Media Service Providers Restore Positive Sentiment After a Long Dry Spell

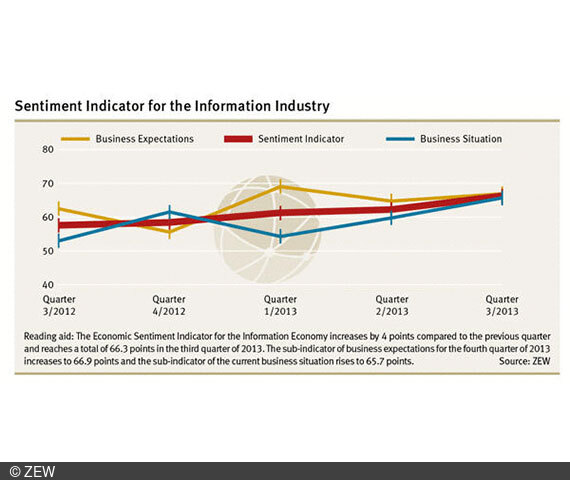

Information EconomyEconomic sentiment in the information economy has continued to improve in the third quarter of 2013. The ZEW Economic Sentiment Indicator in the Information Economy has increased by four points compared to the previous quarter and reaches a total of 66.3 points. The companies' assessment of their business situation in the third quarter as well as their business expecations for the fourth quarter are extremely positive. Reaching values of 65.7 points and 66.9 points, both sub-indicators gain stability on a high level. Sentiment in the media industry, which used to be the sector’s "problem child", also brightened up significantly. These are the findings of a survey conducted by the Centre for European Economic Research (ZEW) in the information economy sector in September 2013.

The information economy sector consists of the sub-sectors information and communication technologies (ICT), media service providers and knowledge-intensive service providers. The sentiment indicator in the media industry has exceeded the critical 50-points mark for the first time since the end of 2011, suggesting positive business expectations in this sub-sector. The sentiment indicator increased by 9.7 points compared to the previous quarter and has reached a total of 53.8 points in the third quarter of 2013.

In recent years, the media sector has undergone substantial restructuring and consolidation processes, not least due to the increasing digitalisation of products and distribution channels. An example of this development is the book market, where e-books are gradually displacing the print media and bookshops are losing market shares to online providers. The current sentiment indicator suggests that companies in this sector now see a light at the end of the tunnel. The sub-indicator of business expectations has risen significantly from 46.5 points in the previous quarter to 70 points, whereas the sub-indicator of the business situation remains at a low level of 41.4 points.

The sentiment of ICT companies, already on a high level, continued to improve in the third quarter of 2013. The sentiment indicator has reached the highest level in the past two years with a total of 71.5 points. The improved sentiment stems from the companies’ positive assessment of the business situation in the third quarter of 2013. The sub-indicator for the business situation has increased by 12 points compared to the previous quarter, thereby reaching a total of 75.1 points. The sub-indicator of business expectations has dropped by 2.3 points, but remains on a remarkable 68.2-points level.

The knowledge-intensive service providers retain their highly positive economic sentiment. The indicator of this sub-sector reaches a total of 64.2 points in the third quarter of 2012. The sub-indicators of the current business situation and business expectations have risen slightly and reach a total of 63.4 points (business situation) and 65.1 points (business expectations). Optimism prevails in all sub-sectors of the knowledge-intensive services industry, but expectations are particularly positive among PR and business consultants. On balance, more than 50 per cent of these companies could increase their turnovers compared to the previous quarter.

For further information please contact

Daniel Erdsiek, Phone +49(0)621-1235-356, E-mail erdsiek@zew.de

The Economic Sentiment Indicator in the Information Economy

The Economic Sentiment Indicator in the Information Economy is composed of the four components sales situation, demand situation, sales expectations and demand expectations (each in comparison with the previous and following quarter). They are equally taken into account for the calculations. Sales situation and demand situation form a partial indicator reflecting the business situation. Sales expectations and demand expectations form a partial indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations amounts to the value of the Economic Sentiment Indicator in the Information Economy. The sentiment indicator can adopt values between 0 and 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

The Economic Survey Conducted by ZEW

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting, (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. The last six sectors make up the knowledge-intensive service providers.

Overview of the ZEW economy survey (in German)

Remark on the Projection

To generate a representative analysis, ZEW projects the answers of the firms participating in the survey with their shares of total turnover realized in the sector of the German IT related service providers. The phrasing ‘share of the businesses’ therewith reflects the share of turnovers of the businesses.