Sense of Optimism in Commercial Real Estate Financing Remains High

DIFI Report by ZEW and JLLDIFI at Its Highest Level Since Autumn 2019

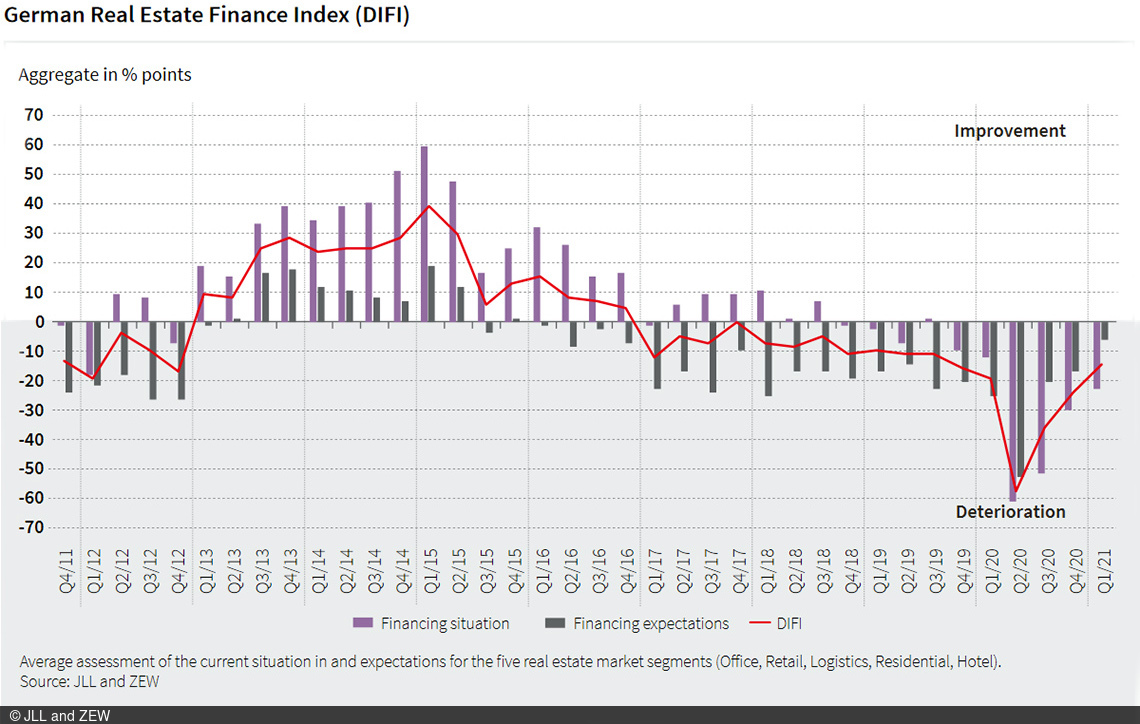

The German Real Estate Finance Index (DIFI) by ZEW Mannheim and JLL continues its recovery in the first quarter of 2021. Despite the gain, it still remains in the red with a total of minus 14 points (plus 9.5 points compared to the previous quarter). Both the current financial situation and the financing outlook for the forthcoming six months are assessed more positively than at the end of the fiscal year 2020. According to the survey participants, the outlook is bleak for the retail sector, which is struggling due to the lockdown brought about by the coronavirus pandemic. By contrast, there is more of a positive outlook regarding the financing situation for office and hotel properties in the next six months

With regard to the office real estate financing market, the experts surveyed indicated that they plan to reduce their involvement within this segment relative to last year. The current crisis has led to a change in circumstances that are relevant for financial decisions. For example, assessment criteria such as the attractiveness of work-from-home for tenants and the flexibility of transforming a building to comply with hygiene concepts have become either important or extremely important factors.

These are the key findings of the survey on the commercial real estate financing market in Germany, conducted on a quarterly basis by ZEW in cooperation with JLL.