Higher Innovation Spending and More Companies Active in R&D

ResearchZEW Innovation Survey 2022: Innovation Behaviour in the German Economy

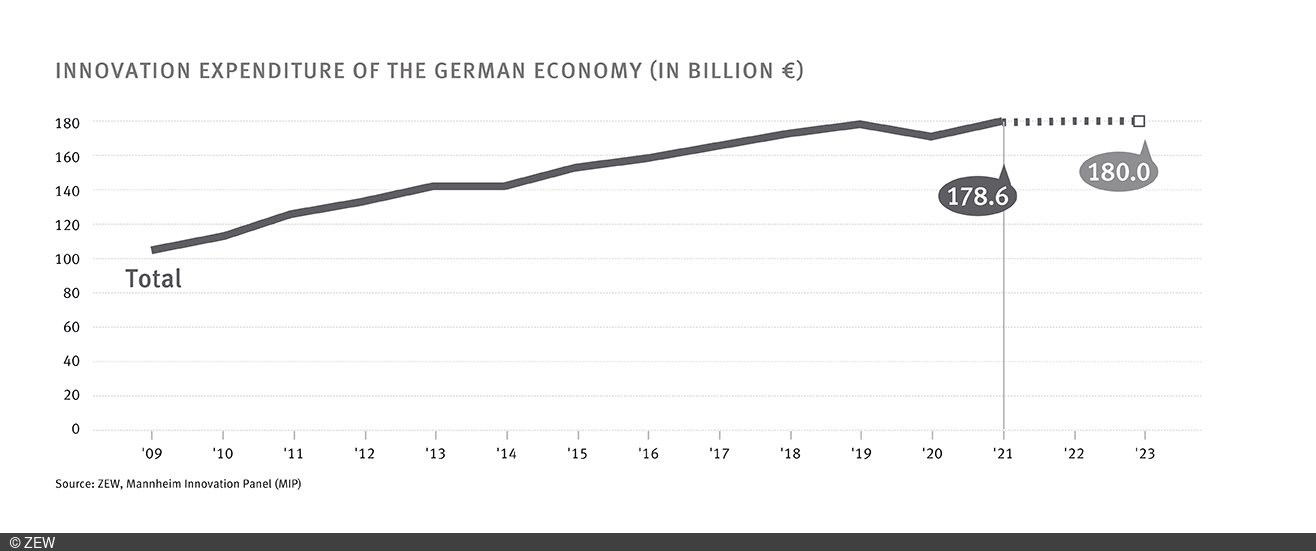

German companies increased their innovation spending in 2021 by 4.7 per cent to 178.6 billion euros. This significant increase has made up for the decline in 2020, when innovation expenditure fell by 3.6 per cent to 170.5 billion euros due to the pandemic. However, the pre-pandemic level from 2019 (176.9 billion euros) was only slightly exceeded. At the same time, the number of companies continuously conducting R&D rose by almost eight per cent and reached a new high of around 42,000. These are the findings of the Innovation Survey 2022 (in German only), which ZEW Mannheim conducts annually on behalf of the German Federal Ministry of Education and Research.

Federal Research Minister Bettina Stark-Watzinger explains: “It is good news that in the second year of the pandemic, companies have caught up well in innovation expenditure and have even spent more money on innovation than in the year before the pandemic. I am pleased that small and medium-sized enterprises in particular have made great headway in this respect. Only with research and innovation can we master the great challenges facing Germany. That is why we seek to further improve the framework conditions for innovation and transfer. With the Future Strategy for Research and Innovation, we – the federal government – will bundle our efforts and resources and concentrate them on the major challenges. One such focus is to increase the innovator rate among small and medium-sized enterprises and to increase the start-up rate. This way we ensure our ability to innovate and thus also growth and prosperity.”

As in previous years, innovation expenditure in the service sectors developed positively in 2021. With an increase of 9.7 per cent, it grew more than three times as much as in the industrial sectors (+3.0 per cent). Nevertheless, at 130.6 billion euros, the level of innovation expenditure in the industrial sectors remains considerably higher than in the services sectors (48.0 billion euros).

With an increase of nine per cent, small and medium-sized enterprises (SMEs) recorded higher growth in innovation spending in 2021 than large companies, which raised their spending by 3.9 per cent. This continues the trend already observed in 2020, when SMEs slightly increased their innovation spending while large companies saw a significant decrease.

The share of turnover spent on innovation – the so-called innovation intensity – fell in 2021 for the first time in six years. At 3.0 per cent, it was 0.3 percentage points below the previous year’s figure. The expansion of innovation spending in 2021 thus did not keep pace with the strong, partly inflation-driven, turnover growth.

