Real Estate an Increasingly Less Attractive Asset Class

ResearchSpecial Question in the ZEW Financial Market Survey from March 2023

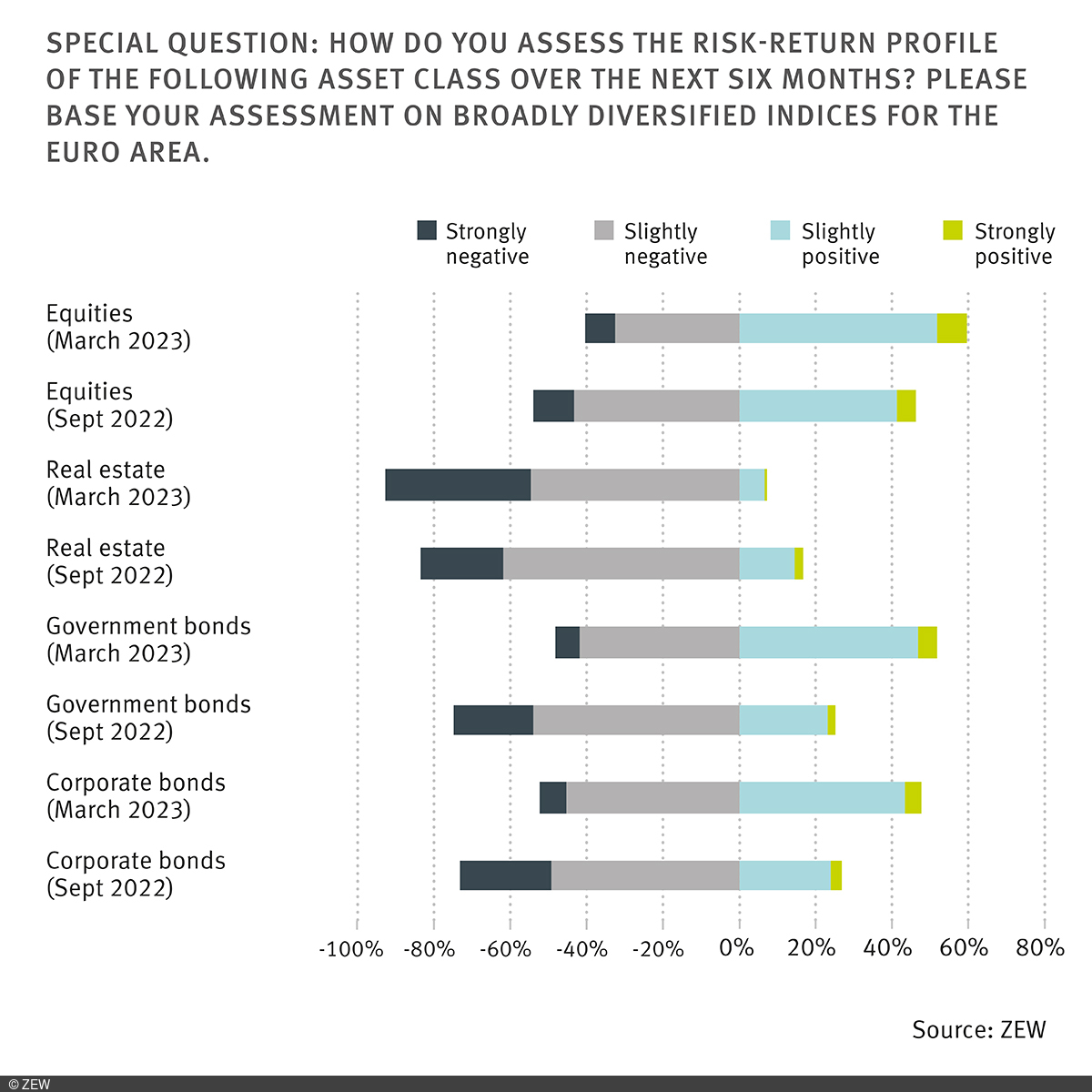

According to the March 2023 ZEW Financial Market Survey, the attractiveness of real estate investments has once again significantly deteriorated. This asset class was already viewed as very unfavourable in the September 2022 Financial Market Survey. According to financial experts, the attractiveness of real estate investments has diminished recently due to a number of factors. Firstly, the already sharp rise in interest rates and the prospect of further interest rate hikes make investing in real estate less appealing. Secondly, according to the surveyed market experts, real estate prices are currently too high, as they have not yet adapted to the changing market environment. Moreover, current political conditions are putting a strain on real estate investments in the eurozone.

