German Banks Need to Make Additional Provisions for Corporate Loans

ResearchZEW Financial Market Survey Reveals Increased Pressure to Consolidate

According to financial market experts, the German banking sector is likely to face a rising number of loan defaults and a growing need to make additional provisions for corporate loans in the coming six months. In addition, they anticipate a slight increase in consolidation among savings banks and cooperative banks. These are the results of a special question featured in the most recent ZEW Financial Market Survey carried out in March 2021 among 189 financial market experts.

The policy measures taken to mitigate the economic consequences of the coronavirus pandemic like the suspension of the obligation to file for insolvency, liquidity support measures or credit programmes are still playing a central role in stabilising the German economy. The fight against the virus comes, however, with major economic costs, some of which will only become apparent once these measures are lifted. For instance, there is a risk that the measures could result in a delayed increase in corporate insolvencies if companies are no longer able to fulfill their repayment obligations due to the accumulated debts. The surveyed financial market experts therefore expect the number of loan defaults in the German banking sector to rise in the coming six months.

More optimistic assessment of the risk of loan defaults

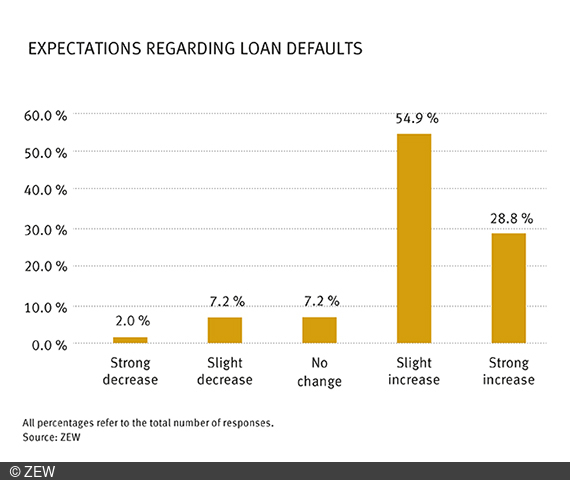

When asked about the number of expected loan defaults, 55 per cent of the respondents stated that they anticipate a slight increase, while 29 per cent expect a strong increase. Moreover, 62 per cent of experts expect a slight increase and 17 per cent a strong increase in the volume of the loans in default.

In the ZEW Financial Market Survey conducted in December 2020, the share of financial market experts expecting a strong increase in loan defaults was as high as 45 per cent, and 25 per cent of the respondents expected a strong increase in the volume of defaulting loans. “The German economy is facing a massive backlog of insolvencies – so far we are only seeing the tip of the iceberg. Due to the long duration of the pandemic and the aid measures, the negative effects of the COVID-19 crisis on the banking sector will only be felt later on, and they will persist for some time,” explained Dr. Karolin Kirschenmann, deputy head of the ZEW Research Department “International Finance and Financial Management”.

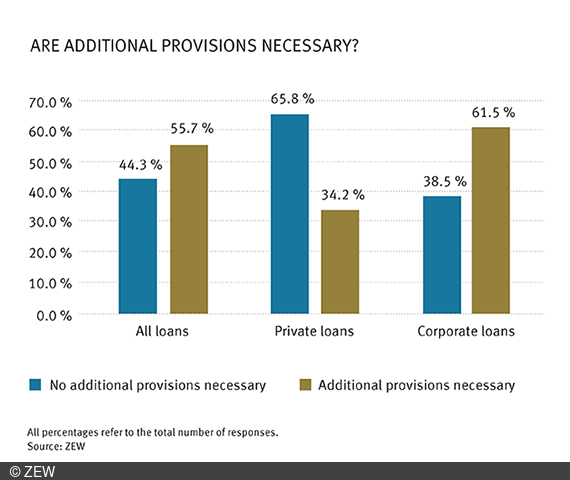

Banks need to take additional risk prevention measures

According to the financial market experts, German banks should take additional preventive measures so that they are able to cover potential losses in case of loan defaults. 61 per cent of the respondents stated that banks will need to make additional provisions for corporate loans. For private loans, on the other hand, only 34 per cent of the respondents consider additional provisions necessary. “Some banks have already taken additional risk prevention measures. There has also been an overall increase in the equity base since the financial crisis. However, these measures seem insufficient to mitigate the risks involved,” highlights ZEW financial expert Kirschenmann. The coronavirus crisis and the loan defaults to be expected from it could also change the structure of the German banking landscape and accelerate the trend towards consolidation. 58 per cent of the surveyed experts expect a slight increase in consolidation among savings banks, whereas 15 per cent even expect a strong increase. The survey results for cooperative banks paint the same picture, with 57 per cent expecting a slight and 15 per cent a strong increase in consolidation.