Growing Optimism in the Information Economy

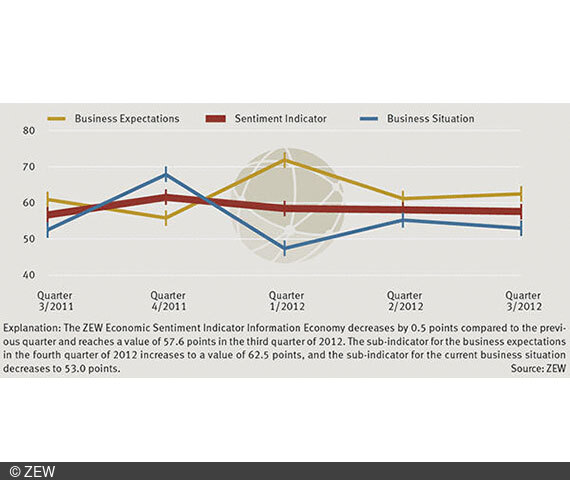

Information EconomyIn spite of a slight decrease by 0.5 points to a level of 57.6 points, the ZEW Sentiment Indicator Information Economy again lies above the crucial 50-points mark in the third quarter of 2012. The majority of companies, hence, expect a positive economic development of the sector. The economic sentiment in the information economy has already been remaining relatively stable since the third quarter of 2011, and by the end of this year, further improvement is expected. Even in the sub-sector of media service providers, where estimations have been rather bleak since the beginning of the year, optimism gradually spreads. Expectations for the coming months have brightened up noticeably. These are the findings of the quarterly survey among companies in the information economy in Germany, conducted by the Centre for European Economic Research (ZEW) in Mannheim.

A closer inspection of the two central components of the Sentiment Indicator Information Economy shows that the indicator’s slight decline conceals an overall positive development. Compared to the previous quarter, the sub-indicator for the current business situation decreases by 2.2 points to a level of 53.0 points in the third quarter of 2012, but at the same time, the sub-indicator for business expectations for the fourth quarter of 2012 increases by 1.3 points to a level of 62.5 points. According to the surveyed companies, the already fairly positive economic situation within the information economy will hence further improve. It also fits in that the perspectives for the overall economic situation in Germany are being assessed more positively than in the previous months. For example, the ZEW Indicator of Economic Sentiment for the German economy in September 2012 increased for the first time since April 2012 and further improved in October 2012.

The sharpest change can be observed for the sub-sector of the media service providers. As opposed to the knowledge-intensive service providers and the ICT sector the media service providers´ sentiment has been characterised by a strong pessimism in 2012. In the current survey, the sentiment indicator of this sub-sector now increases by 5.4 points to 42.6 points. Although it still lies beneath the crucial 50-points mark, business expectations give reason to hope that the economic situation of the media service providers will improve during the next months: the sub-indicator for business expectations increased by 17.2 points and, with a level of 53.9 points, reaches the highest value in the last twelve months. On balance, the share of companies of the media sector expecting increasing sales numbers during the fourth quarter of 2012 is currently eleven per cent larger than the share of those expecting sales losses. Regarding the demand side, the share of optimists exceeds the share of pessimists by five per cent. The sub-indicator for the current business situation, however, decreases by 4.1 points to 33.7 points due to declining sales and reduced demand during the third quarter, but this unfavourable situation can be more than levelled out by the optimistic expectations for the fourth quarter.

For further information please contact

Miruna Sarbu, Phone +49 621/1235-334, E-mail sarbu@zew.de

ZEW Sentiment Indicator Information Economy

The ZEW Sentiment Indicator Information Economy is composed of the four components turnover situation, demand situation, turnover expectations and demand expectations (each in comparison with the previous and following quarter). They are used for the calculations with equal importance. Turnover situation and demand situation form a partial indicator reflecting the business situation. Turnover expectations and demand expectations form a partial indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations amounts to the value of the ZEW Sentiment Indicator Information Economy. The sentiment indicator can adopt values between 0 and 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

Business Survey in the Information Economy

About 1,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. All nine sectors combined make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. The last six sectors make up the knowledge-intensive service providers.

Overview of the ZEW economy survey (German language only)

Comment on the Projection

To ensure the analyses' representativeness, ZEW projects the answers of the survey participants with the turnover value of the businesses with regard to the entire economic sector information economy. The phrasing "share of the businesses" thus reflects the share of turnover of the businesses.