Inflation Has Passed Its Peak

EventsFirst-Hand Information on Economic Policy at ZEW on Challenges of Monetary Policy in Times of High Inflation

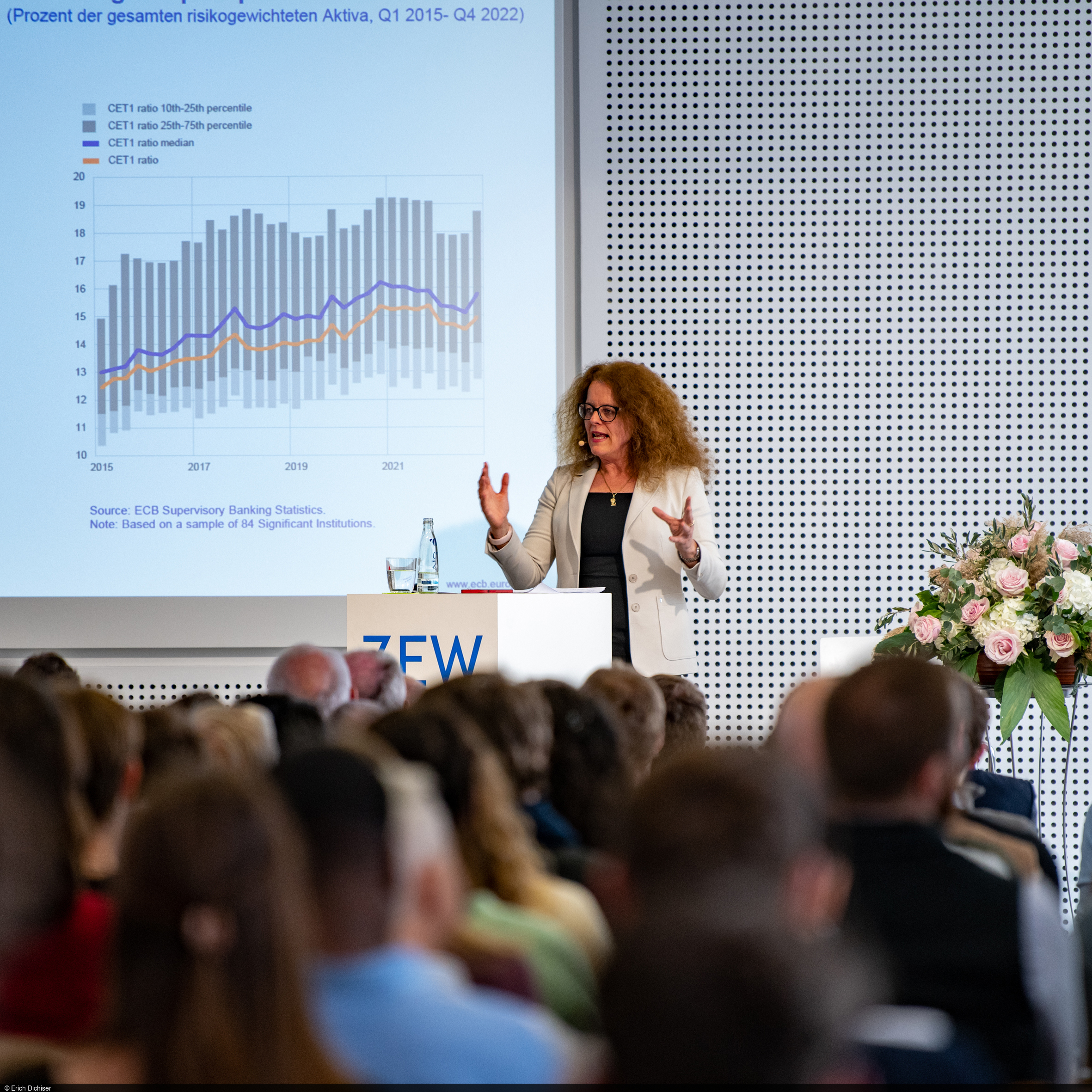

The environment for the ECB’s monetary policy has changed radically. In the last two years, inflation in Germany and the euro area has reached its highest level since the introduction of the euro. This high monetary devaluation is leading to economic and social upheavals. Professor Isabel Schnabel, Member of the ECB’s Executive Board, explained on 19 April 2023 at ZEW Mannheim in the context of the event series “First-Hand Information on Economic Policy” whether vehement interest rate hikes are the right way to reduce inflation and where the possibilities as well as limits of monetary policy lie for central banks.

“With Professor Isabel Schnabel, we welcome a top-class guest this evening. We would like to talk to her about the ECB’s actions in times of crisis and take a short- to medium-term look at the future of European fiscal policy,” said ZEW President Professor Achim Wambach right at the beginning of the event.

Financial stability in times of crisis

“The COVID-19 crisis and rising energy prices were shocks that pushed inflation across Europe to unusually high levels. As a result, the ECB raised interest rates sharply,” explained economist Schnabel in her presentation. She cited higher inflation rates worldwide and the ECB’s mandate to ensure financial stability in the euro area as reasons for the rate hikes. Schnabel also made it clear that higher wages were a decisive factor for inflationary developments. “There is a labour shortage everywhere, not only in Germany. That is why wages have risen noticeably. However, the wage increases were below the inflation rate, so that many people experienced real wage losses,” Schnabel added.

“Inflation rates are too high throughout Europe. This weakens Europe as a location for business. If we don’t get a grip on the problem, investments could decline in the long run. A loss of prosperity in Europe and especially in Germany would be the result,” ZEW President Wambach warned. ECB Executive Board member Schnabel believes the past interest rate hikes were necessary: “Without the ECB’s measures to keep interest rates low, we would be talking about significantly higher inflation rates and thus more volatile stock markets today. The stock markets have remained surprisingly stable.”

Inflation remains a problem in the long run

“During the COVID-19 crisis it was necessary to introduce aid programmes. The ECB’s course during the pandemic years was characterised by the objective that this severe crisis had to be overcome at all costs. Looking back, I can say that we underestimated the dangers posed by inflation,” Executive Board member Schnabel responded to the question of whether the ECB changed its interest rate policy course too late.

“Ultimately, we are helping to maintain financial stability with our measures. The inflation rate has recently fallen again. At the same time, we have not stifled the European economy,” she pointed out. Nevertheless, Professor Schnabel stressed that the inflation rate could remain at a high level next year. “Inflation is persistent. Our primary task as monetary guardians is to put a stop to inflation. That is why we are, of course, sticking to the 2 per cent target,” she concluded.