Thriving ICT Sector: More Jobs and Innovators

ResearchZEW Study on the Situation of the ICT Sector in Germany

The information and communication technology (ICT) sector is flourishing. Employment reached an all-time high and the sector boasts leading start-up and innovator rates in comparison to other industries. Additionally, the nominal turnover soared to an unprecedented 315 billion euros. Thanks to its dynamic development, the ICT sector is making an above-average contribution to both overall economic growth and Germany’s future competitiveness. This is the result of a recent study conducted by ZEW Mannheim on behalf of the Federal Ministry for Economic Affairs and Climate Action.

“The sector’s total turnover surged by twelve per cent compared to the previous year, reaching a new peak of almost 315 billion euros. This follows a partial recovery from the pandemic-induced decline in 2020. However, the overall high inflation in 2022 also pushed up the turnover figures,” comments Dr. Thomas Niebel, the author of the study and a researcher in ZEW’s “Digital Economy” Unit.

Record employment figures

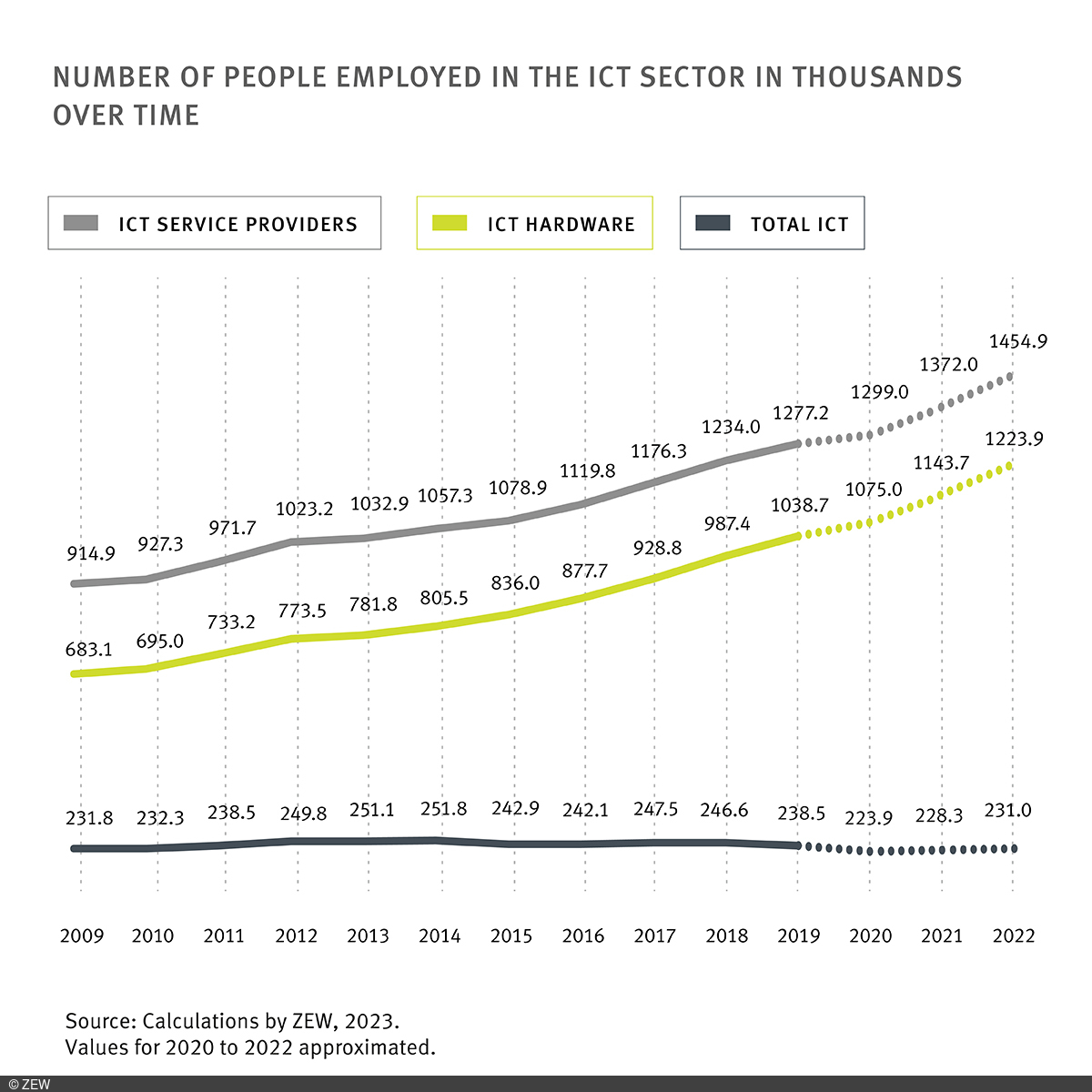

With a six per cent increase in employed individuals, the ICT sector experienced substantial employment growth in 2022, surpassing all comparable industries. The number of self-employed workers and employees liable to social security contributions rose by nearly 83,000 to almost 1.5 million. “Over the entire observation period from 2009 to 2022, the number of people working in the ICT sector increased by around 59 per cent – significantly outpacing all comparable industries,” Niebel points out.

In 2022, the sector comprised around 99,000 companies, representing 3.9 per cent of the total commercial economy in Germany. Notably, the ICT sector is the only one among the examined industries recording a growth in the number of companies.