At around 180 billion euros, innovation spending is unlikely to increase much further in 2022 and 2023. However, these are only approximate figures. Due to the uncertain global economic and geopolitical climate, many companies were unable to provide target figures for their future innovation spending.

Innovation activity concentrated in R&D-active companies

In 2021, innovation activity in Germany was concentrated in fewer companies. While innovation expenditure increased overall, the number of companies engaged in innovation activities fell to around 198,000 (59.6 per cent of all companies). In 2020, more than 201,000 companies (60.9 per cent) were still committed to innovation activities. At the same time, the number of companies implementing innovations as a result of their own continuous R&D activities rose by almost eight per cent to 42,000. This is the highest number since the innovation survey began in the early 1990s. The number of companies that occasionally conduct R&D also increased, by six per cent to around 33,000. In contrast, the number of companies engaged in innovation activities without conducting their own R&D declined. Some of these companies had carried out innovation projects in 2020 to respond to the changed conditions caused by the pandemic. These related in particular to the digitalisation of processes and sales channels. In 2021, this effect is no longer likely to be significant. The share of companies that introduced product or process innovations decreased by 1.3 percentage points to 54.3 per cent in 2021.

Focus on reducing costs

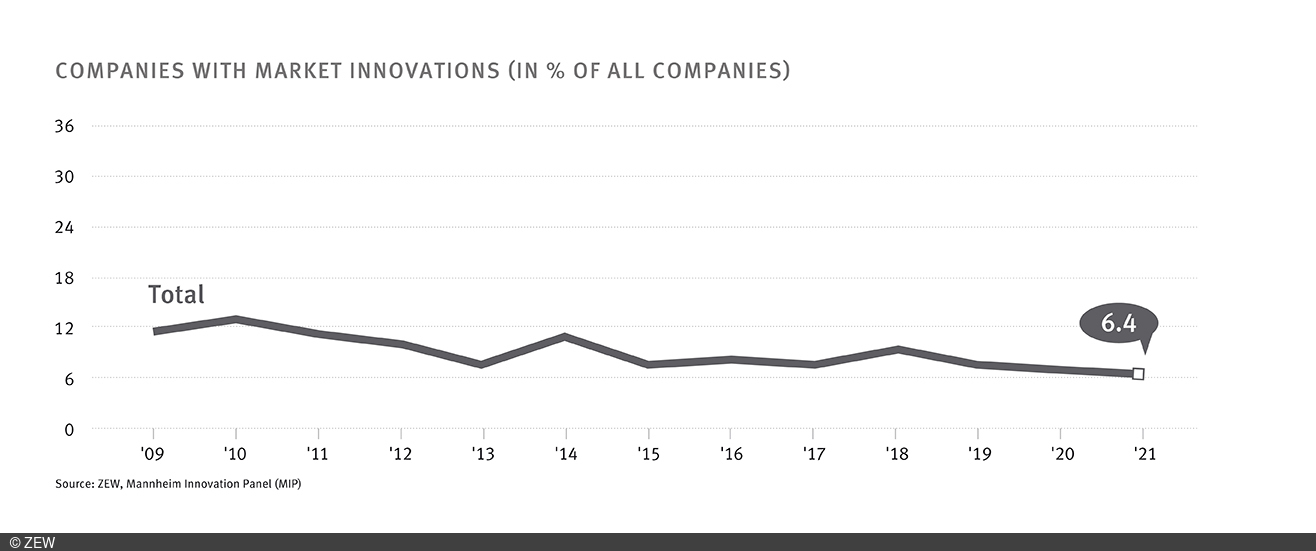

Furthermore, the study shows that the focus of innovation activity has shifted more towards reducing costs. At the same time, the number of companies that introduced genuinely new product innovations (market novelties) declined. In 2021, around 44,000 companies in Germany, or 13.4 per cent of all companies, implemented cost-reducing process innovations – an increase of 13 per cent compared to 2020. Only 21,000 companies (6.4 per cent) offered market novelties, which is a drop of eight per cent compared to 2020. The average reduction of unit costs achieved with process innovations improved to 3.3 per cent in 2021 (2020: 3.1 per cent). The sales share of market novelties increased slightly from 3.2 per cent (2020) to 3.3 per cent (2021) despite the shrinking number of companies offering such innovations. However, this is due to the introduction of Covid-19 vaccines, which produced unique effects.

About the ZEW Innovation Survey

ZEW Mannheim, in cooperation with the Institute for Applied Social Sciences (infas) and the Fraunhofer Institute for Systems and Innovation Research (ISI), collects data on the innovation activities of German companies every year on behalf of the German Federal Ministry of Education and Research. The study considers companies with five or more employees. In 2021, these were around 332,000 companies with 18.0 million employees and a turnover of almost 6.0 trillion euros.