Commercial Real Estate Financing Continues Its Upward Move

DIFI Report by ZEW and JLLDIFI Back in Positive Territory Again

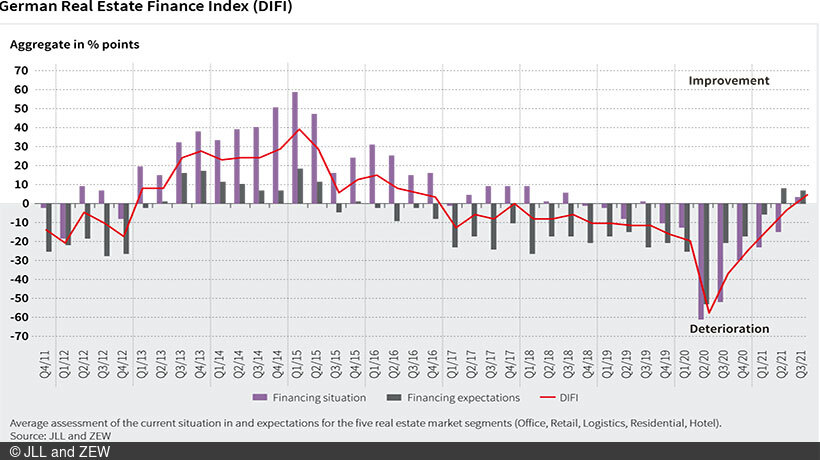

The German Real Estate Finance Index (DIFI) by ZEW Mannheim and JLL continues its upward trend. In the third quarter of 2021, it increases for the fifth time in a row and stands at 5.6 points (up 8.9 points compared to the previous quarter). This is the first time since the fourth quarter of 2017 that the index has moved above the zero mark.

While assessments of the current market situation have improved, expectations for the coming six months remain almost unchanged.

Logistics and Housing Benefit from Favourable Conditions

The logistics and residential sectors continue to benefit most from the current favourable conditions. While the expectations indicator for the residential sector increased by 7.0 points, the assessment for the last six months was much more pessimistic at minus 15.8 points. Nevertheless, this sub-indicator remains clearly in positive territory at 17.0 points. Assessments and expectations for the real estate for logistical use have risen slightly. After declines in the previous quarter, both the situation and the expectations indicators are again slightly higher in the third quarter. At 34.3 points, the corresponding sub-indicator reached the highest balance among the sectors analysed and remained at a high level for the third quarter in a row.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. The DIFI is a survey conducted and published by Jones Lang LaSalle (JLL) and ZEW Mannheim. 29 experts participated in the survey, which was conducted 26 July–17 August 2021.