“Throughout the entire observation period, the number of companies in the ICT sector exhibited the most dynamic growth among all the studied sectors. Except for a pandemic-related setback in 2020, the number of companies steadily increased between 2009 and 2022. Overall, it rose by almost 23 per cent, equivalent to an increase of around 18,300 companies,” notes co-author Robin Sack from ZEW’s “Digital Economy” Unit.

Highest start-up rate, highest innovator rate

With an average value of more than 7.3 per cent over the years 2020 to 2022, the ICT sector boasts by far the highest start-up rate among all the industries analysed. Start-up activity in the compared industries has generally been on a decline since 2010.

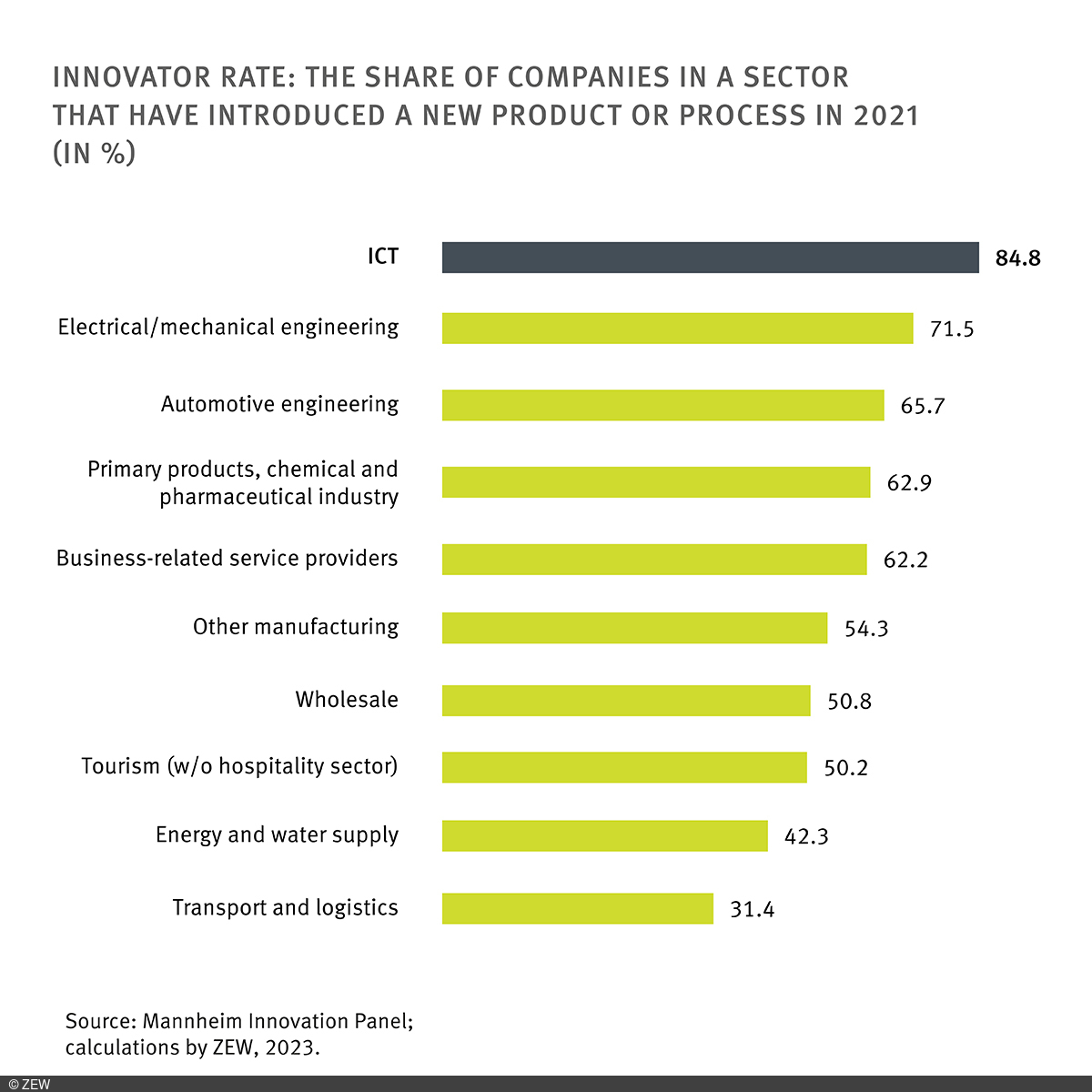

Furthermore, the ICT sector claims the top position once again in the innovator rate, i.e. the proportion of companies that have introduced at least one new or considerably improved product or process in the last three years, from 2019 to 2021. With an impressive 85 per cent, the ICT sector increased this value by five percentage points compared to the previous year.

The so-called innovation intensity – the share of turnover spent on the development and implementation of product and process innovations – follows the general trend and records a decline compared to the previous year. However, at 8.6 per cent, the ICT sector still holds the second position behind the automotive industry.

Public statistics and special analyses

The annual “ICT Sector Profile” thoroughly examines the economic importance as well as the innovation and start-up activities of the German ICT sector, providing valuable comparisons with other core sectors of the German economy. The data foundation encompasses both publicly available statistics and special analyses from the Federal Employment Agency, Destatis, and Eurostat, as well as the Mannheim Innovation Panel (MIP) and the Mannheim Enterprise Panel (MUP) from ZEW.