Sentiment Among German Real Estate Financiers Slumps

DIFI Report by ZEW and JLLDIFI Collapses

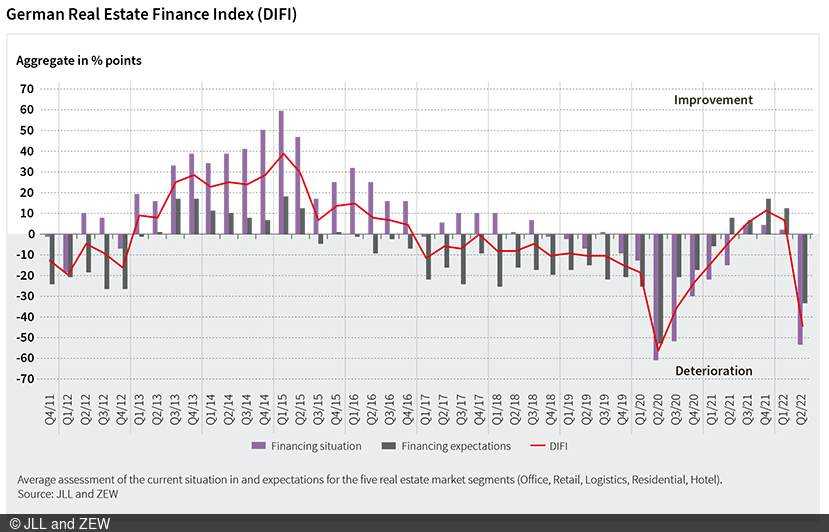

The German Real Estate Finance Index (DIFI) by ZEW Mannheim and JLL slumped significantly in the second quarter of 2022. The index lost 51.7 points compared to the previous quarter and slipped to minus 44.5 points. In the first quarter of 2022, the DIFI had already recorded a decline for the first time in six quarters.

The effects of the sharp rise in interest rates combined with the uncertain economic outlook are creating a sense of crisis in the financing markets. The current situation is assessed much less favourably than the outlook. The situation indicator has fallen by 53.4 points to minus 55 points, the expectations indicator by 35.5 points to minus 48.3 points.

Residential properties most affected

The slump in sentiment in the second quarter affected all asset classes equally. The residential real estate sector was hit the hardest: the situation indicator plummeted by 66.7 points, and expectations dropped by 54.2 points. The hotel sector, on the other hand, was hit relatively moderately, but comes from an already tighter financing level. Especially in the assessment of the next six months, hotels got off lightly with a drop of only 13.7 points. Of all asset classes, the lowest margins are still to be found in residential real estate – even though they recorded the highest increase compared to the fourth quarter of 2021. On average, banks charge a margin of 112 basis points for core products and 162 basis points for value-add products. With 213 basis points for core real estate and a credit margin of 271 basis points in the value-add segment, banks charge the most for hotel financing. An entirely different picture emerges for loan-to-values (LTVs). The average LTVs for residential properties in the core and value-add segments have fallen slightly compared to the fourth quarter of 2021, while they have risen for all other property types. In the core segment, they currently range between 60 per cent (residential) and 73 per cent (logistics), and in the value-add segment between 59 per cent (residential) and 69 per cent (logistics). “While the average LTVs for logistics properties have never been higher than in the second quarter of 2022 since data collection began in the second quarter of 2014, they are currently at a new low for residential properties,” says ZEW economist Frank Brückbauer.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. The DIFI is a survey conducted and published by Jones Lang LaSalle (JLL) and ZEW Mannheim. 25 experts participated in the survey, which was conducted 9–20 May 2022.