Euro Area Economy Growing, Uncertainty for Inflation

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomists Optimistic for Euro Area Economy

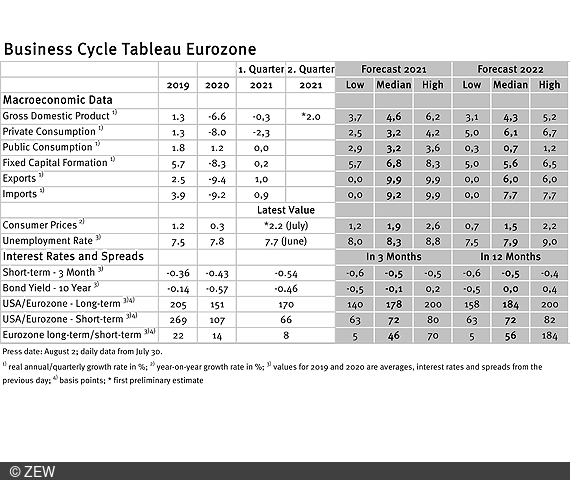

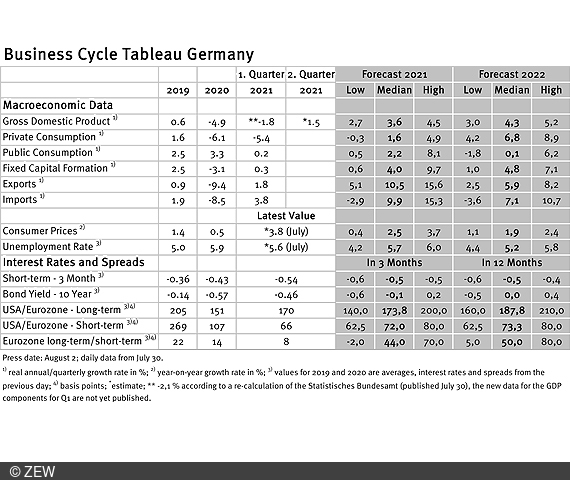

The forecasts of the economic experts for economic growth in the euro area were slightly increased; according to the forecasts, the German economy would perform significantly better than the average of the euro area during the coronavirus crisis. It will be intersting to see the further development of the inflation rate. This is the result of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

According to preliminary calculations by Eurostat, real gross domestic product (GDP) in the euro area grew by 2.0 per cent quarter-on-quarter in the second quarter of 2021. The strongest quarter-on-quarter growth was recorded by Portugal (+4.9 per cent) and Austria (+4.3 per cent). Spain (+2.8 per cent), Italy and Latvia (both +2.7 per cent) are also well above average. Lithuania (+0.4 per cent), the Czech Republic (+0.6 per cent), Sweden, and France (both +0.9 per cent), on the other hand, are far below average. The German economy, with a quarterly increase of 1.5 per cent, was unable to reach the euro area average in the second quarter.

German economy may withstand the coronavirus crisis better than the entire euro area

The current annual forecasts for the euro area real GDP are slightly higher than a month ago. The median forecast for the current year rose from 4.3 per cent to the current 4.6 per cent. For 2022, it is 4.3 per cent instead of 4.2 per cent at the beginning of July. According to these forecasts, the euro area's real GDP at the end of 2021 would still be about 2.3 per cent below the GDP value at the end of 2019 (before the coronavirus crisis). According to these forecasts, it should be about 1.9 per cent above this value at the end of 2022. By contrast, the German economy would be about 1.5 per cent below the pre-coronavirus value of real GDP at the end of 2021 and about 2.8 per cent above it at the end of 2022. According to these forecasts, the German economy would thus withstand the coronavirus crisis significantly better than the euro area average. Even the currently rather below-average GDP growth of the German economy does not change this view.

Will there be surprises in the inflation rate?

The further course of the inflation rate in the euro area seems to be rather uncertain. The inflation rate for the euro area as a whole is 2.2 per cent in July, an increase of 0.3 percentage points compared to June. This is still far below the 3.8 per cent inflation rate (harmonised index of consumer prices, HICP: 3.1 per cent) measured for Germany in July. According to Eurostat, the price increase in July came mainly from the energy and services sectors, while prices for food and industrial goods actually declined compared to the previous month. So far, experts have assumed in their forecasts that the price surge will be short-term in nature. However, the maximum forecasts have been raised considerably since last month. For 2022, the highest forecast is now 2.6 per cent (previous month: 2.0 per cent) and for 2022, 2.2 per cent (previous month: 1.7 per cent). As with the median, these forecasts assume that the inflation rate is likely to fall again in 2022. However, it would be above the target value of the European Central Bank (ECB) in both years. This could and should lead to a less loose ECB monetary policy or even to a first interest rate hike. Given the high forecast uncertainty for inflation usually present in medium-term forecasts, there may well be major surprises in the course of the next 12 to 18 months in terms of both inflation and monetary policy. Although the median forecast of a decline in inflation below 2 per cent and an unchanged loose monetary policy is currently still the majority opinion, it will be put to the test with every further increase in the inflation rate.

Unchanged unemployment rate

The labour market in the euro area has developed favourably. In June, the unemployment rate is 7.7 per cent, a decrease of 0.2 percentage points from the previous month. The projected figures remain virtually unchanged from the previous month's forecasts at 8.3 per cent (for 2021) and 7.9 per cent (for 2022). It can be assumed that the forecasts for next year and the current year will be adjusted downwards, as the development of the labour market so far has been much more favourable than expected. Even the lower limit of the forecasts of 7.5 per cent for 2022 is hardly compatible with the developments already achieved.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.