Uncertainty About Inflation Makes Forecasts Rather Difficult

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomic Experts Divided on Forecasts

After the economic experts had significantly adjusted their forecasts in the previous month, this month they only see the need to adjust their projections more strongly with regard to inflation. What is rather unusual is the wide range of forecasts. This is the result of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

The forecasts of the most important macroeconomic variables have changed only slightly since the previous month. The new geopolitical situation resulting from the Ukraine war is thus reflected in the assessments of economic development.

Economic development uncertain

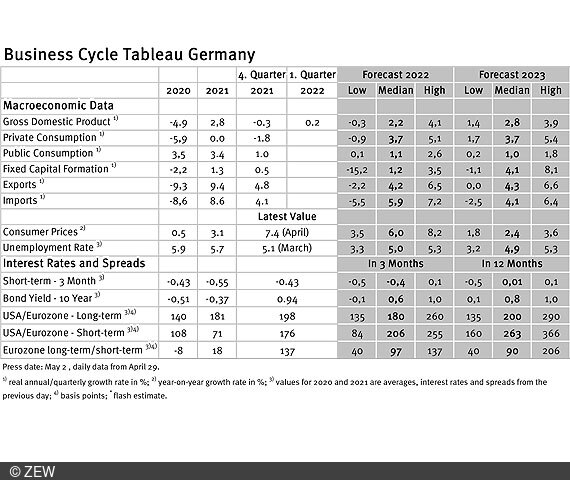

The median forecast for the growth of the real gross domestic product (GDP) of the German economy in the current year 2022 remains unchanged at 2.2 per cent, for 2023 it is slightly higher at 2.8 per cent (previous month: 2.7 per cent). However, the range of forecasts is considerable and reflects great uncertainty about the further economic development this year: The lowest forecast predicts a slight recession with a decline of 0.3 per cent (relative to the previous year), while the highest forecast sees very strong growth at 4.1 per cent. For 2023, this GDP forecast range is between 1.4 per cent (lowest) and 3.9 per cent (highest).

Positive signals for labour market development

The further development of the German labour market is expected to be overwhelmingly positive. For 2022, the annual average (median) unemployment forecast is 5.0 per cent, and for 2023 it is 4.9 per cent. Both figures are slightly higher than in the previous month, but compared to the current unemployment rate of 5.1 per cent (March 2022), virtually none of the experts assume that this rate will rise. Instead, many of the experts can imagine to see an even more significant decline.

Strong decline in inflation expected next year

The inflation forecast for 2022 has increased from 5.7 to 6.0 per cent since last month. However, experts still expect a sharp decline next year; in 2023, inflation is forecast to be 2.4 per cent, only slightly above the target set by the European Central Bank (ECB). For 2022, the range of forecasts is also unusually wide: The lowest forecast value is 3.5 per cent, the highest forecast value is 8.2 per cent. For 2023, the forecast ranges between 1.8 and 3.6 per cent.

What is surprising about the forecast ranges is that the uncertainty expressed by them is very high for the current year, while it is significantly lower for 2023. This is remarkable because, in principle, unexpected developments are more likely to occur in a longer period of time than in a shorter one. There is another tendency in the forecasts that somewhat calls into questions that the forecast interval be interpreted as a mere expression of uncertainty: Thus, the rather low forecasts for 2022 are accompanied by rather high forecasts for 2023 and vice versa.

Business cycle tableaus by ZEW and Börsen-Zeitung

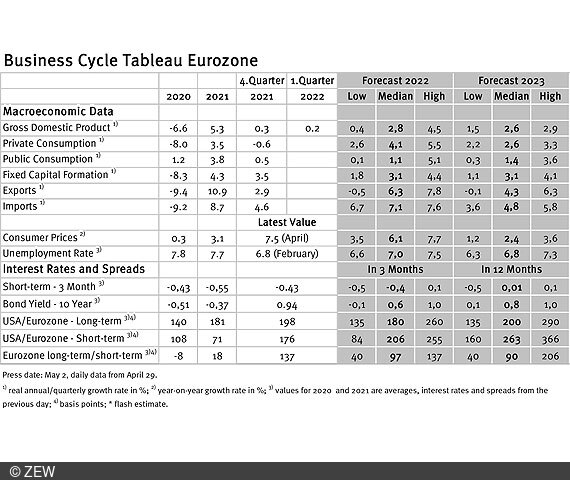

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.