Difficult Position for the New EU Green Bond Standard

ResearchThe EU GBS Is in Danger of Going Unused

In order to enhance transparency in green bonds and create reliable frameworks for evaluating their “greenness”, standards are in place such as the CBI Climate Bond Standard or the ICMA Green Bond Principles. Recently, the EU introduced its own EU Green Bond Standard (EU GBS). However, a ZEW analysis suggests that this EU standard is unlikely to be widely accepted by market participants for the time being given the prevalence of well-established alternatives.

“The EU GBS can be seen as a combination of existing labels, yet it additionally requires bond issuers to provide some legally binding information. We assume that this will discourage them from using the EU GBS, especially since issuers can already have their bonds’ conformity with the EU taxonomy certified,” explains Karolin Kirschenmann, deputy head of ZEW’s “Pensions and Sustainable Financial Markets” Research Unit. Frank Brückbauer, researcher in ZEW’s “Pensions and Sustainable Financial Markets” Research Unit, adds: “The new EU standard for green bonds also comes with the need for new internal procedures and more bureaucracy for issuers, further reducing the incentive to use the EU GBS.”

Green bond standards are already established

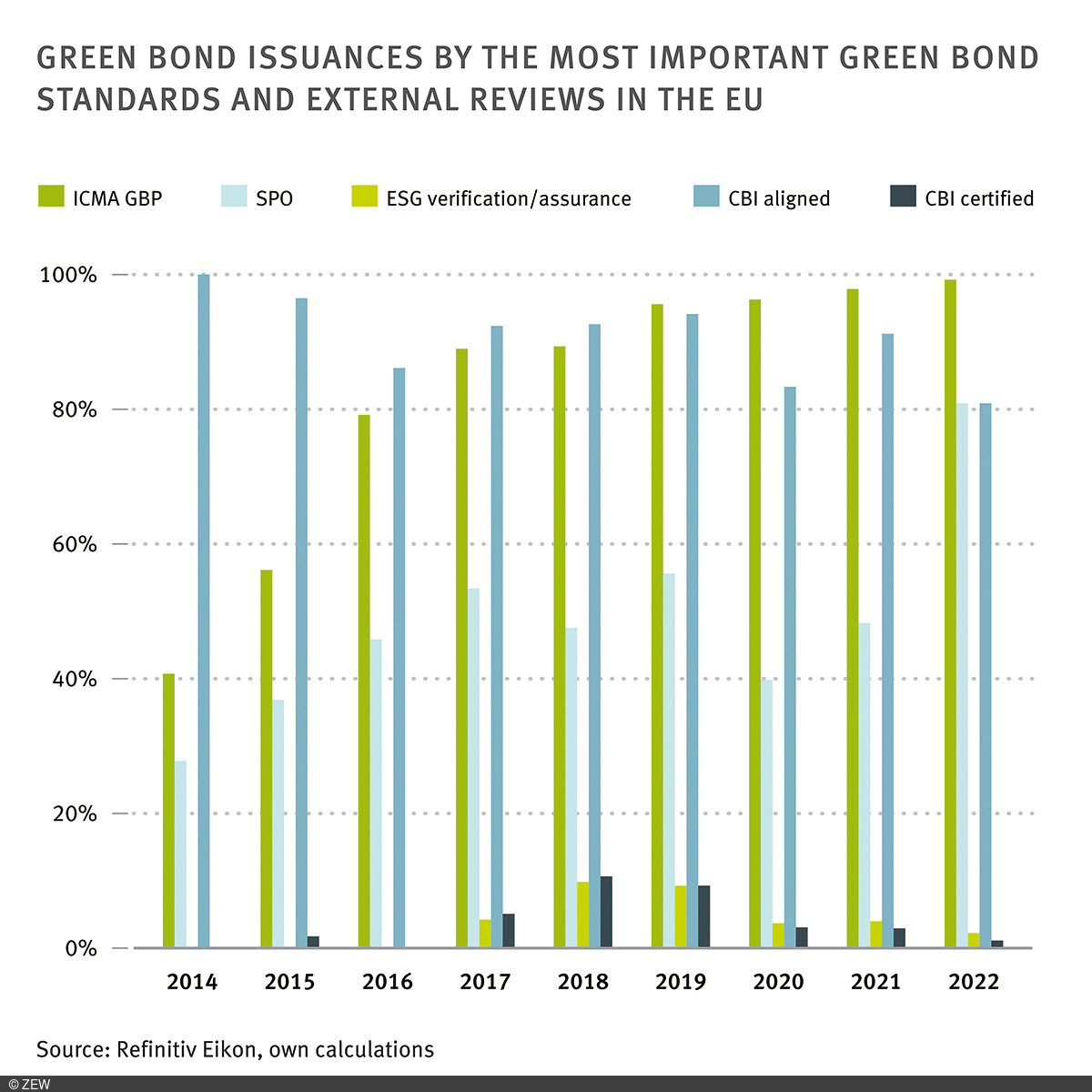

The figure illustrates the market shares of the main green bond standards since 2014. It shows that the ICMA Green Bond Principles have evolved into the industry’s de facto standard, with its market share surging from approximately 40 per cent since its introduction in 2014 to nearly 100 per cent in 2022. Concurrently, the number of green bonds that follow the CBI Climate Bond Standard, or even apply for CBI certification, has fallen.

What is the role of the EU Green Bond Standard?

The existing green bond standards are heterogeneous and relatively opaque in terms of the actual environmental performance of bonds. This is particularly true for the ICMA label. Nevertheless, the ICMA label is well known and accepted by investors worldwide. The EU GBS will only be able to develop real significance for the market if EU Member States use it for their own green bond issues or if it becomes mandatory for all green bond issuances.