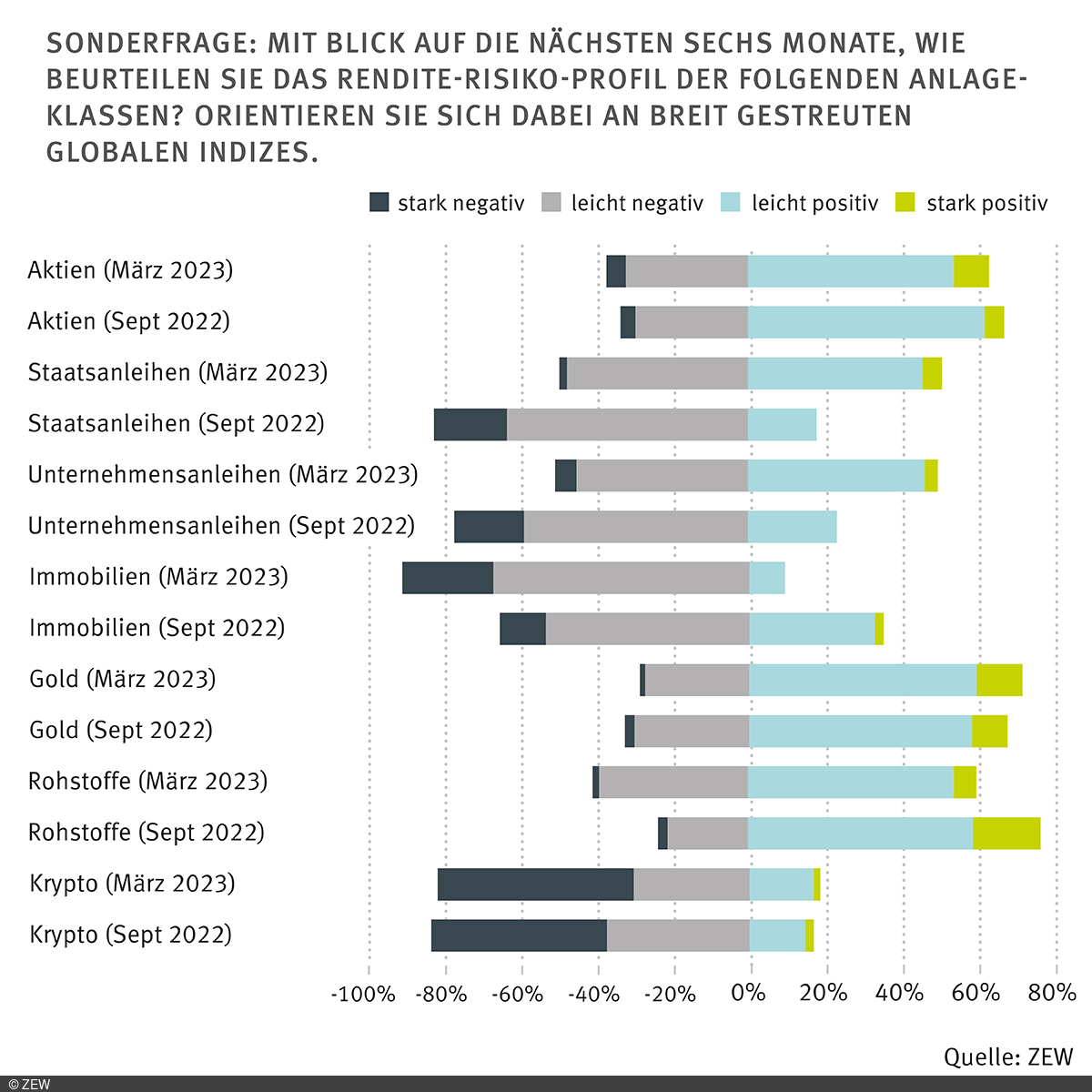

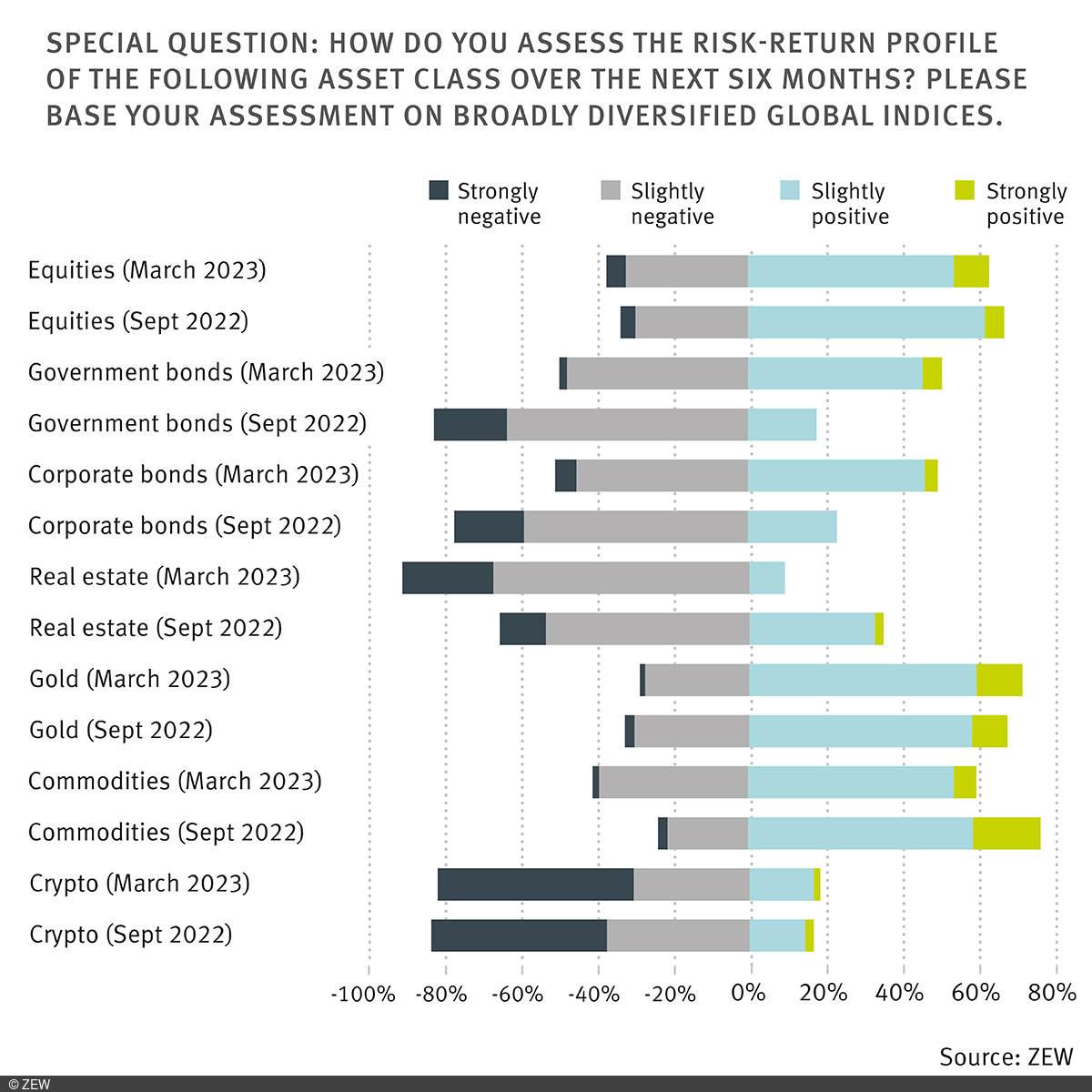

Governments and corporate bonds are slowly winning back the favour of financial market experts after an exceptionally difficult year. Gold, equities, and commodities are being valued predominantly positively, while real estate investments and cryptocurrencies are viewed unfavourably by the majority. Such are the results of the special question from the ZEW Financial Market Survey of March 2023, in which financial experts were asked to give their assessments of various asset classes.

“Compared to September 2022, equities in the eurozone are overall being rated better in terms of their risk-return profile, which the respondents mainly attribute to the overall improved economic outlook for the eurozone. In contrast, investments in broadly diversified, global stock indices, are viewed as slightly less attractive,” comments Dr. Frank Brückbauer, advanced researcher in ZEW’s “Pensions and Sustainable Financial Markets” Unit, on the results.

Government and corporate bonds grow in popularity

Compared to the September 2022 survey, government and corporate bonds have become more attractive as an investment option. Although these bonds promise a significantly higher return than in recent years, the enthusiasm of financial market experts for these types of investment is restrained in view of the uncertainties surrounding the progress of inflation and thus the future development of monetary policy. The continued positive assessment of gold and commodities reflects this uncertainty among financial market experts about the inflation outlook. While the share of those who assess gold positively overall is slightly higher than in September 2022, commodities are currently assessed slightly worse overall.

