COVID-19 Crisis Hampers Companies’ Innovation Activities

ResearchZEW Survey on the Impact of the COVID-19 Crisis on Innovation Activity as Part of the EFI Report

The current annual report from the Commission of Experts for Research and Innovation (EFI) that was delivered virtually to Chancellor Merkel today, analyses the impact of the coronavirus crisis on research and innovation (R&I) activities of companies and comments on the current R&I policies implemented by the government.

“The COVID-19 crisis has hit the global economy unexpectedly and hard. The lockdowns that have been imposed in Germany have brought about massive economic imbalances,” says Professor Irene Bertschek, head of the ZEW Research Department “Digital Economy”, professor of economics of digitalisation at Justus Liebig University Giessen, and EFI member.

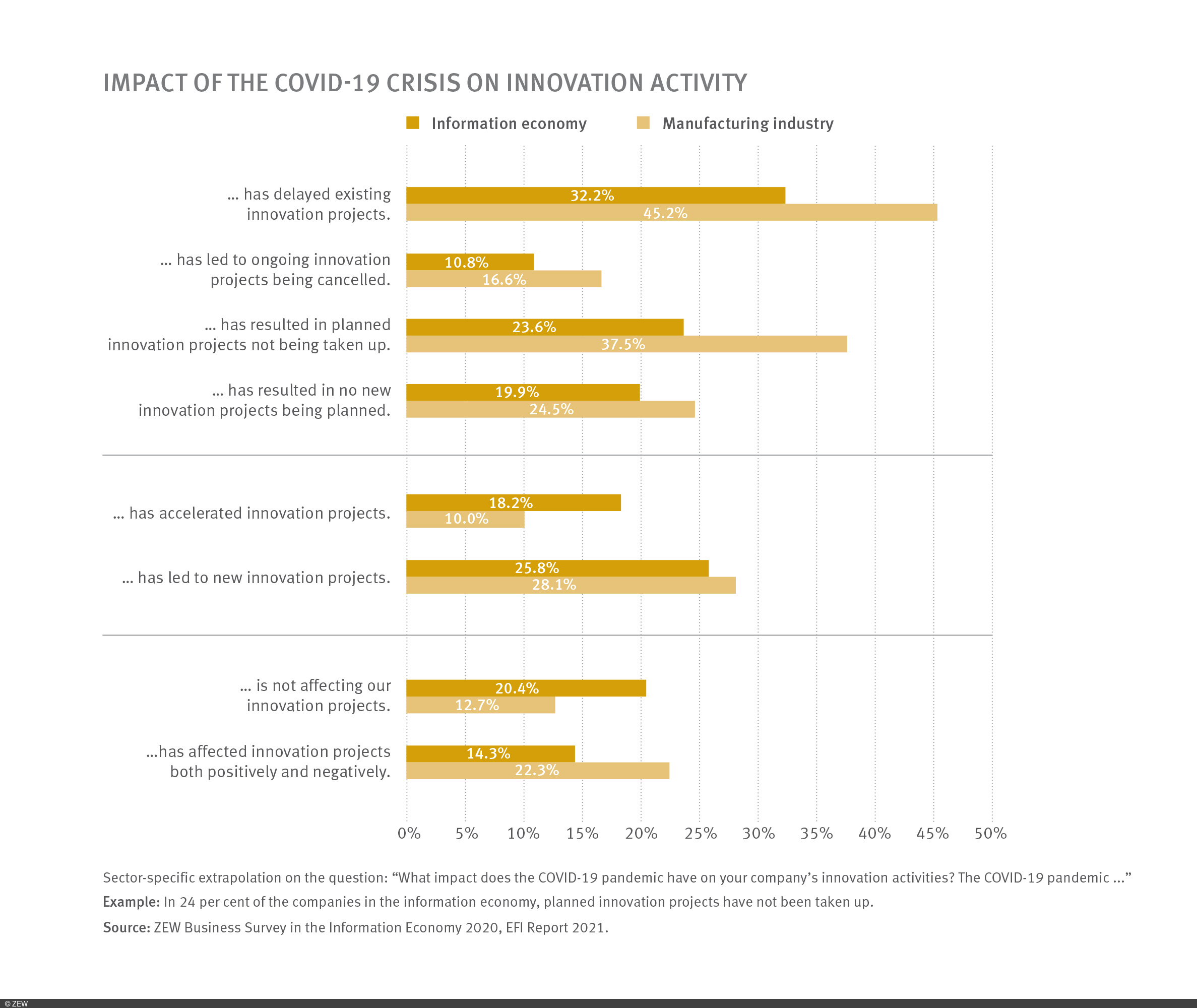

To learn more about the impact of the coronavirus crisis on companies’ innovation projects (not on budgets) and the reasons why such projects are affected, a special evaluation of the ZEW Business Survey was carried out on behalf of the Commission of Experts in September 2020. It shows that the COVID-19 crisis has had a negative impact on a majority of German companies with regard to their innovation activity. For example, approximately 32 per cent of companies in the information economy and 45 per cent of companies in the manufacturing industry have delayed existing innovation projects. Furthermore, a substantial amount of businesses have reported that they have not initiated previously planned projects (24 per cent in the information economy and 38 per cent in the manufacturing industry) or have not made any plans for new innovation projects (20 per cent in the information economy and 25 per cent in the manufacturing industry). Far less frequently have companies reported that they completely abandoned innovation projects already underway (11 per cent in the information economy and 17 per cent in the manufacturing industry).

“Besides the predominantly negative effects of the coronavirus crisis, however, positive developments in innovation activity can also be observed. For example, approximately 26 per cent of companies in the information economy and 28 per cent of companies in the manufacturing industry have reported that the effects of the crisis have resulted in new innovation projects being initiated. For 18 per cent of companies in the information economy and 10 per cent in the manufacturing industry, the crisis has even led to an acceleration of innovation projects,” says Bertschek.

