Sentiment Among German Real Estate Financiers Worsens Again

DIFI Report by ZEW and JLLDIFI Falls for the First Time in Two Years

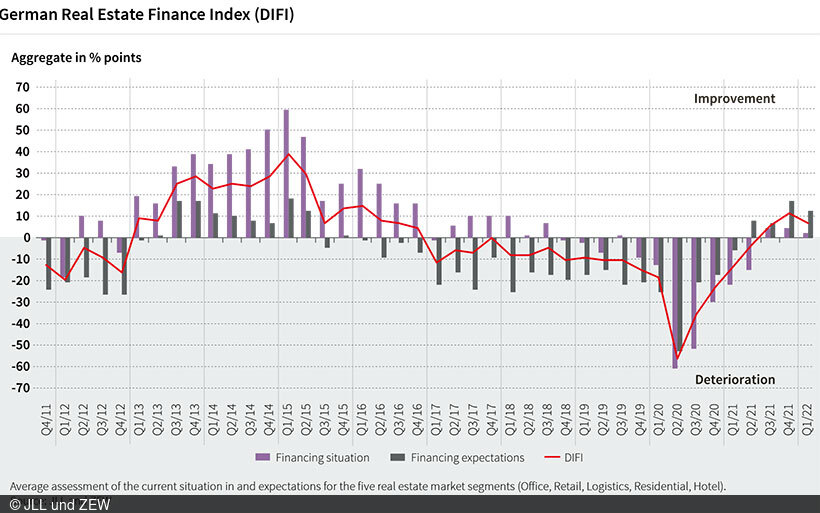

After the sentiment indicator had recorded an increase for six quarters in a row, the German Real Estate Finance Index (DIFI) by ZEW Mannheim and JLL fell in the first quarter of 2022. Compared to the previous quarter, the index dropped by 3.5 points to 7.2 points.

The market experts surveyed continue to assess the outlook more positively (12.8 points) than the current financing situation (1.6 points). Nevertheless, the expectations indicator falls by 4.6 points and thus more strongly than the situation indicator (minus 2.4 points). However, it must be noted that the survey was conducted before the escalation of the Ukraine conflict.

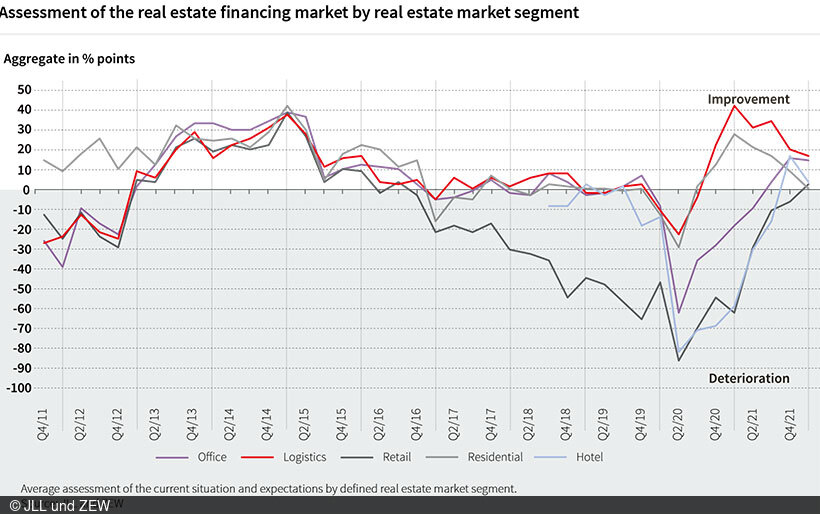

Assessment of individual real estate segments reveals mixed picture

A look at the individual asset classes reveals a mixed picture. The financing situation for logistics and residential real estate is assessed significantly worse than in the previous quarter. For logistics properties, the balance of positive and negative assessments decreases by 20.8 points, but remains clearly positive at 18.3 points. For residential real estate, the index records a decline of 18.2 points to zero points. The outlook for residential real estate remains slightly negative, while the assessments for logistics real estate are predominantly positive. The assessment of office properties has remained largely unchanged. Both the current situation (13.6 points) and the outlook (15 points) continue to be assessed optimistically. For hotels and retail properties, on the other hand, there have been significant changes compared to the fourth quarter of 2021. According to the experts, the financing situation for the hotel segment has improved slightly, but the negative assessments (minus 19 points) clearly predominate. Expectations for the next six months are brightening, although the market experts were still much more optimistic in the previous quarter. For the retail segment, the situation has improved considerably. The balance of positive and negative assessments climbed by 26.8 points to minus five points. The financing expectation remains in positive territory despite the somewhat less favourable outlook.

Inflation and interest rate outlook affects assessment of real estate equity markets

On the refinancing markets, the situation has deteriorated for deposits, unsecured debt securities and in particular for real estate equities in the first quarter of 2022. Assessments for covered bonds and mortgage-backed securities are more optimistic than in the previous quarter. The outlook for real estate stocks is rather gloomy: The indicator drops by 35.2 points to minus 42.9 points and thus to a similarly low value as in the third quarter of 2020. In contrast to the third quarter of 2020, however, the poor assessment for real estate equity markets is currently likely to be due to the inflation and interest rate outlook for Germany.

Special question: sustainability certificates are gaining more importance

In a special question, the experts were asked to assess the importance of sustainability certificates. They expect that sustainability certificates will become more important for all real estate segments and risk classes, but especially for office properties. Certification according to the DGNB and BREEAM standards are rated best. The LEED and Ecore sustainability labels score somewhat lower.

The German Real Estate Finance Index (DIFI)

The German Real Estate Finance Index (DIFI) reflects survey participants’ assessment of the current situation (including the previous six months) of and expectations (for the coming six months) for the commercial real estate financing market. It is conducted on a quarterly basis and calculated as the average value of the balances between the following segments: office, retail, logistics, residential properties and hotels. The balance for each segment is the difference between the percentage of participants who are optimistic and the percentage of participants who are pessimistic about the current state and future development of financing conditions in the German real estate market. The DIFI is a survey conducted and published by Jones Lang LaSalle (JLL) and ZEW Mannheim. 23 experts participated in the survey, which was conducted 7–14 February 2022.