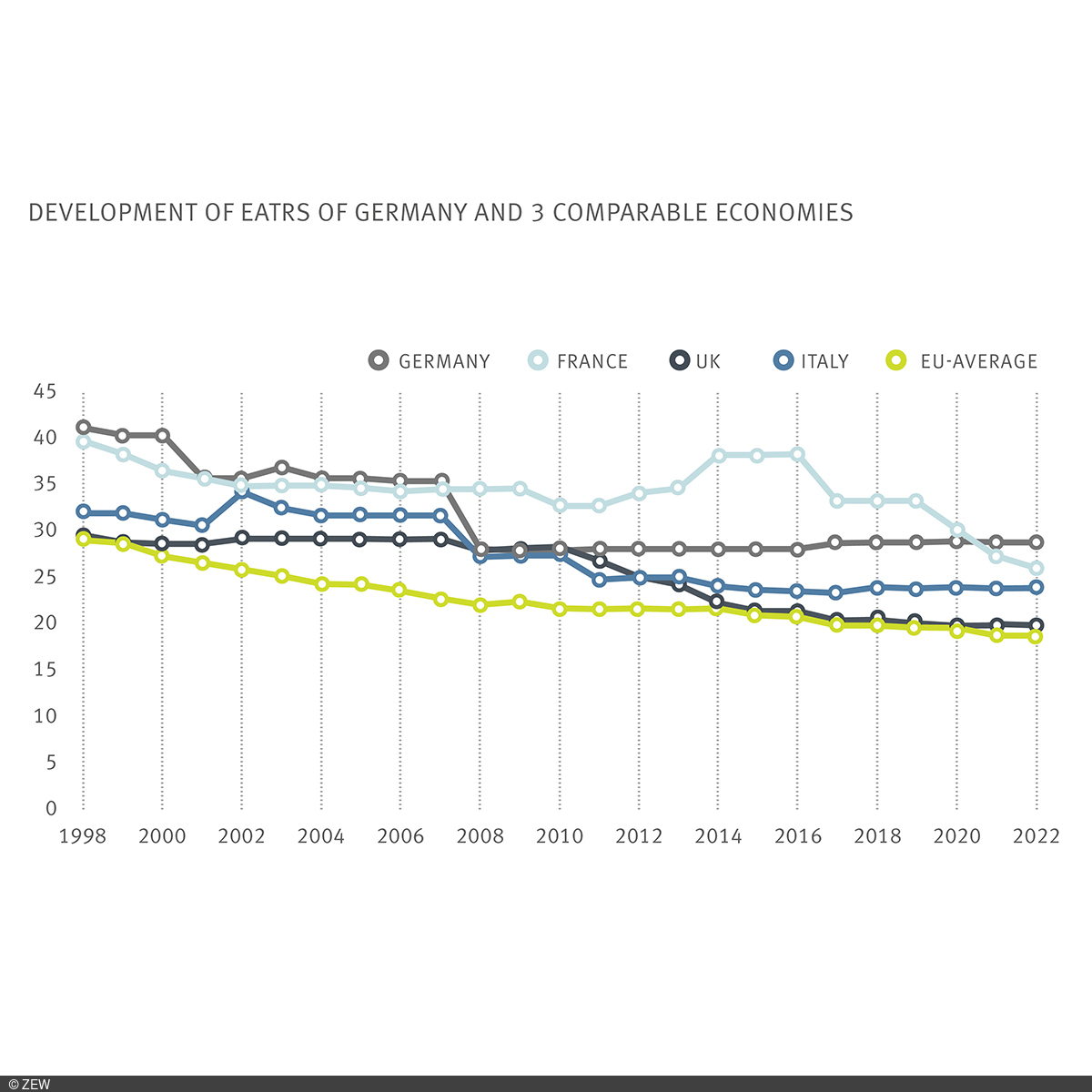

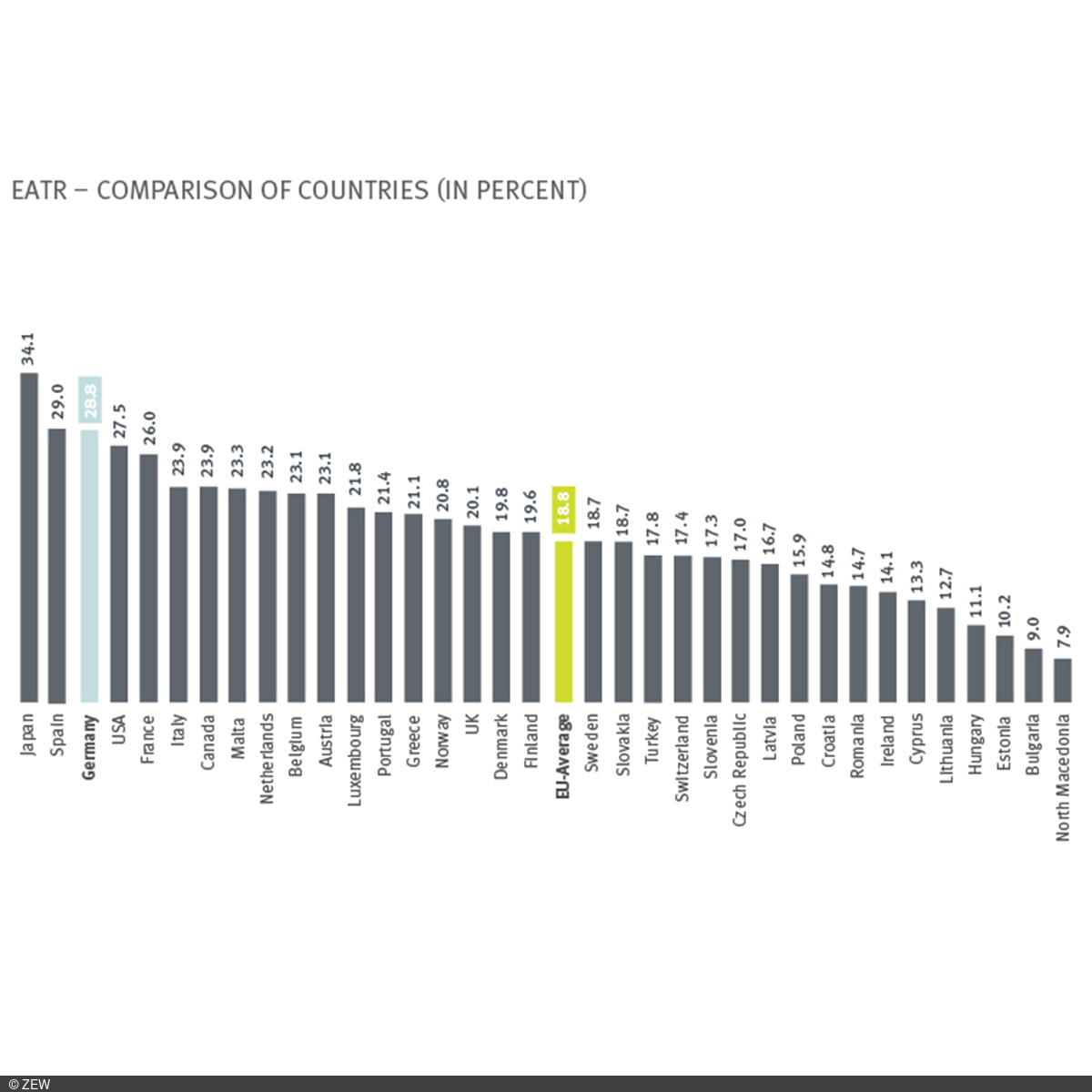

The current Mannheim Tax Index from ZEW Mannheim shows that Germany has lost further ground in international tax competition. This is particularly due to France having lowered its corporate tax rate in recent years. With that said, Germany’s corporate tax burden is now the highest when directly compared with important competitors. The effective average tax burden of a profitable investment project in Germany in 2022 is 28.8 per cent, exceeding the EU average by 10 percentage points.

“Germany has now become a high-tax country for investment compared to France, Italy and the United Kingdom. In terms of the tax burden, Germany’s midfield position among comparable large industrial nations is at risk due to a lack of reforms since the fundamental tax reform of 2008,” emphasises Professor Christoph Spengel, ZEW Research Associate in the Research Unit “Corporate Taxation and Public Finance” and professor at the University of Mannheim. “Without significant reforms in corporate taxation, Germany is comparatively unattractive from a tax perspective for companies that have other investment opportunities internationally,” adds ZEW economist Dr. Daniela Steinbrenner.

Tax rate cuts and depreciation allowances can improve Germany’s attractiveness for businesses

In addition to a general cut in the high profit tax rate – as has been done in France – bonus and immediate depreciation allowances based on the example of the UK offer an attractive alternative to make Germany more attractive. In the latter case, only companies that actually invest benefit from these depreciation allowances. However, a significant improvement in investment dynamics and thus in Germany’s attractiveness as a tax location can only be expected if these bonus and immediate depreciation allowances are broadly structured so that a large number of companies and investments can benefit from them.

Mannheim Tax Index measures effective average tax burden of companies

The effective average tax burden at the company level is an important factor for multinational companies when deciding on an investment location. The Mannheim Tax Index takes into account taxes on companies’ profits and capital costs. The calculations consider both the tariff burdens of these taxes as well as the interaction of the different types of taxes and the most important regulations for determining the tax base. Examples are the regulations on tax depreciation or the valuation of inventory assets. The index covers a comprehensive set of countries (EU 27, United Kingdom, Switzerland, Norway, USA, Canada, Japan, North Macedonia and Turkey) for the period from 1998 to 2022.