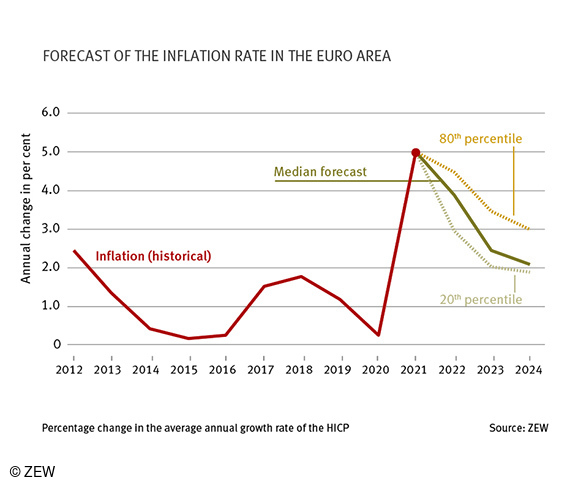

Inflation Rates Expected to Stay Above Two Per Cent Until the End of 2024

ResearchThe currently very high consumer price inflation rates in the euro area are expected to remain well above the ECB’s two per cent target over the whole year 2022 before gradually declining in the medium and long term. High energy prices, scarcity of raw materials and problems in international supply chains are expected to be the main drivers of this high inflation, and are likely to last longer than previously forecast. In line with these results, the ECB is expected to increase its main refinancing rate, but only very gradually over the coming years. These are the results of a survey of financial market experts conducted by ZEW Mannheim.

For the current year, the inflation forecasts average 3.8 per cent. Although inflation rates are expected to decline gradually over the next two years, an average price increase of 2.7 per cent is expected for 2023. For 2024, the average forecast is 2.3 per cent. In the longer run, inflation is expected to be lower: 53 per cent of the participants estimate that inflation rates in the period 2025-2030 will be lower than in the period 2022-2024. About 22 per cent think it will be similar and 23 per cent that it will be higher.

“With a share of 53 per cent, only small majority of financial market experts expects inflation to slow again in the period 2025-2030 compared to their projections for the period between 2022 and 2024. The remaining participants currently tend to believe that the times when inflation in the euro area was too low rather than too high are over for now,” says Frank Brückbauer, a researcher in ZEW’s “International Finance and Financial Management” Department.

Energy prices, scarcity of raw materials and international supply problems are seen as main drivers

Respondents named high energy prices, scarcity of raw materials and problems with international supply chains as the most important drivers of the higher predicted inflation for 2022-2024. These three factors had a positive influence on the inflation forecasts for this period for 91, 88 and 81 per cent of the participants respectively.

“In the last survey in November 2021, it was assumed that the effect of those factors on inflation would only be temporary and would fade in 2022 and 2023. The predictions of the February survey suggest that these factors may have a more persistent influence,” says Thibault Cézanne, also a researcher in ZEW’s “International Finance and Financial Management” Department.

Another, more structural element – the green transformation – also contributed positively to these inflation forecast (for 61 per cent of the participants). “The financial market experts surveyed see the main drivers of inflation in rising energy prices, the shortage of raw materials and international supply bottlenecks. Largely unrelated to the pandemic is the influence of the green transformation of the economy and the society, which comes in fourth place, but is also seen as a major inflation driver in the long term,” says Brückbauer.

Rise in euro short-term interest rate expected mainly due to green transformation

In line with these inflation forecasts, the ECB’s main refinancing operations rate is expected to increase progressively and steadily over time. The expected 90 per cent mean confidence interval evolves from -0.1 per cent and 0.15 per cent over a six-month period to 0.07 per cent and 0.40 per cent at the end of 2022 before reaching 0.57 per cent and 1.28 per cent at the end of 2024. The ECB’s main refinancing operations rate is expected to continue to rise in the long run as 66 per cent of the participants estimate that it will be higher in 2025-2030 than in 2022-2024, while 29 per cent anticipate similar levels and only four per cent forecast lower levels.

“In the medium and long term, the majority of financial market experts expect interest rates in the euro area to continue to rise,” says Frank Brückbauer.