Coronavirus Pandemic Threatens Existence of Many Businesses

ResearchWith the coronavirus pandemic starting to spread and take its toll on the German economy, many businesses find themselves in less than ideal conditions, as they go into the crisis with low credit ratings. Industries like the gastronomy sector, automotive suppliers and the construction sector have the highest shares of small companies with weak credit scores. These are the results of calculations conducted by ZEW Mannheim and the economic research division of Creditreform, Neuss, with data from the Mannheim Enterprise Panel, which is based on the databases of Creditreform.

The federal government has rolled out the heavy artillery: unlimited loans for companies who run into liquidity constraints due to the crisis, a significant expansion of short-time working grants, and the announcement of comprehensive tax deferrals to ease the situation. In addition, there are plans to suspend the obligation to file for insolvency until at least this autumn. Alternatively, this time period could also be extended until 31 March 2021. All these measures, which aim to protect businesses facing serious liquidity issues from insolvency, have become necessary in light of the interruptions in global supply chains, the rapidly collapsing demand, and employee absences due to sickness and the shutdown of child care facilities.

“This determination shown by the federal government was urgently needed,” says Patrik-Ludwig Hantzsch, spokesperson of the economic research division of Creditreform. “Despite the long period of economic prosperity, many companies are ill-equipped to handle what could become the gravest economic crisis of the post-war era.” Hantzsch goes on to explain: “More than ten per cent of private companies older than three years that have just grown out of their infancy stage have weak or poor credit scores. This affects approximately 345,000 companies, which employ 1.5 million workers.”

Many sectors are characterised by a disproportionally large share of companies at risk of bankruptcy. This is particularly true for the gastronomy sector, where 16 per cent of companies with less than 50 employees (almost 24,000 companies) have a weak credit rating. The same applies to automobile suppliers (15 per cent) and the chemical and pharmaceutical industries (14 per cent).

Preserving business structures over temporary lean period

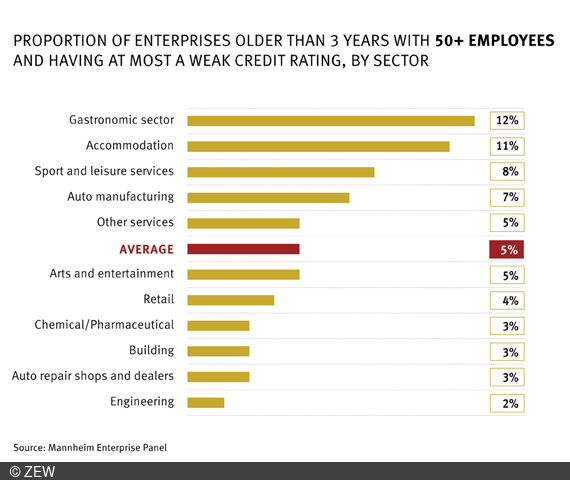

As far as businesses with 50 or more employees are concerned, the situation is completely different. For these companies, the share of firms at risk of insolvency is much lower, with the gastronomy sector once again coming top of the list, followed by the accommodation sector, and sports and leisure services. A considerable share of hotel and leisure companies in the latter two sectors had already been on the verge of insolvency before the crisis.

“These results reflect the structural problems currently facing the German private economy before the coronavirus crisis,” explains ZEW research department head Dr. Georg Light, “they shed light on where we stand at the onset of the crisis. These sectors will, however, be affected by the economic standstill in very different ways.” Larger purchases, maybe even holiday trips, can to some extent still be postponed. This is, however, less likely when it comes to business trips, and cinema and concert visits. Above all, leisure, sport and cultural service providers will be particularly hard hit by this temporary halt in demand.

Depending on how long the economy remains on lockdown, this could shrink their annual turnover by 30 to 40 per cent. These disruptions can even throw companies with previously good credit records into insolvency if they do not receive support. “The federal government was right to decide against setting any limits,” says ZEW economist Dr. Georg Licht. “Preserving business structures through a temporary lean period makes more economic sense in the long run than letting essentially healthy firms go into bankruptcy, which would then have to be re-established and rebuilt after the crisis.”

The study results outlined above do not include the approximately 440,000 young companies in the private sector that are less than four years old, which currently employ around 1.2 million workers. As newcomers to the markets, these companies already face a tense financial situation, with their products and services still having to establish themselves on the markets. For companies with radically new products, this is always problematic – even when there is no crisis. Firms first have to convince potential customers of the benefits and take longer to penetrate the market. It is therefore to be expected that these young companies will face much greater risks than older ones.