Experts Anticipate Slowdown of German Economy

ResearchZEW Survey of Financial Market Experts

German economic growth has stalled – and is expected to proceed at a sluggish pace in the coming years. According to the financial market experts surveyed by ZEW, lower but stable annual growth rates of between 2.0 and 2.5 per cent are anticipated in 2022 to 2024. Several factors will act as a drag on German GDP, including high energy prices, raw material shortages, and supply chain disruptions – as well as the new geopolitical situation that has arisen with Russia's invasion of Ukraine. The majority of experts have made downward revisions to their GDP growth forecasts for 2022, 2023 and beyond. With a view to the next five years, individual sectors of the German economy will be affected to varying degrees by geopolitical developments, with the greatest impacts being suffered by vehicle manufacturing, chemicals and pharmaceuticals, steel and non-ferrous metals, and mechanical engineering.

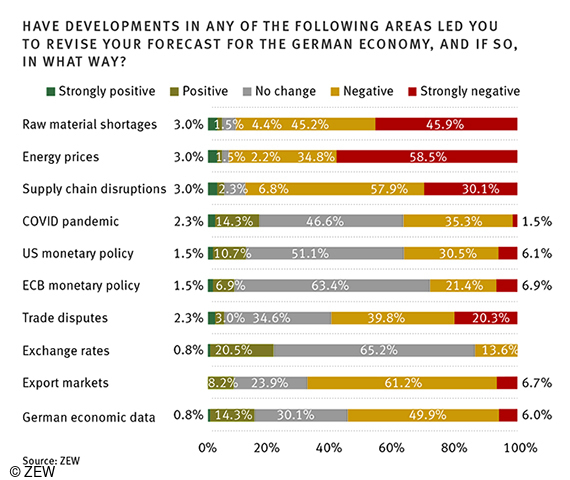

The German economy is expected to grow 2.0 per cent in 2022. “Following robust activity in 2021, the surveyed financial market experts believe that the German economy will lose steam in 2022. Even a recession is no longer completely ruled out,” says ZEW President Achim Wambach. Looking ahead, the experts anticipate 2.5 per cent growth in 2023, and 2.0 per cent growth in 2024. Supply chain disruptions were a frequently cited negative factor: 58 and 30 per cent of respondents, respectively, believed this will exert a negative or strongly negative impact on growth. The experts additionally cite rising energy prices and raw material shortages as negative factors, with some 35 and 59 per cent of respondents, respectively, saying that energy prices will have a negative or strongly negative impact on GDP. Meanwhile, 45 and 46 per cent of respondents, respectively, indicate that raw material shortages will have a negative or strongly negative impact. Other factors, including current economic data, export markets, and international trade conflicts would have less pronounced impacts, the experts said.

Geopolitical situation will affect GDP forecasts and the earnings of German companies

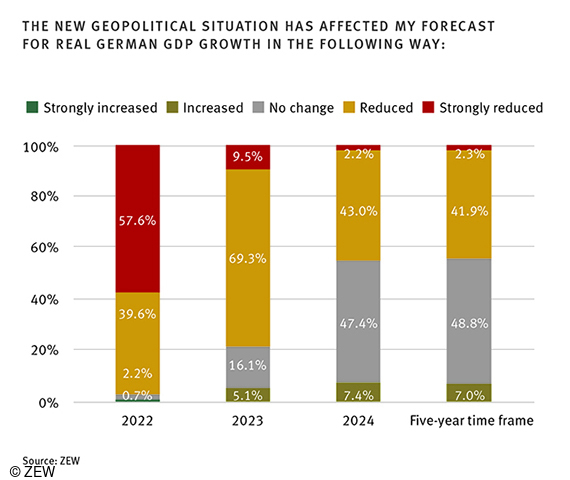

The outbreak of war in Ukraine was one reason why a clear majority of respondents have made significant downward revisions to their GDP forecasts for 2022 and 2023. Specifically, some 40 per cent of the experts made small downward adjustments to their 2022 growth forecast, while nearly 58 per cent made significant downward adjustments. However, a different picture emerges for 2023: while just under 10 per cent sharply reduced their forecasts, 69 per cent continue to expect slightly negative impacts in 2023. “In the opinion of the surveyed experts, the new geopolitical situation will affect growth not only this year, but also in 2023,” Prof. Wambach noted. Some 45 per cent of respondents expect negative effects to linger in 2024. With a view to the next five years, some 44 per cent believed negative effects will predominate. In both cases, the largest group of experts was composed of those who anticipated slightly negative effects. By contrast, almost half of the respondents no longer expect negative effects in 2024 or over a five-year time frame.

In the view of the experts, the geopolitical situation will impair the earnings of German companies on a five-year time scale, but to varying degrees by industry. According to the majority of respondents, vehicle manufacturing, chemicals & pharmaceuticals, steel & non-ferrous metals and mechanical engineering will suffer the most pronounced negative impacts. The vehicle manufacturing sector garnered the worst assessment, with 74 per cent of respondents saying it would experience small or significant impacts. By contrast, banking, insurance, electronics, consumer/retail, construction, service providers, telecommunications and IT are likely to see no or only small impacts, according to the majority of respondents.