Stocks and Commodities Are Attractive Investments, Cryptocurrencies Less So

ResearchFinancial Market Experts on Asset Classes

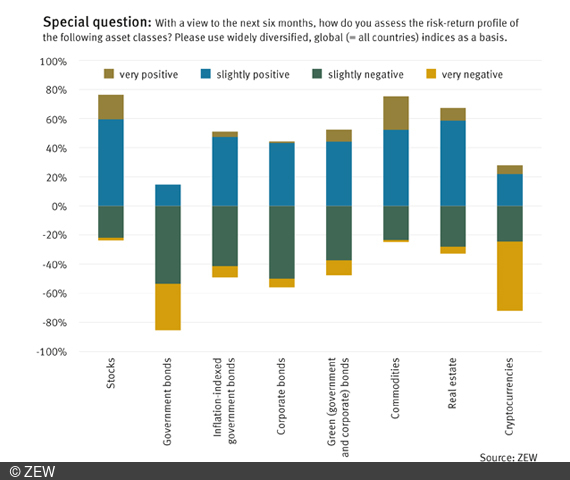

Against the background of rising inflation expectations and low interest rates, financial market experts have assessed the attractiveness of various asset classes for the next six months: While investments in stocks, commodities and real estate are currently considered attractive, the outlook for cryptocurrencies and conventional government bonds is clearly negative. Inflation-indexed bonds and green bonds are rated slightly positively by the financial analysts. This is the result of a question included in the ZEW Financial Market Survey, which was conducted among around 160 financial market experts in June 2021.

In the survey, the financial analysts were asked about the risk-return profile of stocks, government bonds, inflation-indexed government bonds, corporate bonds, green government and corporate bonds, commodities, real estate and cryptocurrencies in the coming six months and in retrospect. The results show that approximately 77 per cent and 75 per cent of the experts, respectively, rate stocks and commodities positively for the coming six months; real estate also pays off as an investment according to 67 per cent of the experts.

Cryptocurrencies, on the other hand, have become much less attractive: around 73 per cent of the experts do not regard them as a worthwhile investment over the coming six months. Conventional government bonds and corporate bonds are also expected to perform relatively poor: 86 per cent and 56 per cent of the analysts, respectively, rate them negatively. For inflation-indexed government bonds and green bonds, by contrast, there is no clear trend visible for the coming months, with positive assessments slightly outweighing negative ones. “Financial market experts currently assess the risk-return profile of investments that offer some protection against inflation more positively than of those that offer little or no protection. It is unlikely that cryptocurrencies are currently considered by the experts to provide a high degree of protection against inflation,” explains Frank Brückbauer, a researcher in the ZEW Research Department “International Finance and Financial Management”.

Looking at the development over the past six months, the financial market experts also assess the individual asset classes very differently. For the majority of respondents (54 per cent), the risk-return profile of commodities has become more attractive, while that of stocks (40 per cent) and cryptocurrencies (52 per cent) has become less attractive. The assessment of government bonds, inflation-indexed government bonds, corporate bonds, green bonds and real estate has remained largely unchanged.

Overall, the financial analysts give green government and corporate bonds a better rating than conventional government and corporate bonds. “From the experts’ point of view, sustainable investments will become even more relevant in the future. The demand for green bonds is likely to grow much faster than the supply in the short term. In this case, the prices of green bonds would develop more favourably than those of comparable conventional bonds,” says Frank Brückbauer.