Energy Crisis, Raw Material Shortages and Supply Bottlenecks Lower Growth Forecasts

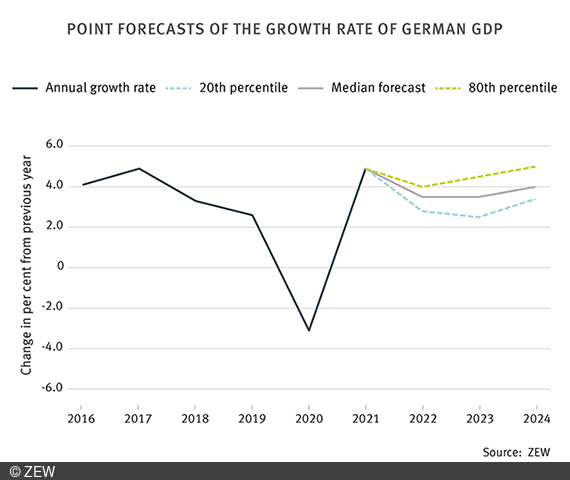

Dates and NewsThe German economy will grow only moderately by 1.5 per cent in 2022, according to the assessment of the financial market experts surveyed by ZEW Mannheim in July 2022. Compared to April 2022, the respondents have revised their forecast for 2023 downwards from 2.5 to 1.5 per cent. The experts do not expect the economy to accelerate before 2024, when growth is expected to reach 2.0 per cent.

For the second, third and fourth quarters of 2022, the respondents expect a median growth rate of 0.2 per cent each. At the median, the respondents expect a 30 per cent probability of declining GDP in the second quarter. For the third quarter, the median probability of the German economy contracting is predicted to be as high as 50 per cent. “Even though the probability of a recession in Germany is clearly increasing, it is not the most likely scenario that the respondents expect, at least for now,” comments Thibault Cézanne, a researcher in ZEW’s “Pensions and Sustainable Financial Markets” Department.

Dr. Marc Frick from the ZEW Research Department “Environmental and Climate Economics” then provided specific insights into one of ZEW research units and talked about his daily work at the institute. His core message was: “It’s all about asking the right questions! He then spoke about the challenges for the EU and Germany to achieve climate policy goals without losing competitiveness. In this way, the students gained a realistic impression of what empirical economic research is and what a day’s work for economists can look like.

Rising inflation, raw material shortages and disrupted supply chains have the strongest negative impact on respondents’ growth forecast. About 38 and 51 per cent of participants, respectively, say that energy prices had a negative or strongly negative impact on their forecast. 53 and 21 per cent of respondents, respectively, attribute a negative or strongly negative influence to inflation (excluding energy prices) on their forecast. The third strongest influencing factor is the shortage of raw materials, to which 43 or 33 per cent of the participants attribute a negative or strongly negative effect. In fourth place, with 48 and 27 per cent respectively, are the supply chains disruptions.