Are Fiscal Interests Slowing the Reduction of ECB Assets?

ResearchZEW Study on the Reduction of ECB Stocks from Asset Purchase Programmes Poses Critical Questions

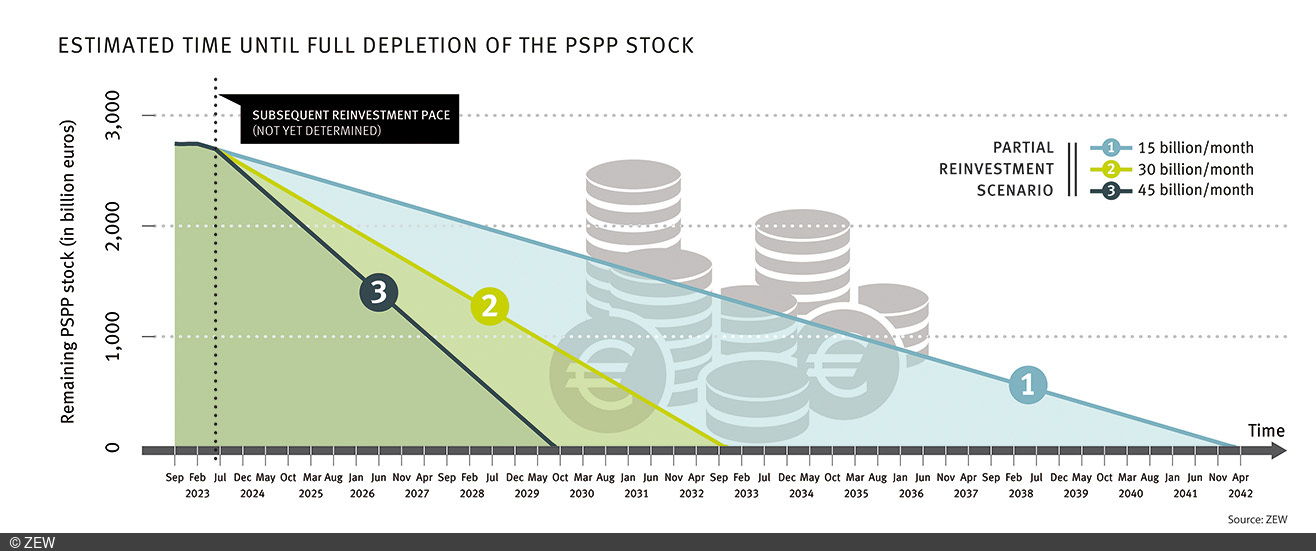

If the European Central Bank (ECB) maintains the current slow pace of asset reduction from the bond-buying programme PSPP (Public Sector Purchase Programme), it would take until 2042 for the stock to be fully depleted. Additionally, PEPP (Pandemic Emergency Purchase Programme) reinvestments have shifted even more in favour of Italy and Spain. At the same time, the Eurosystem holds a share of more than 30 per cent of the total government debt of EU Member States. These indications point to fiscal policy motives, concludes the update of an ongoing study by ZEW Mannheim, supported by the Brigitte Strube Sitftung. The study examines the magnitudes and deviations from the capital key of the ECB’s assest purchase programmes.

By June 2022, the net asset purchases in the PSPP and the PEPP had reached a total volume of 4.41 trillion euros. Since then, the ECB has begun to deplete the stocks in the PSPP at an average pace of 15 billion euros per month. At this rate, the stocks will not be fully depleted until the year 2042. Even if the pace were doubled, this would take until 2032. Professor Friedrich Heinemann, head of the ZEW Research Unit “Corporation Taxation and Public Finance” and co-author of the study, is critical of this approach: “Net purchases were far more aggressive when the risk of deflation was high than net reductions are now when inflation is high. This gives the impression of an asymmetrical monetary policy that combats a too-high inflation rate less resolutely than one that is too low.”

Heavier PEPP usage despite the end of the pandemic

For the PEPP, the full reinvestment of principal payments from maturing securities is planned until at least the end of 2024. Although the pandemic shock has largely been absorbed, the ECB continues to deviate from its capital key and recently even continued to increase its overweighting of Italy and Spain. Carlo Birkholz, co-author of the study and economist at ZEW, finds this to be alarming: “The 1.5 percentage point overbalance towards Italy, as measured by the ECB capital key, which existed at the end of net purchases has even increased over the course of full reinvestments. Italy and Spain are now supported to the tune of 2 per cent of their annual gross domestic product.”

Heinemann concludes: “A strong asymmetry between bond purchases and sales, the overbalance towards highly indebted countries, and the still-increasing PEPP support for Italy despite the pandemic being over raise critical questions. All these are signs that the ECB is pursuing an agenda in which fiscal interests play a role that is not insignificant.”