Positive Economic Development in the Eurozone

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomists Also Optimistic About Labour Market

Economic experts expect the euro area economy to develop positively despite the sharp downturn in 2020. The German economy is forecast to grow only at an average rate in the medium term, but the German labour market is expected to perform well above average compared to the rest of the eurozone. This is the result of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

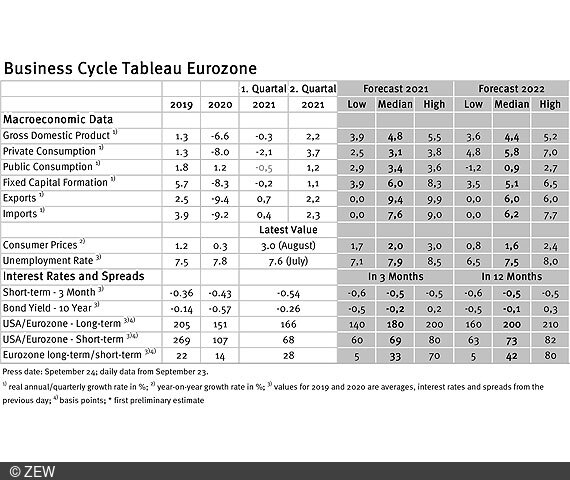

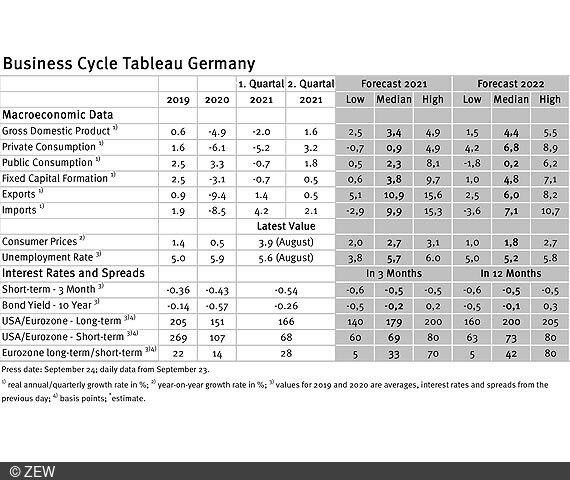

The median forecast for real gross domestic product (GDP) in the eurozone is now 4.8 per cent for 2021. This is 0.2 percentage points higher than it was a month ago. The forecast for 2022 remains unchanged at 4.4 per cent. For German GDP, on the other hand, the forecast for 2021 has been slightly revised downwards from 3.5 to 3.4 per cent. Hopes for stronger growth have been postponed for a few months to next year: for 2022, the GDP forecast is 4.4 per cent, just as for the euro area. According to these forecasts, the economy in the eurozone will develop far better than in Germany in 2021. For next year, however, the growth rates are expected to converge again.

Only average economic growth in Germany

However, with overall growth of 2.66 per cent in the period from 2020 to 2022, the German economy would still perform slightly better than the euro area economy, whose GDP growth is expected to be 2.19 per cent in this period. This is due to the fact that the eurozone experienced a more severe slump in 2020. If the period under consideration is extended to 2019, the picture turns in favour of the eurozone: in the period from 2019 to 2022, GDP in the euro area would grow by 3.5 per cent, while German GDP would only grow by 3.3 per cent. This makes it clear that economic growth in Germany is likely to be only average in the medium term.

Unemployment rate back to pre-COVID-19 level

The forecasts for the unemployment rate in the eurozone echo the expected positive economic development. For the current year, the forecast was lowered from 8.1 to 7.9 per cent and for next year to 7.5 per cent. This would put the unemployment rate in the euro area in 2022 at the same level as before the COVID-19 crisis in 2019. In contrast to GDP growth, where economic development in Germany is roughly in line with the eurozone average, the labour market in Germany is performing much better. With a value of 5.6 per cent in August, unemployment in Germany is significantly below the euro area average of 7.6 per cent. However, the two statistics are based on a different definition of unemployment. Using Eurostat’s definition, the unemployment rate in Germany is even far lower at 3.6 per cent (July 2021). The German labour market is thus developing much better than the euro area average.

Inflation rate reaches new high

The price development in the eurozone has reached a new high this year with an inflation rate of 3.0 per cent in August. Since January, the inflation rate has thus risen by 2.1 percentage points. The increase in the inflation rate from July to August shows that the momentum of the upward movement has not yet abated. Since the surge in inflation is mainly caused by the typically very volatile energy prices, most experts still do not expect the inflation rate to remain permanently high. The inflation rate of 1.6 per cent forecast for 2022 is slightly higher than in the previous month, but well below the European Central Bank’s inflation target. Accordingly, the experts continue to expect a very loose monetary policy for 2022.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.