Financial Market Experts Expect Further Rise in Inflation

ResearchZEW Financial Market Survey: Special Question

Financial experts surveyed by ZEW Mannheim expect that in the period 2022 to 2024 the inflation rate in the eurozone will exceed the ECB inflation target of 2.0 per cent by a greater margin than was still assumed in August 2022. Developments in energy and raw material prices as well as wages in the euro area again led to rising inflation expectations among experts. These are the results of the special question included in the ZEW Financial Market Survey in November 2022, in which around 190 respondents gave their assessment of the developments of inflation rates in the eurozone for the years 2022–2024.

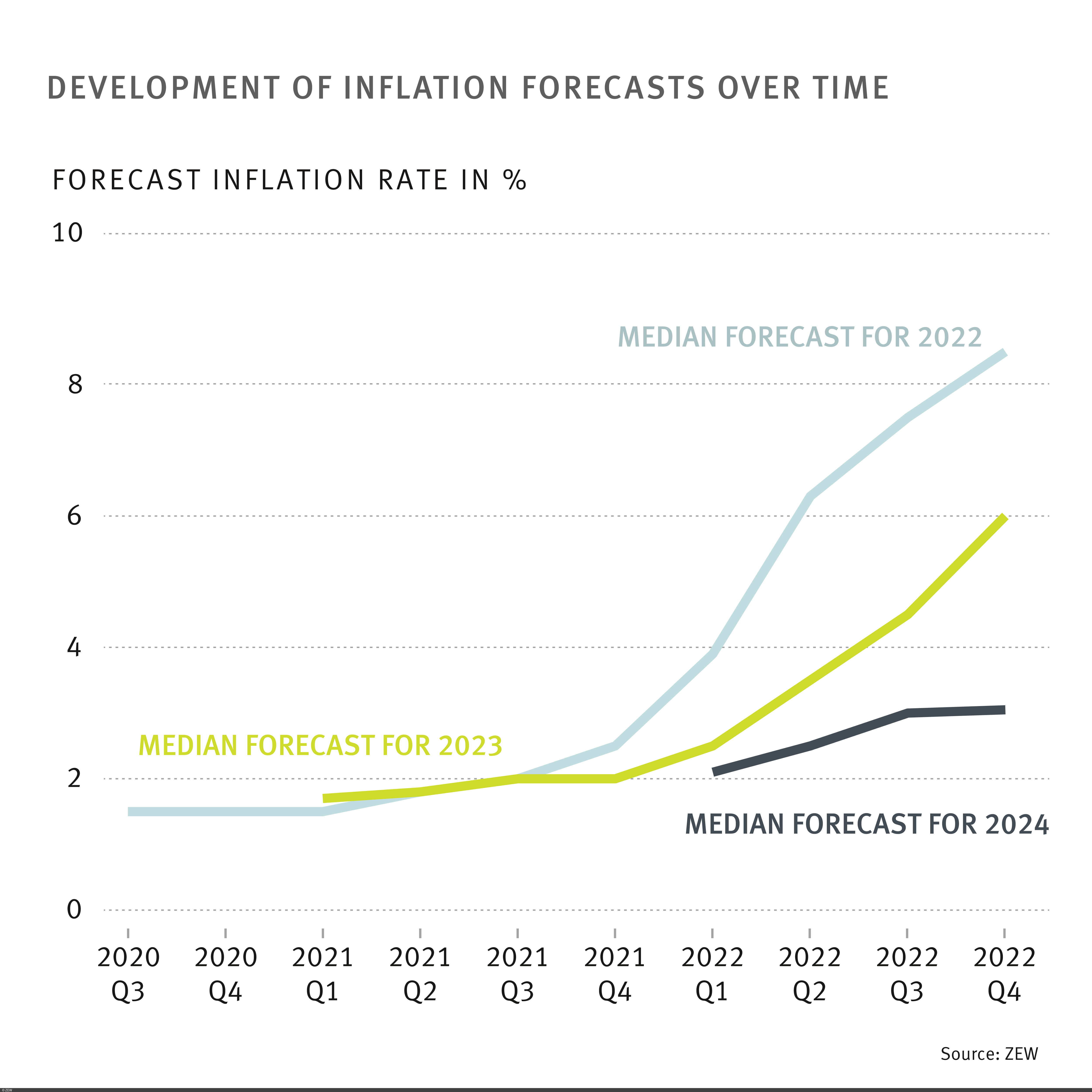

In November 2022, median inflation rate forecasts for the years 2022, 2023 and 2024 are 8.5, 6.0 and 3.1 per cent, respectively. Although the experts continue to assume that inflation will slow down by the end of 2024, inflation forecasts are significantly higher than in August 2022, when ZEW last asked about inflation in the eurozone. More specifically, in August 2022, median inflation rates for the years 2022 to 2024 were 7.5, 4.5 and 3.0 per cent, respectively.

The majority of the financial market experts base their higher inflation forecasts in November 2022 on developments in energy prices (around 60 per cent of respondents), wage developments in the euro area (around 60 per cent), the war in Ukraine (around 53 per cent) and raw material price developments (excluding energy, around 52 per cent). As in the previous surveys, the development of energy prices remains the most important inflation driver: almost 37 per cent of respondents in November 2022 say they have revised their inflation forecasts sharply upwards for this reason.

The financial market experts assess the impact of the ECB’s monetary policy developments on their inflation forecast for the period 2022 to 2024 quite differently than they did in August 2022. At around 37 per cent, the relative majority of respondents say that these have not affected their inflation forecasts. A further 26 per cent of respondents believe that the ECB’s monetary policy itself contributes to inflation, i.e. it is considered to be still too expansionary. The remaining 33 per cent of respondents say they have revised their inflation forecasts downwards due to ECB monetary policy developments.

Click for the ZEW Financial Market Report with the complete results (in German only)

About the survey

The ZEW Financial Market Survey has been conducted since December 1991. Participants are asked monthly about their expectations concerning the development of major international economies, including Germany, the eurozone, the United States and China. In total, the panel consists of about 350 financial analysts from banks, insurance companies and selected corporations, specifically from the finance, research and economics departments as well as the investment and securities departments. Most of the participants are from Germany.

The financial experts are asked about their expectations on a six-month horizon regarding the development of the economy, the inflation rate, short- and long-term interest rates, equity prices and exchange rates. In addition, they are asked to assess the earnings situation in 13 German sectors. Besides a fixed survey section, special questions on current topics are included on a regular basis. The ZEW Indicator of Economic Sentiment, which has established itself as an early indicator of economic development (“ZEW Index”), is calculated from the expectations of financial market experts on the development of the economic situation in Germany. The results are published and analysed in detail in the monthly ZEW Financial Market Report.