Eurozone GDP at Risk of Stagnation in 2023

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomic Experts Uncertain About Developments

The euro area economy is expected to stagnate in 2023. For Germany, GDP expectations are in negative territory. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

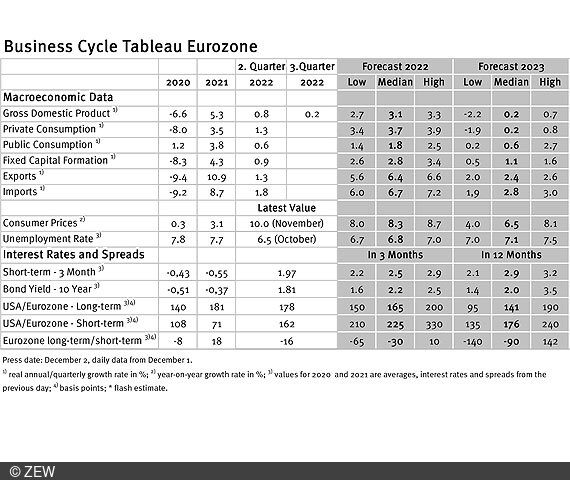

The economic and inflation forecasts for the eurozone have remained virtually unchanged from the previous month. The median forecast for this year puts real GDP growth at 3.1 per cent, which is still relatively high; however, at 0.2 per cent next year, it is at risk of stagnating.

Eurozone GDP up since 2019 despite crises

Compared to 2019, just before the start of the Covid-19 crisis, eurozone real GDP grew by a total of 1.4 per cent between 2019 and 2022. This means that despite the considerable economic difficulties caused by the pandemic and Russia’s war with Ukraine, the pre-crisis level – measured in terms of real GDP – has been slightly exceeded. Although the median forecast for 2023 is still slightly positive at 0.2 per cent, there are also some experts who are much less optimistic: The lowest forecast (“low”) foresees a decline of 2.2 percentage points, while on the other end of the forecast spectrum (“high”) growth of a maximum of 0.7 per cent is considered possible.

Outlook for the German economy worsens

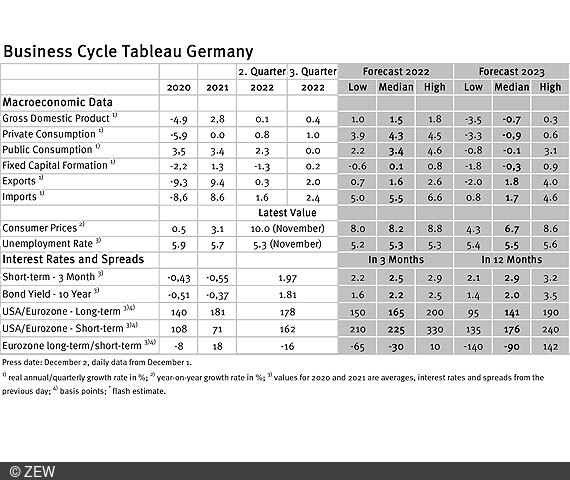

The German economy is expected to perform somewhat worse compared with 2019: By the end of 2022, real GDP is likely to have reached at most the pre-Covid crisis level in 2019, but not exceeded it. And for 2023, the experts again expect a median decline of 0.7 per cent. For German GDP, the range of forecasts is almost entirely on the negative side at -3.5 per cent (low) and 0.3 per cent (high).

High uncertainty about the development of consumer prices

Although inflation forecasts for the eurozone have risen very slightly to 8.3 per cent (previous month: 8.2 per cent) for 2022 and 6.5 per cent (previous month: 6.3 per cent) for 2023, experts continue to expect a slowdown next year. The range of forecasts for the next year is quite wide at 4.0 per cent to 8.1 per cent, reflecting the uncertainty about the further development of consumer prices.

Stärkere Invertierung der Renditekurve in der Eurozone erwartet

Short-term interest rates in the eurozone are forecast to rise by a further one percentage point over the next 12 months, while long-term interest rates are expected to remain slightly below current levels. Accordingly, the experts expect to see an even more strongly inverted yield curve in 12 months’ time than today. For the United States, the projected interest rates can be derived from the forecasts for interest rate differentials with the eurozone. Both short-term and long-term interest rates in the US are expected to change little over a 12-month horizon. In particular, the Federal Reserve System’s (Fed) monetary policy is not expected to tighten further. The changes in the US–eurozone interest rate differentials can therefore be attributed primarily to changes in interest rates in the eurozone.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.