Outlook Remains Cautious

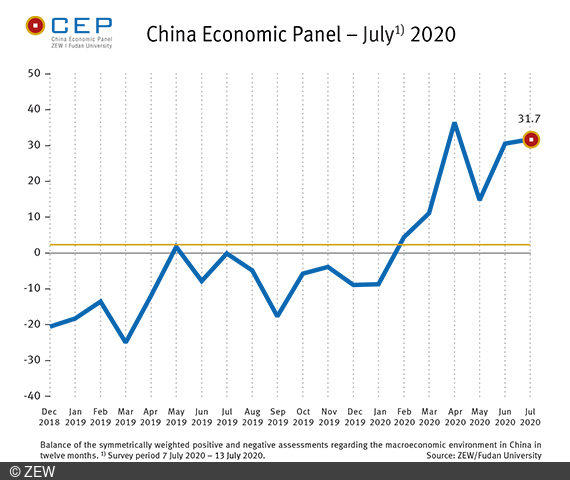

China Economic PanelCEP Indicator Rises to a New Reading of 31.7 Points

In the current July survey (7–13 July 2020), the CEP indicator increased slightly by 1.2 points, reaching a new value of 31.7 points. The CEP indicator, based on the China Economic Panel (CEP) in cooperation with Fudan University, Shanghai, reflects the economic expectations of international financial market experts for China on a 12-month basis.

“This change in month-on-month sentiment indicates that the upward momentum is expected to weaken,” says Dr. Michael Schröder, project manager of the CEP survey and senior researcher in the Research Department “International Finance and Financial Management” at ZEW Mannheim. The share of experts expecting a strong improvement declined from 33.3 per cent to 21.1 per cent. A majority (52.6 per cent) anticipates the economy to improve only slightly over the next 12 months. “The recently published figures for real gross domestic product (GDP) growth in the second quarter, which was surprisingly high at 3.2 per cent year-on-year, are likely to decline again in the second half of the year, which is in line with these estimates,” says Michael Schröder in light of the current survey data.

For the third quarter, the participants expect real GDP to increase by only 1.0 per cent year-on-year, and by 2.7 per cent for the fourth quarter. This means that growth estimates for the entire year are also continuing to decline and are only at 0.8 per cent in the current survey. Growth forecasts for 2021 are also worsening, currently standing at 4.0 per cent year-on-year. “A major reason for this rather subdued outlook by Chinese standards could be the continued reluctance of private consumers to spend,” assumes Schröder. Expectations for the next 12 months for both private consumption and private investment have fallen significantly. The experts believe that the employment situation will also deteriorate significantly as a result of continuing economic weakness.

The rise in expectations for government consumption shows that the government is expected to remain strongly committed to economic policy. As a result of the continued practice of active economic policy and, nevertheless, relatively weak growth, experts are forecasting a significant increase in debt. In light of these estimates, the surprisingly strong economic growth in the second quarter is put into perspective. The experts surveyed in the context of the CEP Indicator therefore anticipate that the Chinese economy will continue to face problems for some time to come.