The survey took place between 13 and 20 March 2023 and was impacted by the turbulence of the financial markets caused by the USA’s Silicon Valley Bank and Switzerland’s Credit Suisse. In terms of corporate bonds, the negative assessments only barely outweigh the positive ones. For government bonds, the opposite is the case, as only a small majority of respondents regarded this type of investment as positive. Of the asset classes included in the survey, gold was rated most positively, followed by equities and commodities.

Click for the ZEW Financial Market Report with the complete results (in German only)

About the Survey

The ZEW Financial Market Survey has been conducted since December 1991. Participants are asked monthly about their expectations concerning the development of major international economies, including Germany, the eurozone, the United States and China. In total, the panel consists of about 350 financial analysts from banks, insurance companies and selected corporations, specifically from the finance, research and economics departments as well as the investment and securities departments. Most of the participants are from Germany.

The financial experts are asked about their expectations on a six-month horizon regarding the development of the economy, the inflation rate, short- and long-term interest rates, equity prices and exchange rates. In addition, they are asked to assess the earnings situation in 13 German sectors. Besides a fixed survey section, special questions on current topics are included on a regular basis. The ZEW Indicator of Economic Sentiment, which has established itself as an early indicator of economic development (“ZEW Index”), is calculated from the expectations of financial market experts on the development of the economic situation in Germany. The results are published and analysed in detail in the monthly ZEW Financial Market Report.