Slightly Dimmer Economic Outlook

Business Cycle Tableaus by ZEW and Börsen-ZeitungExperts Divided Over Recovery in the Eurozone

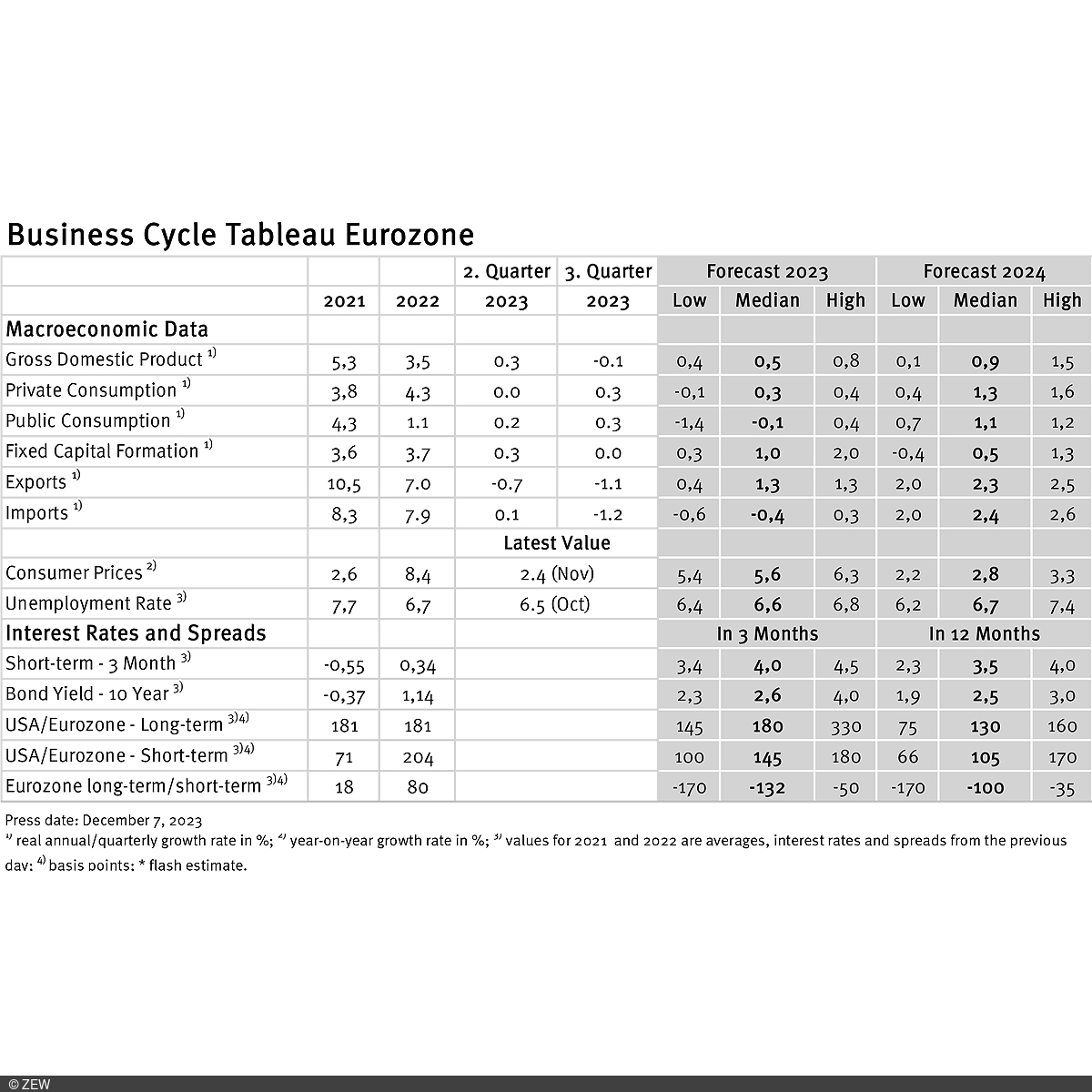

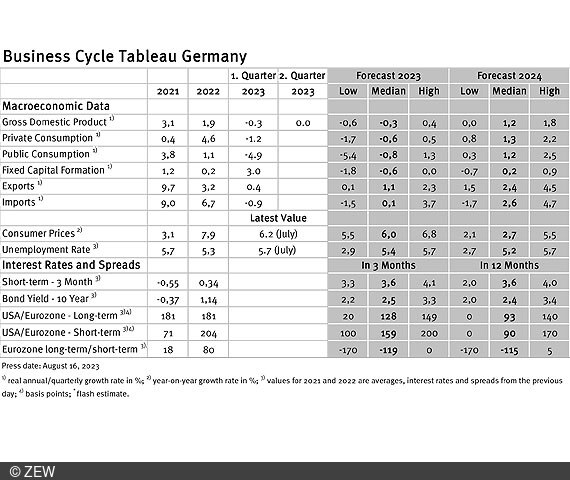

Business cycle experts have adjusted their growth predictions for the eurozone slightly downward for this year and the next, painting a somewhat more negative picture of the future. Their forecasts on the economic recovery, however, vary significantly. Expectations for Germany’s economy are also subdued. On a more positive note, inflation is on an encouraging trajectory, bringing the ECB target within reach. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

The quarterly growth figures for the real gross domestic product (GDP) in the eurozone remain unchanged at 0.3 per cent for the second quarter and at minus 0.1 per cent for the third quarter. The third quarter thus marks the first contraction in economic performance since the pandemic. In contrast to the quarterly figures, growth projections for 2023 and 2024 have been marginally revised downward, by 0.1 percentage points each. The experts expect real GDP to grow by 0.5 per cent in 2023 and by 0.9 per cent in 2024. The slightly more pessimistic outlook can be attributed to the ongoing conflict in the Middle East. At the same time, the range of expectations for 2024 remains wide, with a difference of 1.4 percentage points between the highest (1.5 per cent) and lowest (0.1 per cent) projections. This underscores the considerable lack of consensus among experts regarding the economic recovery in the eurozone next year. Notably, foreign trade is viewed as a key driver of recovery, with high growth rates expected for both exports and imports, at 2.3 and 2.4 per cent, respectively, in the coming year.

German quarterly growth figures remain stagnant

German quarterly growth figures persist at 0 per cent in the second quarter and at minus 0.3 per cent in the third quarter. However, growth expectations for Germany have shifted. While the experts have raised their growth forecast for 2023 by 0.1 percentage points to minus 0.3 per cent, the forecast for 2024 is 0.6 per cent, 0.3 percentage points lower than in November. The most pessimistic experts, foreseeing minus 0.3 per cent, even anticipate a contraction in German economic performance next year. The overall more pessimistic outlook for 2024 is in line with expectations for the eurozone.

