AI Start-up Boom

ResearchGerman AI Start-up Landscape: A First Stocktaking

Start-up activity in the field of artificial intelligence in Germany has been very dynamic over the past decade. The years 2014 to 2018 saw a veritable start-up boom with annual figures rising from 250 newly founded companies to over 450. AI start-ups have a high probability of survival in the market and are characterised by strong growth in employee numbers, as a comprehensive stocktaking of the AI landscape by ZEW Mannheim shows. “The high dynamics and the good performance of AI start-ups illustrate that artificial intelligence is an important growth field with a lot of room for development for newly founded companies,” says ZEW economist Dr. Christian Rammer from ZEW’s Research Department “Economics of Innovation and Industrial Dynamics”.

The study is the first comprehensive stocktaking of start-up activities in the field of AI in Germany, mapping the broad spectrum of start-up activities in the field of AI. It shows that the AI start-up scene has developed significantly positively in recent years. “For economic policy, the strong AI start-up scene is an excellent starting point for driving the uptake of AI applications in the German economy. In this way, policymakers can fully exploit the high innovation potential and positive effects on productivity and economic growth,” says study author Dr. Christian Rammer.

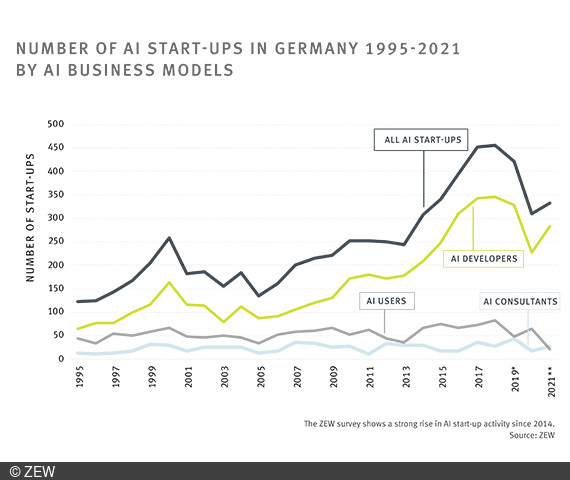

There has been a strong increase in the number of start-ups: Since 1995, more than 6,600 companies have been founded in Germany with business models that are based on AI technology. The number of AI start-ups rose sharply from 2014 onwards, reaching a peak in 2017 and 2018 with more than 450 new companies founded in each year. In 2019, the number of AI start-ups declined for the first time since 2005 to around 420 start-ups and dropped to around 310 in the first pandemic year of 2020. There are no signs of a further decline in 2021.

Very high survival rate and favourable credit ratings

A decisive factor for the positive development of AI start-ups is their extraordinarily high probability of survival compared to start-ups in other sectors. In 2021, 92 per cent of all the AI start-ups studied, i.e. around 6,000 companies, were still economically active. The survival rate is twice as high as the average for all start-ups in Germany. In 2019 and 2020, however, there was a noticeable increase in company closures of AI start-ups. The credit rating of AI companies – a key indicator of economic success – is also significantly better than for other start-ups. On average, the credit rating is 13 per cent higher than for all start-ups in Germany.

A look at the field of activity of the AI start-ups shows that approximately two-thirds are involved in the development of AI technologies or AI applications that are either used as products or services for other companies or are a central component of the start-up’s range of services. Around ten per cent are AI consultants who offer advice on the topic of AI for other companies or institutions. Around 20 per cent of the AI start-ups surveyed use AI as a process technology for their own products or the provision of services.

The number of people working in AI start-ups also increased steadily and is expected to reach around 150,000 employees in 2021. Almost seven per cent of AI startups exceeded the threshold of 100 employees, and more than 90 AI startups already counted as large enterprises (250 or more employees).

Bringing AI start-ups and potential users closer together

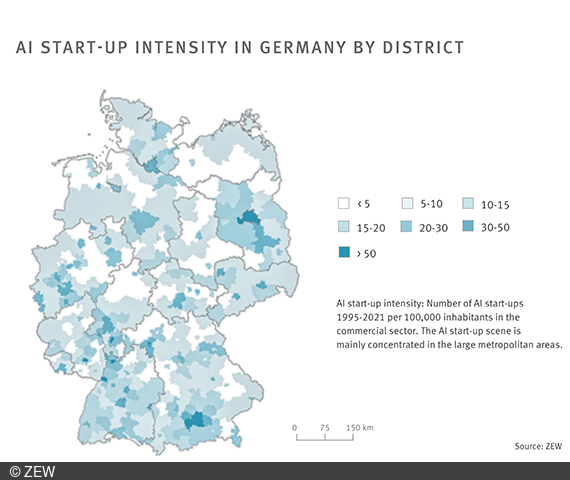

The study also shows that 93 per cent of all AI start-ups are located in Germany’s central regions. For AI developers, this share is even 95 per cent. Hotspots of AI start-ups are the major cities of Berlin, Munich, Hamburg, Cologne and Frankfurt. “One challenge is to bring together the AI start-up scene, which is heavily concentrated in the large metropolitan areas in Germany, with the broad spectrum of user companies, which are often also located outside these central areas. This is where intermediary organisations that specialise in promoting networking among AI start-ups could play an important role,” Rammer concludes.