Sustainable Investments Become More Important for Financial Market Experts

ResearchSustainable investments (ESG investment products) are becoming more relevant for financial market experts. This is the result of a special question featured in the most recent ZEW Financial Market Survey conducted among approximately 150 financial market experts. Around 59 per cent see greater market potential for ESG products than for conventional investments. According to the respondents, ESG products are also associated with a similar ratio between risk and return as conventional investment products. Two thirds of the experts want to have ESG investment products in their own portfolios, even if only to a share of less than 50 per cent. However, the majority of the participants hold the view that social and ecological aspects are addressed only insufficiently by ESG investment products. The survey was conducted by ZEW Mannheim in September 2020.

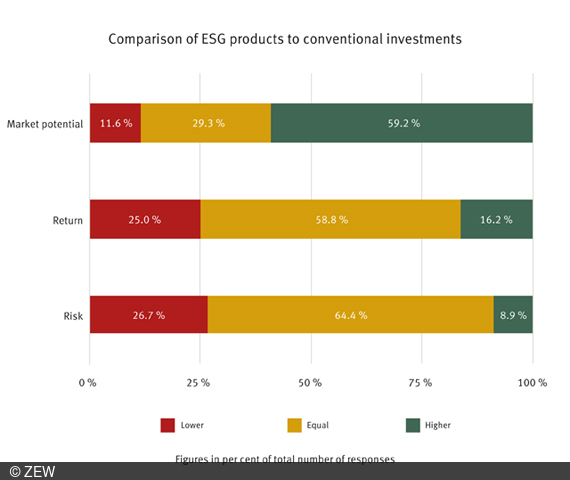

“Overall, sustainable investments are assessed as positive by the respondents. The assessment has clearly gained momentum compared to the 2007 survey,” says Dr. Michael Schröder, researcher for ZEW Mannheim’s “International Finance and Financial Management” Department and co-author of the evaluation. 59.2 per cent of respondents currently see a greater market potential for sustainable investments than for conventional investments, 29.3 per cent assume that the market potential is equally good, and only 11.6 per cent see less potential. Experts in 2007 still estimated the market potential to be much lower (see Fig. 1).

Increasing amount of ESG investments in expert portfolios

ESG investments are also keeping pace with conventional investments in terms of risk/return characteristics. Compared to conventional investments, the majority of financial market experts assess both the risk and return characteristics of sustainable investments as somewhat lower. “According to the experts, investors do not face a trade-off between sustainability and return when considering ESG investment products. This view has changed considerably since the ZEW Financial Market Survey in 2007, in which the experts rated the risk of sustainable investments higher and their return lower,” comments Frank Brückbauer, researcher for ZEW’s “International Finance and Financial Management” Department and second co-author of the evaluation.

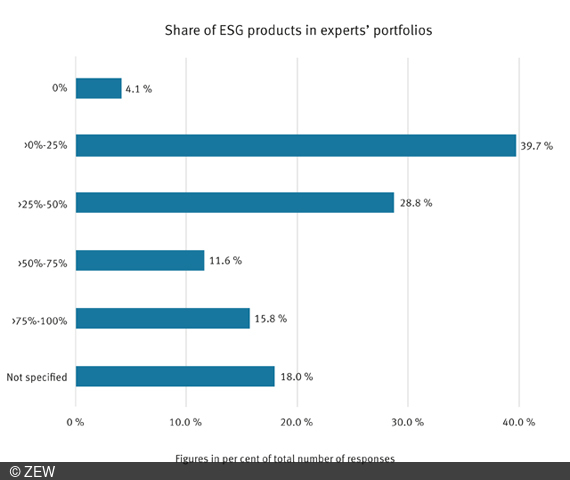

The larger share of ESG investments in their own portfolios also demonstrates the experts’ increasingly high regard for them. While 37.1 per cent in the 2007 survey did not even want to include ESG investments in their portfolio, this same proportion of sceptics has fallen to just 4.1 per cent in the current survey (see Figure 2). A 68.5 per cent majority prefers to hold a portfolio share of less than 50 per cent (39.7 per cent of which would be between 0 and 25 per cent). 15.8 per cent of the experts would even place the largest part of their portfolio (between 75 and 100 per cent) in ESG investments.

“As far as the focus on social and ecological aspects is concerned, sustainable investments still have a considerable amount of catching up to do. Many financial market experts think there is still insufficient attention being paid to these criteria,” says Michael Schröder. 57.7 per cent of the experts think that supposedly sustainable investments hardly take social and ecological aspects into account. However, confidence in sustainable investments has also grown in this respect: 42.3 per cent say that ESG investments strongly consider social and ecological aspects, compared to the 34.4 per cent in the 2007 survey.