European Integration

European Research at ZEW

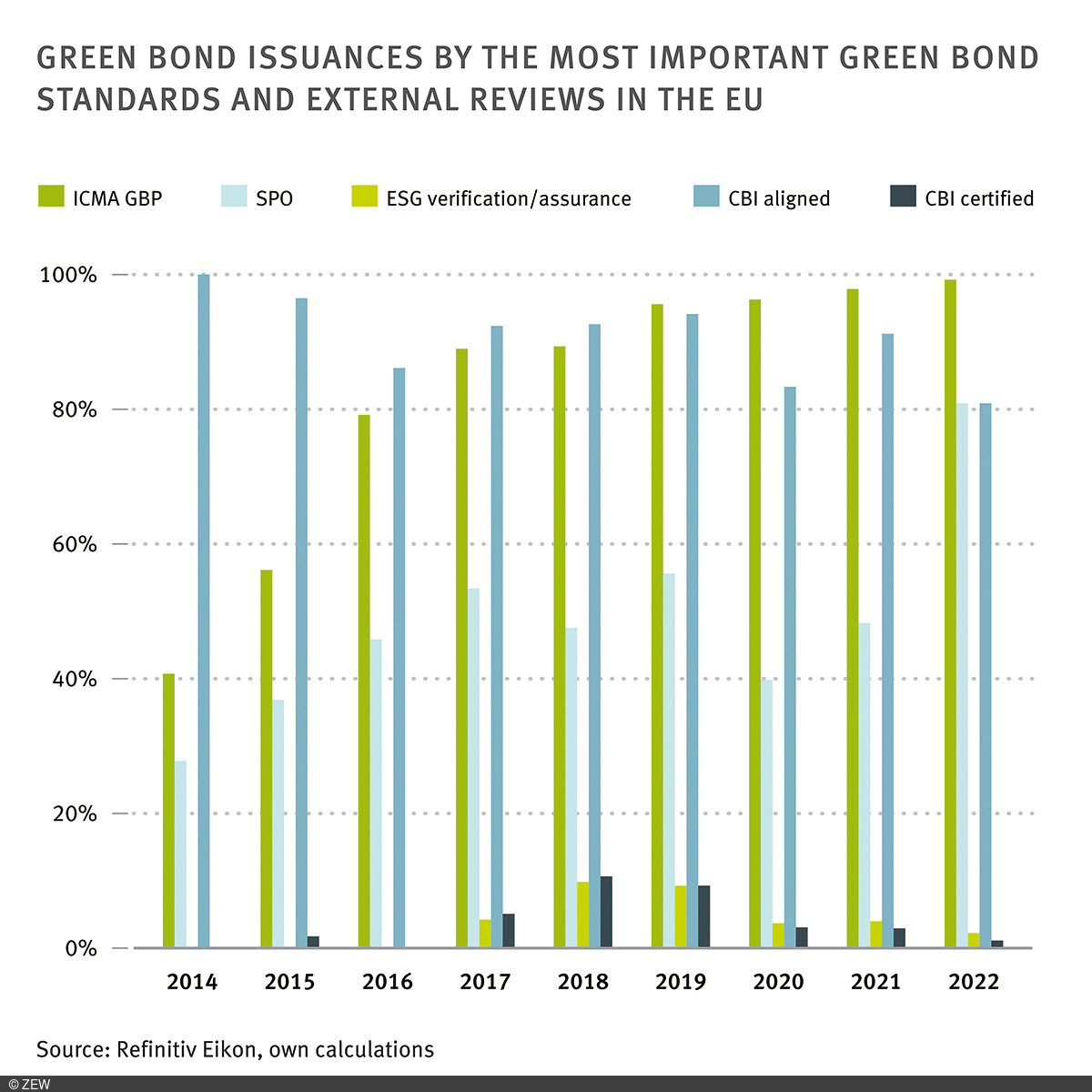

Until today, the European integration project delivers great political and economic benefits to Europeans. Events such as the euro debt crisis and Brexit, however, have raised the question to which extent the EU and its current structures are still fit for the future. ZEW wants to contribute its research and knowledge to the understanding of different reform options. For example, we develop models for an appropriate and intelligent harmonisation of European tax policies. Moreover, ZEW researchers are asking, how the eurozone could be made crisis-proof. A further key topic on our research agenda is the European budget and how it should be structured in the future so that it creates a genuine European added value on fields such as climate protection, migration policy, and security.

Prof. Achim Wambach, PhD

ZEW President“Europe is the answer for many of the current economic challenges; European added value can only be developed together.”

Friedrich Heinemann on European Research at ZEW

Prof. Dr. Friedrich Heinemann

ZEW expert Phone +49 (0)621 1235-149 Email friedrich.heinemann@zew.de To the profile“The EU must develop in such a way that it convincingly demonstrates its benefit to all Member States and their citizens over and over again.”

