Start-up Founders Struggle amid Energy Crisis and Ukraine War Fallout

ResearchNumber of business start-ups decreased by 7 per cent compared to the previous year

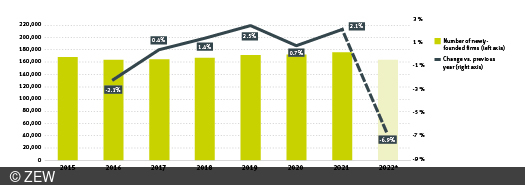

The year 2022 marked a turning point in many ways, including entrepreneurial activities in Germany. According to a joint study by Creditreform and ZEW Mannheim, the number of business start-ups decreased by 7 per cent compared to the previous year. Despite the challenges posed by the COVID-19 pandemic and its impact on the economy, the number of new companies had stabilised at around 176,000 in both 2020 and 2021. For 2022, Creditreform and ZEW anticipate only around 163,000 start-ups. This preliminary result is in line with the business registration statistics published by the Federal Statistical Office in January 2023, which indicate a 5 per cent decline in newly registered businesses compared to the previous year.

“We can clearly observe that factors such as rising energy costs, high inflation, and disrupted or delayed supply processes of materials and raw products have a profound impact on the start-up landscape,” explains Patrik-Ludwig Hantzsch, head of Economic Research at Creditreform. Virtually all industries are affected by these challenges. Especially in the manufacturing industry and the high-tech sector, many are deterred from starting their own business due to the prevailing conditions. The only sector experiencing growth amid this crisis is the energy supply sector. The heightened sensitivity towards energy costs has not only generated significant demand but has also led to a noticeable increase in the number of start-up ventures. In 2022, approximately 2,300 start-ups were launched, reaching around 150 per cent of the 2015 level.

Start-up activity in Germany from 2015 to 2022

In addition to current events, the long-term demographic trend is also casting a shadow on the start-up scene. “The growing shortage of skilled labour increases the costs of starting a business on the one hand, while making dependent employment more attractive on the other. Consequently, the willingness to embark on risky start-up projects, relative to stable employment, decreases,” says Dr. Sandra Gottschalk, senior researcher in ZEW’s “Economics of Innovation and Industrial Dynamics” Unit and author of the study.

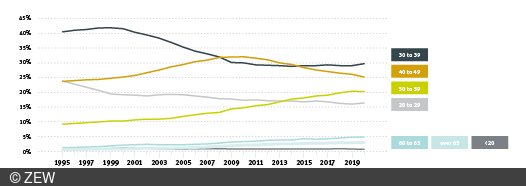

This trend is reflected in the figures from Creditreform and ZEW, which reveal a clear decline in the proportion of younger founders. While individuals aged 30 to 39 still comprise the largest group, accounting for nearly 30 per cent, their share has declined from over 40 per cent around the turn of the millennium. The proportion of founders aged 20 to 29 is also decreasing, albeit to a lesser extent. In contrast, the proportion of founders aged 50 to 59 has risen from ten per cent to nearly 20 per cent during the same period. There has also been an increase in the participation of founders aged 60 to 65 and those over 65 in the start-up scene.

Development of the age structure of founders in the year of founding

Sandra Gottschalk suggests several potential reasons for this trend. On the one hand, older individuals are increasingly enjoying extended periods of good health, and on the other hand, they tend to have higher average wealth compared to earlier cohorts of older people. Today’s entrepreneurs over the age of 60 often leverage their capital as “founding angels”, acting as private investors to financially support start-ups and contribute their professional experience. In doing so, they partially address the funding gap that many founders commonly face.

Banks, being risk-averse, are often hesitant to take on such risks. Consequently, young companies driving innovation and exhibiting high growth potential are more likely to secure financing from venture capitalists. “Against this backdrop, it will be interesting to see the outcomes of the planned new financing regulations for start-ups announced by the German government,” notes Patrik-Ludwig Hantzsch. “It remains to be seen whether these regulations will enhance access to the capital market and enable a resurgence of start-up activity in Germany.”