Economic Sentiment for China Continues to Rise Slightly

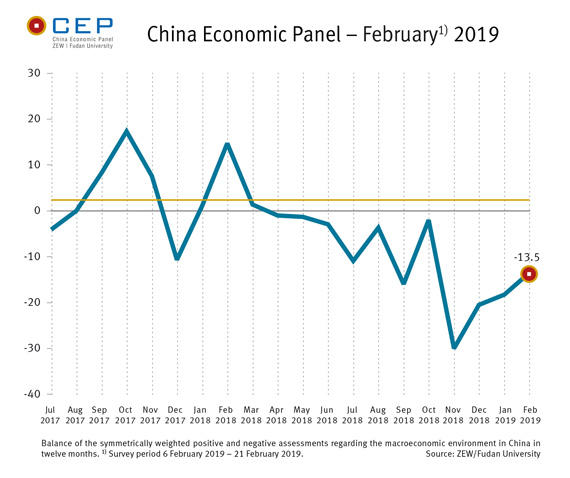

China Economic PanelAccording to the most recent survey for February (6–21 February 2019), the expectations regarding the Chinese economy have risen by 4.8 points to a reading of minus 13.5 points (January 2019: minus 18.3 points). Despite this renewed increase, the CEP Indicator, which is based on the China Economic Panel and reflects the expectations of international financial market experts regarding China’s macroeconomic development over the coming twelve months, is still in negative territory and remains well below the long-term average of 2.4 points.

The expectations for the current economic situation have experienced yet another drop, falling by 8.9 points to a level of minus 13.5 points. A total of 34.6 per cent of the respondents evaluated the economic situation as poor, whereas merely 7.7 per cent considered it to be good.

With a value of 6.1 per cent, the point forecast for the Chinese gross domestic product (GDP) for 2019 has again experienced a decrease compared to the previous survey. For the year 2020, the surveyed experts expect a growth rate of 6.0 per cent, which is – at least in Chinese terms –relatively low.

“Meanwhile, experts are expecting to see negative developments for almost all major economic regions in China,” says Michael Schröder, senior researcher in the Research Department “International Finance and Financial Management” at the ZEW – Leibniz Centre for European Economic Research and project leader of the CEP survey. With a level of 2.3 points, only the business centre Chongqing has received slightly positive assessments.

Pessimistic outlook for several sectors

According to the survey, the following five sectors are expected to see a relatively strong decline (month-to-month changes in brackets): retail trade (minus 21.5 points), retail banking (minus 15.2 points), electrical engineering (minus 14.9 points), mechanical engineering (minus 12.6 points), investment banking (minus 9.0 points). The corresponding indicators of these sectors have now also entered negative territory.

Especially alarming is the fact that expectations regarding private consumption and private investment have experienced a sharp decline, falling to minus 11.9 points and minus 24.3 points, respectively.

A growing number of survey participants considers it likely that China’s poor economic forecast will have negative implications for employment. At 2.0 points, the corresponding indicator is still in positive territory, but shows a clear decline compared to the previous month (minus 11.2 points).

For more information please contact

Dr. Michael Schröder, Phone +49 (0)621-1235-368, E-mail michael.schroeder@zew.de