Economic Mood Reaches a New High

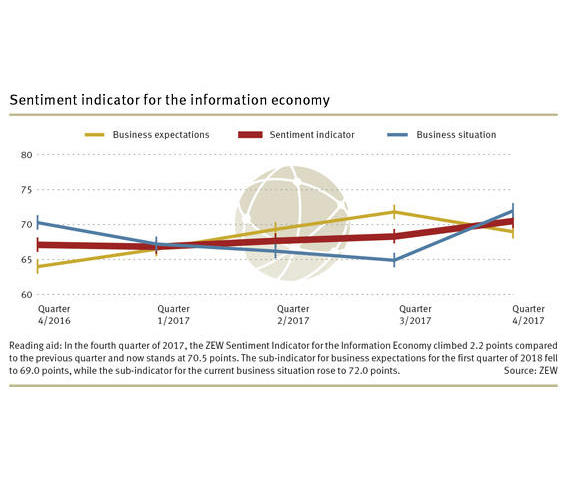

Information EconomyFirms in Germany’s information economy kicked off 2018 in an extremely positive mood. This positive economic climate is clear from the most recent reading of the ZEW sentiment indicator, which reached a remarkable 70.5 points in the fourth quarter of 2017. This represents an increase in the sentiment indicator of 2.2 points compared to the previous quarter, signalling that a significant majority of companies are satisfied with the current economic situation. This is the finding of a survey conducted among companies in the German information economy by the Centre for European Economic Research (ZEW), Mannheim, in December 2017.

The increase in the sentiment indicator is the result of positive developments in the business situation. Compared to the previous quarter, the sub-indicator for the business situation increased by 7.1 points in the fourth quarter, reaching a total of 72 points. The fact that this figure is well above the critical 50 point mark indicates that the majority of firms saw an increase in turnover and demand for their products or services compared to the previous quarter. Business expectations for the first quarter of 2018, meanwhile, display a slight downward trend, though they remain at a high level. Despite a drop of 2.8 points, the reading for the sub-indicator for business expectations remains fairly high at 69 points, indicating that the majority of the surveyed companies are optimistic about what the beginning of 2018 has in store.

The information economy consists of the sub-sectors information and communication technologies (ICT), media service providers, and knowledge-intensive service providers. Following a high reading in the previous quarter, the mood among ICT companies remained overwhelmingly positive in the fourth quarter of 2017, with the indicator climbing an extra 4.6 points, reaching a total of 77.9 points. Decisive for this positive trend of the sentiment indicator were firms’ more favourable assessments of the business situation, which caused the corresponding sub-indicator to rise by 10.5 points to 77.6 points. While 66.7 per cent of ICT firms reported higher turnover in the fourth quarter of 2017 than in the previous quarter, only 7.4 per cent saw revenues decline. The sub-indicator for business expectations dropped two points compared to the previous quarter, but still remained at a high level of 78.1 points. On balance, 49.2 per cent of ICT firms expect to see higher revenues in the first quarter of 2018 compared to the fourth quarter of 2017.

Slightly less optimistic mood among media service providers

The economic mood among media service providers experienced a slight setback in the fourth quarter of 2017. Compared to the previous quarter, the sentiment indicator dropped 4.3 points, but still remains just above the critical 50-point mark with a reading of 51.5 points. This indicates that only a small majority of media service providers gave a positive assessment of the economic mood. Meanwhile, their assessment of the business situation in the fourth quarter of 2017 was considerably more positive than their expectations for business growth in the first quarter of 2018. The corresponding sub-indicator for the business situation currently stands at a level of 58.3 points, an increase of 8.2 points compared to the previous quarter. Following a drop of 16.6 points compared to the previous quarter, the sub-indicator for business expectations dipped below the critical 50-point mark with a reading of 45.6 points. This tells us that slightly over half of the media service providers have a pessimistic view of the coming months.

The economic mood among knowledge-intensive service providers remained positive in the fourth quarter of 2017 following the previous quarter, in which the sentiment indicator for knowledge-intensive service providers reached its highest level in a long while. The sentiment indicator has climbed a further 1.5 points to a reading of 68.8 points, an increase that can primarily be attributed to the improved business situation. The sub-indicator for the business situation climbed by 4.1 points compared to the previous quarter and now stands at 70.6 points. Despite a slight decrease of one point, the sub-indicator for business expectations among knowledge-intensive service providers still gives an overwhelmingly positive reading of 67.1 points.

For further information please contact:

Dr. Daniel Erdsiek, Phone + 49 (0)621/1235-356, E-mail daniel.erdsiek@zew.de

The Economic Sentiment Indicator for the Information Economy

The Economic Sentiment Indicator for the Information Economy is composed of the four components turnover situation, demand situation, turnover expectations and demand expectations (each in comparison with the previous and following quarter). They are equally taken into account for the calculations. The turnover situation and the demand situation form a sub-indicator reflecting the business situation. Turnover expectations and demand expectations form a sub-indicator reflecting business expectations. The geometrical mean of the business situation and the business expectations is the value of the Economic Sentiment Indicator for the Information Economy. The sentiment indicator can take on values from 0 to 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

The ZEW Business Survey in the Information Economy

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting, (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the information economy. The ICT sector consists of ICT hardware and ICT service providers. Sectors three to nine make up the knowledge-intensive service providers. To get an overview of the ZEW Business Survey in the Information Economy (in German), please visit: http://www.zew.de/konjunktur.