Inflation rates approach ECB target

Inflation rates continue to fall sharply in both the eurozone and Germany. In November, inflation rates stood at 2.4 per cent for the eurozone (down 0.5 percentage points on October) and 3.2 per cent for Germany (down 0.6 percentage points on October). Consequently, inflation rates are steadily approaching the ECB’s target. For 2023, inflation rates of 5.6 per cent (eurozone) and 6.1 per cent (Germany) are anticipated. Looking ahead to 2024, inflation rates of 2.8 per cent (eurozone) and 2.7 per cent (Germany) are forecast. Inflation expectations thus show only minor changes compared to last month’s figures.

Unemployment rates and monetary policy expectations remain nearly unchanged

In contrast to inflation, unemployment rates in the eurozone and Germany recorded only minor changes. The unemployment rate in the eurozone remained at 6.5 per cent in November, the same as in October. Germany’s unemployment rate saw a marginal decline of 0.1 percentage points in November, settling at 5.6 per cent. At the same time, experts have revised down their expectations for the German unemployment rate in 2023 and 2024 by 0.2 percentage points each, to 5.4 per cent. With short- and long-term interest rates stable, monetary policy expectations have hardly changed compared to the previous month. Short-term interest rate expectations for the next twelve months have been adjusted downward by 0.1 percentage points to 3.5 per cent. Meanwhile, expectations for long-term interest rates in the next three months have also dropped by 0.1 percentage points, now standing at 2.6 per cent. The overall stability in monetary policy expectations aligns with the assumption that no interest rate changes will be made at the upcoming ECB meeting on 14 December 2023.

Business Cycle Tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.