Start-ups Are Bolstering the German Chemical Industry, but Lose out on Venture Capital

ResearchChemical start-up companies in Germany are providing the country’s chemical industry with innovative products and services, boosting the entire sector. But as far as the provision of venture capital to these companies and the general start-up activity in the chemical industry are concerned, Germany lies considerably behind other European countries. These are the key findings of a study conducted by the ZEW – Leibniz Centre for European Economic Research, Mannheim, and the Leibniz University Hannover’s Center for Economic Policy Studies (CWS), on behalf of the German Chemical Industry Association (VCI).

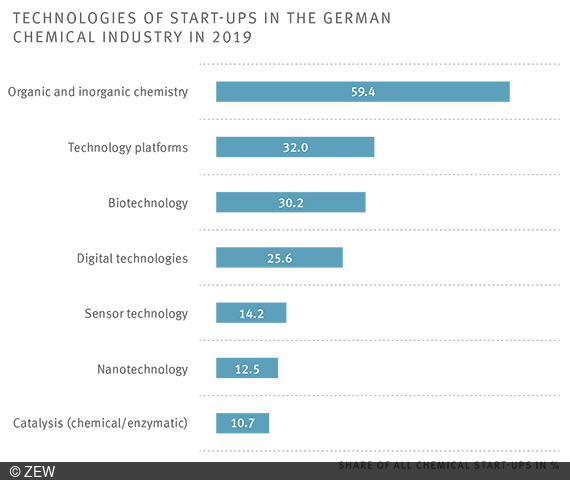

“Instead of manufacturing traditional chemical products, many chemical start-ups focus on offering special products for the industrial production sector and dedicated services for established chemical companies,” explains Dr. Christian Rammer, deputy head of the ZEW Research Department “Economics of Innovation and Industrial Dynamics” and co-author of the study. Gerd Romanowski, director of “Science, Technology and Environment” at VCI, adds: “For our industry, the strength of chemical start-ups lies above all in their ability to position themselves at the interface between the traditional chemical sector and new areas of application, for instance by providing digital solutions or platform technologies.”

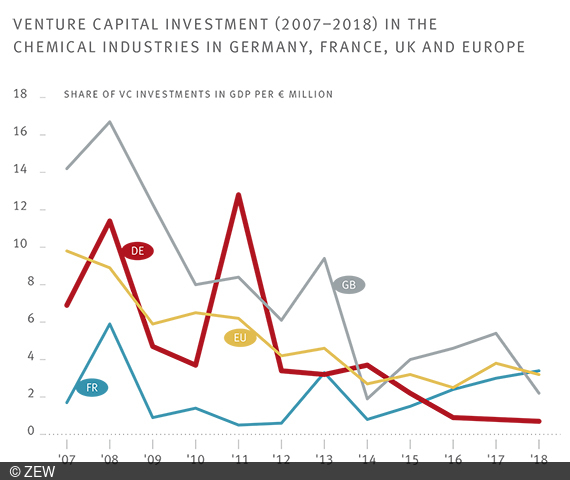

In terms of venture capital, German chemical start-ups are in a relatively weak position compared to their European competitors. While chemical companies across Europe were able to secure venture capital amounting to 54.5 million euros in 2018, chemical companies in Germany acquired merely 2.4 million euros in investments – the lowest value since 2007. With a total of 34.5 million euros, 2011 saw the highest volume ever recorded in terms of venture capital investments for German chemical companies.

In the period between 2015 and 2018, an average of seven per cent of all venture capital investments in the European chemical industry went to German companies. Germany thus ranks seventh behind Great Britain (19 per cent), the Netherlands (16 per cent), Belgium (13 per cent), France (eleven per cent), Spain (ten per cent) and Norway (eight per cent). This represents a substantial decline, especially when compared to historical standards: In the period between 2007 and 2010, Germany still ranked second, with a share of 16 per cent. In contrast, the German digital economy (46 per cent) and the biotechnology and healthcare sector (19 per cent) received significantly more venture capital between 2015 and 2018.

“When compared to the other two leading chemical-producing countries in Europe, Great Britain and France, Germany’s weak development in terms of venture capital investments becomes particularly evident. In most Scandinavian countries as well as in the Netherlands and Belgium, the chemical sector plays also a more important role in the respective national venture capital markets than it does in Germany,” concludes Christian Rammer. “It is therefore all the more important for legislators to improve incentives to mobilise private venture capital; otherwise we risk compromising Germany’s attractiveness as a location for chemistry research,” emphasises Gerd Romanowski.

Declining number of start-ups

Venture capitalists investing in German chemical start-ups are mainly concentrating on young patenting companies. These have so far filed almost 550 patent applications. However, merely 25 per cent of chemical start-ups in Germany have applied for at least one patent. According to the authors of the study, this relatively low share can be attributed to the fact that the majority of chemical start-ups focus on offering services. “It is usually not possible to secure patent protection for innovative services,” explains Christian Rammer. Start-up companies that specialise in research and development (R&D) services are also less likely to file patent applications, as they carry out R&D for third parties and therefore cannot protect the R&D results themselves via patents.

Finally, the study also revealed that the number of start-ups in the German chemical and pharmaceutical industries has developed less favourably than in other major European economies. While the start-up rate in Germany declined from 2008 to 2016, most European countries considered in the study recorded rising start-up rates in the chemical and pharmaceutical industries.

In their study, the researchers defined chemical start-ups as young companies that offer innovative products and services for the chemical industry on the basis of chemistry-specific knowhow or chemical technology. The firm-level data analysed in this study stems from the Mannheim Enterprise Panel of ZEW as well as from a list of chemical start-ups compiled by “Forum Startup Chemie”, an initiative to support start-up companies in the chemical industry. The researchers identified a total of 281 chemical start-ups that were active at the beginning of 2019. A central feature of these start-ups is their focus on innovation.