No Time for a Sigh of Relief Despite Less Pessimism

Business Cycle Tableaus by ZEW and Börsen-ZeitungBusiness Cycle Experts Expect Greater Resilience in the Eurozone

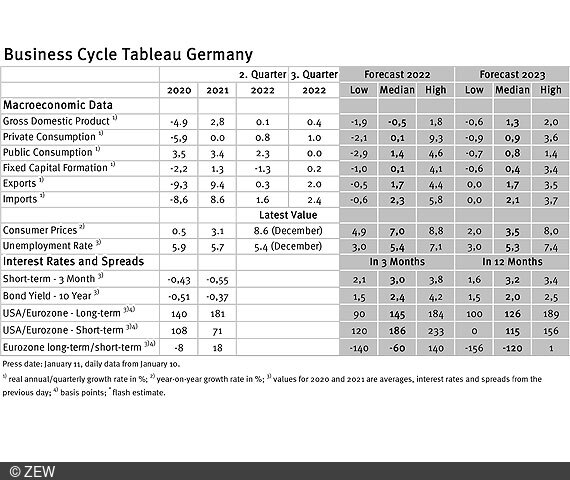

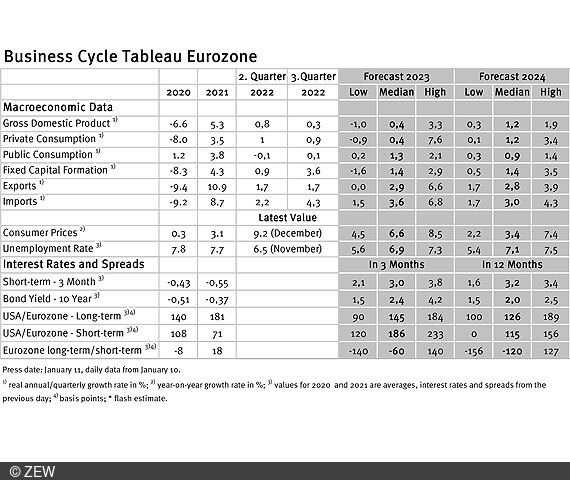

Business cycle experts are less pessimistic about real gross domestic product (GDP) growth in Germany and the eurozone, projections are less negative. In the eurozone, however, growth forecasts improve slightly more. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung, published on 13 January 2023.

The forecasts for economic growth in Germany are more optimistic - or rather less pessimistic - than they were the previous month. The median forecast for real GDP growth in 2023 rises from minus 0.7 per cent to minus 0.5 per cent. This is not a substantial change, however. The range of forecasts, the difference between the lowest and the highest GDP forecast, shows that the expected changes in real GDP no longer include high negative figures. One month ago growth prospects still ranged from minus 3.5 to 0.3 per cent but in early January they are between minus 1.9 and 1.8 per cent. This indicates, experts are of the opinion that the risk of a severe negative impact on economic growth has declined. For 2024, the median forecast is at 1.3 per cent and positive once more. The range of forecasts from minus 0.6 to 2.0 per cent shows, negative forecasts have improved significantly compared to 2023.

Eurozone economy expected to be more resilient

The forecasts for the eurozone real GDP are overall slightly higher than for Germany. At 0.4 per cent the median forecast for 2023 is 0.2 percentage points higher than it was in December. It is striking, that the range of forecasts, from minus 1.0 to 3.3 per cent, is considerably higher than the growth rates for Germany. Thus the risk of an economic setback is considered to be lower in the eurozone than on the Germany market. For 2024, the median forecast of 1.2 per cent is close to the forecast for Germany, still the lowest forecast value for the eurozone is with 0.3 per cent significantly higher than for Germany (minus 0.6 percent). These figures indicate the eurozone’s economic resilience is expected to be higher than it is in Germany.

Decline in inflation not reflected in forecasts for 2023

Compared to the previous month, inflation fell significantly in December 2022. In December inflation was at 8.6 per cent in Germany, 1.4 percentage points lower than in November. In the eurozone, inflation rates were at 9.2 per cent (December) and 10.0 per cent (November). The 2023 forecasts, however, do not reflect the reduced inflation rates. Quite the opposite is true. The median forecasts for January are somewhat higher than in December, 7.0 per cent for Germany and 6.6 per cent for the eurozone. Rates that come close to the European Central Bank's (ECB) target level can not be expected before 2024. The 2024 inflation forecasts are 3.5 per cent for Germany and 3.4 per cent for the eurozone. Accordingly, the experts forecast a three-month interest rate of 3.2 per cent for 2024, which is only slightly higher than the 3.3 per cent rate for 2023. This indicates that the ECB’s monetary policy is not expected to tighten much further.

Decline in long-term interest rates expected

Long-term interest rates are expected to decline in 2024 compared to 2023, which should lead to a yet further inverted yield curve reaching minus 120 basis points by the end of 2024.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.