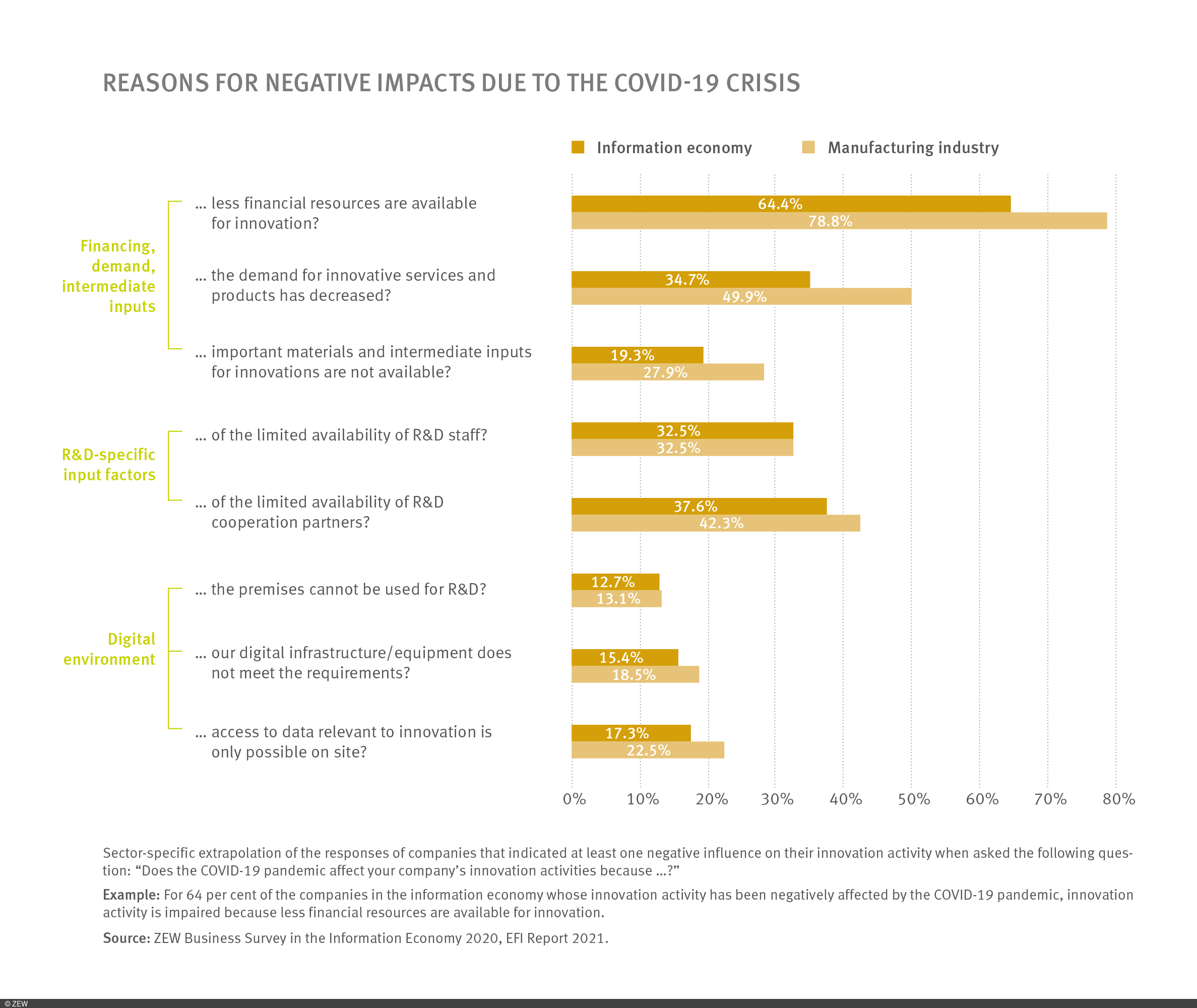

Reduced availability of financial resources is stated by companies as being the most common reason for the negative impact on innovation activity. Specifically, this applies to approximately 79 per cent of the negatively affected companies in the manufacturing industry and 64 per cent in the information economy. Moreover, many companies have become aware of a falling demand for innovative products and services. Again, this pandemic-related negative effect is more frequently reported by companies in the manufacturing sector (50 per cent) than by those in the information economy (35 per cent). Companies have also cited further restrictions brought about by the pandemic, such as supply difficulties for materials and intermediate inputs, as well as reduced availability of R&D staff and R&D cooperation partners. In addition to this, there has been restricted use of R&D premises, lack of access to data relevant for innovation as a result of working from home, and limited suitability of companies’ own digital infrastructure and equipment for working under certain pandemic-related conditions.

“As the pandemic goes on, these developments may lead to a long-term weakening of the German R&I system,” concludes Professor Bertschek. “The government has provided important political impetus by introducing short-term aid measures and economic stimulus programmes, which both also support the research and innovation system. For its long-term competitiveness, further measures should be designed with the greatest possible focus on R&I.

The Commission of Experts therefore welcomes the government’s package of measures, the so-called ‘Zukunftspaket’. It includes substantial investment in education, research and innovation, as well as in future technologies such as artificial intelligence, hydrogen technology, and quantum technology. We should definitely continue in this direction.”

The ZEW Business Survey

The ZEW Business Survey in the Information Economy, on which the results presented above are based, was conducted among approximately 1,410 companies. In order to guarantee that analyses were representative, the participants’ answers were extrapolated by ZEW to the number of all companies in the sectors considered. The ZEW survey is regularly carried out among companies with at least five employees in the sectors of information and communications technology (ICT hardware and ICT services), digital services and knowledge-intensive services (including legal, tax and management consultants, auditing, public relations and business consultancy, architecture and engineering firms, technical, physical and chemical examination, R&D, advertising and market research companies, as well as other freelance, scientific and technical activities). All of the aforementioned sectors together form the information economy.

The survey for the Commission of Experts in September 2020 was expanded to companies in the manufacturing industry. The subsectors chemical and pharmaceutical industry, mechanical engineering, automotive manufacturing and other manufacturing sectors all fall into this category.