Companies Largely Looking Ahead into the New Year with Optimism

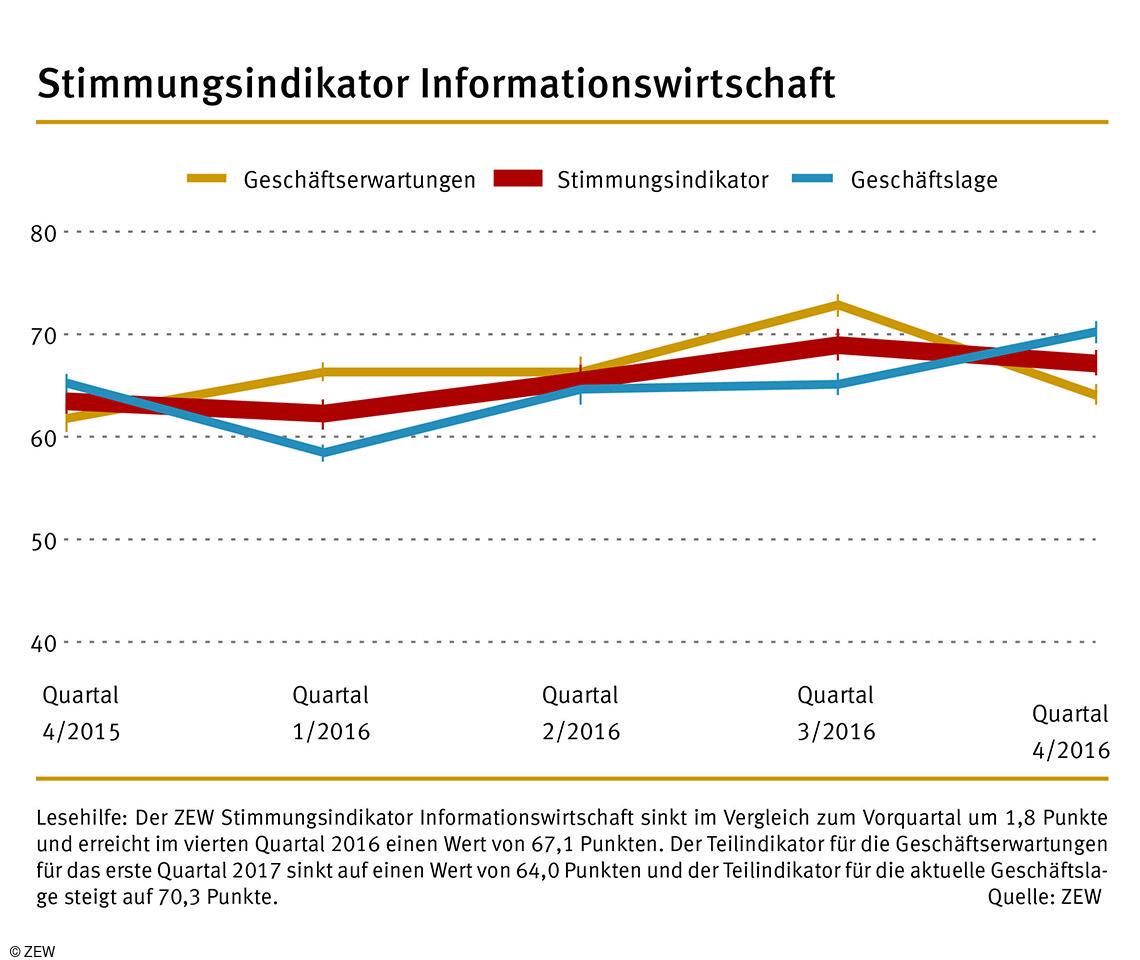

Information EconomyCompanies in the information economy are kicking off 2017 in a positive economic mood, as indicated by the ZEW sentiment indicator for this sector, which reached 67.1 points in the fourth quarter of 2017. Though the indicator fell below that of the previous quarter by 1.8 points, the consistently high value signals a positive climate among the majority of firms within the information economy. This is the result of a survey among companies in the German information economy, conducted by the Centre for European Economic Research (ZEW), Mannheim, in December 2016.