European Institutions

Europe introduced the euro in 1999 as its common currency. This step towards monetary integration was initially associated with only minor adjustments in fiscal institutions. As of now, though, the euro sovereign debt crisis has revealed the weaknesses of this constellation; to date, the fiscal institutions of the eurozone remain incomplete. A key question of our research in this field is: how can fiscal responsibility and European solidarity be brought into balance?

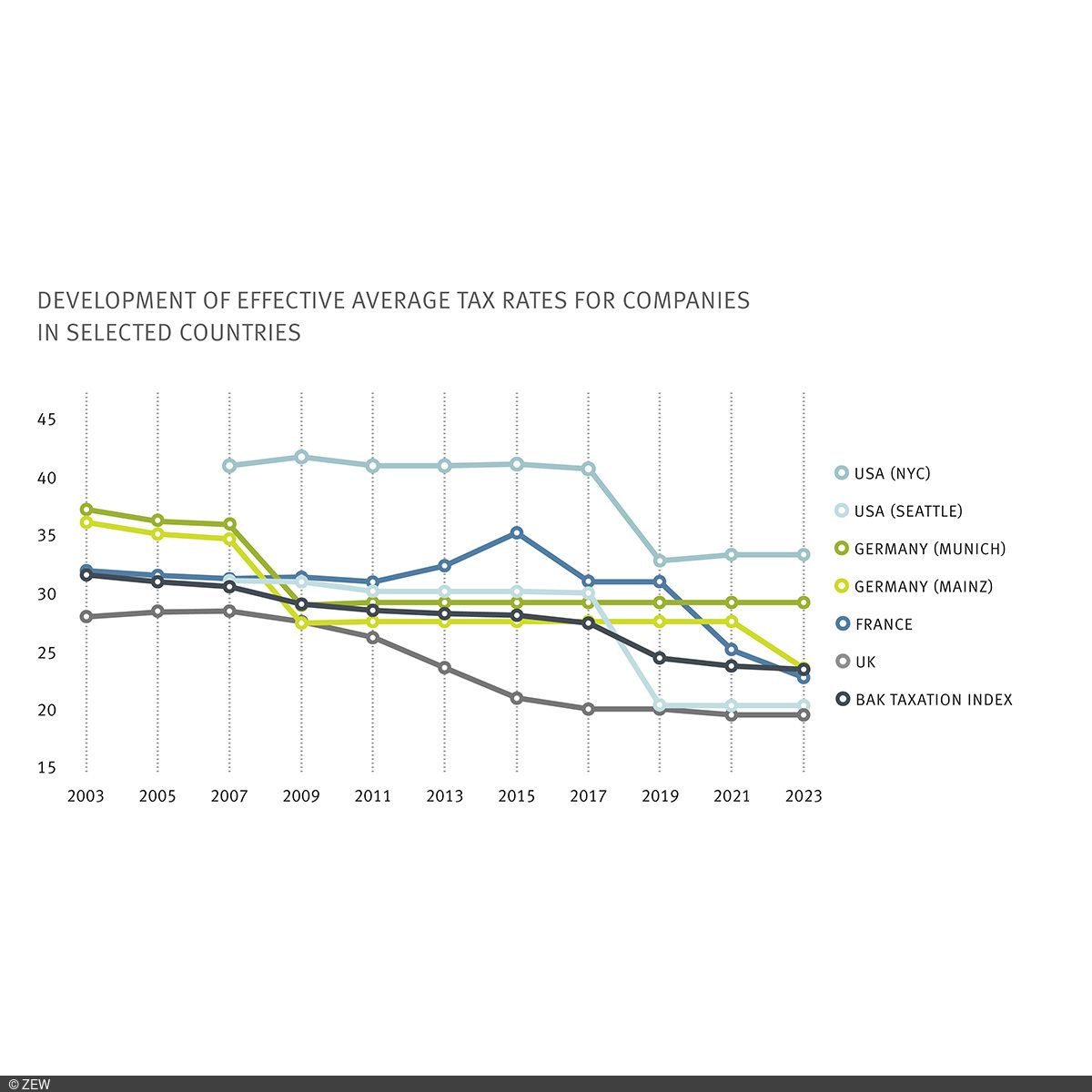

MannheimTaxation: Europe's Tax System of the Future

What does the tax policy of the future look like? What can our research contribute to the European and global tax integration? And how can we make the tax system ready for the economic and social challenges of our time? A joint initiative of ZEW and the University of Mannheim, The Leibniz Science Campus MannheimTaxation, deals with these questions. MannheimTaxation research is interdisciplinary, spanning the fields of economics, business administration, law, and political science.

Growth, Productivity and Innovation in Europe

Europe can only be successful in pursuing its ambitious goals in areas such as social policy, ecology and international development if it has a sound economic basis. Against this background, ZEW aims to contribute its research and knowledge of the subject to a better understanding of the determinants of innovation, start-up processes, and entrepreneurship. ZEW thus positions itself as a policy advisor on innovation and technology issues at the national and European level.