One reason for the sentiment indicator's slight decline is that business expectations for the first quarter of 2017 have dampened somewhat. The corresponding sub-indicator for business expectations dropped from 72.9 points in the third quarter of 2016 to 64 points in the fourth quarter of the same year. Nonetheless, the fact that the sub-indicator still clearly surpasses the critical 50 point mark indicates that the majority of firms are looking ahead to the first quarter of 2017 with optimism. The optimistic expectations for the year-end business for 2016 were partially fulfilled according to the progress of the business situation sub-indicator in the fourth quarter of 2016. At 70.3 points, this sub-indicator reached its highest point in many years, indicating an overwhelmingly positive trend in terms of turnover and demand for the firms' products.

The information economy sector consists of the sub-sectors information and communication technologies (ICT), media service providers, and knowledge-intensive service providers. The optimistic economic mood in the ICT sector changed little in the fourth quarter of 2016. The sentiment indicator for the ICT sector reached a very high 77.5 points. These companies had an overwhelmingly positive view of their business situation in the fourth quarter of 2016 and equally positive business expectations for the first quarter of 2017. The business situation sub-indicator climbed to 80.6 points, its highest point in recent years. The majority of companies in the ICT sector expect demand and sales to continue to increase in the first quarter of 2017. This is indicated by the sub-indicator for business expectations, which stands at 74.6 points.

Economic mood rated overwhelmingly positively

While the mood in the media sector darkened somewhat in the fourth quarter of 2016, the economic climate still has a largely positive rating. The sentiment indicator surpassed the critical 50 point mark twice in a row and now stands at 52.7 points. After climbing considerably in the previous quarter, the sentiment indicator dropped again in the fourth quarter by 5.5. points. This drop in the sentiment indicator is the result of poorer business expectations, with the corresponding sub-indicator falling to 43.8 points. This indicates that the majority of firms have a pessimistic view of the future. The economic mood in general is, however, rated overwhelmingly positively thanks to a brighter assessment of the business situation in the fourth quarter of 2016.

A clear majority of knowledge-intensive service providers still have a positive view of the economic mood. The sentiment indicator currently stands at a level of 61.8 points. The sub-indicator for business expectations decreased by 6.9 points compared to the previous quarter, falling to 59.8 points. Meanwhile, the sub-indicator for the business situation climbed 2.7 points to 63.8 points. This suggests that the majority of knowledge-intensive service providers had both a positive view of the business situation in the fourth quarter of 2016 and positive business expectations for the first quarter of 2017.

For further information please contact

Dr. Daniel Erdsiek, Phone + 49 (0)621/1235-356, E-mail erdsiek@zew.de

The Economic Sentiment Indicator for the Information Economy

The Economic Sentiment Indicator for the Information Economy is composed of the four components sales situation, demand situation, sales expectations and demand expectations (each in comparison with the previous and following quarter). They are equally taken into account for the calculations. The sales situation and the demand situation form a sub-indicator reflecting the business situation. Sales expectations and demand expectations form a sub-indicator reflecting the business expectations. The geometrical mean of the business situation and the business expectations is the value of the Economic Sentiment Indicator in the Information Economy. The sentiment indicator can take on values from 0 to 100. Values above 50 indicate an improved economic sentiment compared to the previous quarter, values smaller than 50 indicate deterioration compared to the previous quarter.

The economic survey conducted by ZEW

About 5,000 businesses with a minimum of five employees participate in the quarterly survey conducted by ZEW. The companies surveyed belong to the following business sectors: (1) ICT hardware, (2) ICT service providers, (3) media, (4) law and tax consultancy, accounting, (5) public relations and business consultancy, (6) architectural and engineering offices, technical, physical and chemical analysis, (7) research and development, (8) advertising industry and market research, (9) other freelance, academic and technical activities. Combined, all nine sectors make up the economic sector of the information economy. The ICT sector consists of ICT hardware and ICT service providers. Sectors three to nine make up the knowledge-intensive service providers. Overview of the ZEW Business Survey in the Information Economy (in German):http://www.zew.de/konjunktur.