ZEW Conference on Ageing and Financial Markets

ConferencesEconomists Discuss the Effect of Demographic Change on Household Finances and Banking

How does demographic change affect financial markets and their actors? What are the policy implications of current research findings, and how can research evolve from this? To address these questions, ZEW Mannheim organised the first conference on “Ageing and Financial Markets” from 10 to 12 February 2021 as an online-only event with guests from all over the world.

In addition to keynotes by leading experts in household finance and the analysis of social security systems, the event featured presentations and discussions on 14 selected research papers.

Keynotes on private finance and retirement planning: Focusing on social interactions and the impact of the coronavirus pandemic

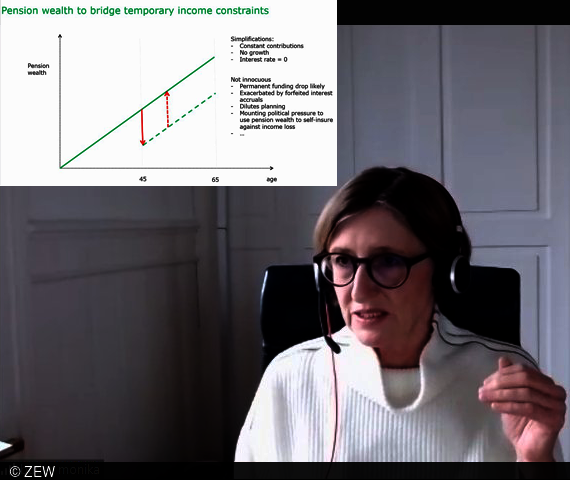

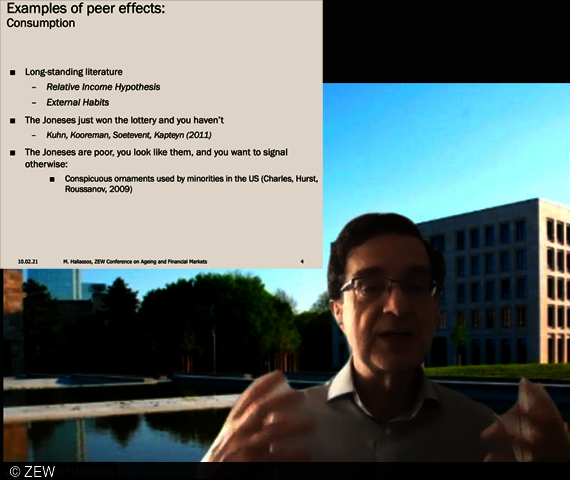

Michael Haliassos, professor of macroeconomics and finance at Goethe University Frankfurt and founding director of the Centre for Economic Policy Research (CEPR) Network on Household Finance, opened the event. His lecture provided insights into the importance of social interactions for the analysis of household finances. He addressed, for example, peer effects and the underlying mechanisms. Professor Monika Bütler from the University of St. Gallen in Switzerland not only discussed the effects of economic and social crises on retirement systems in her keynote but also gave insight into her current work as an economist for the «Swiss National COVID-19 Science Task Force». In her presentation, she impressively portrayed the timeliness and importance of the conference’s topic and the research field at large, as the dangers of the pandemic meet a tension between demographic change, the need for reform, and low interest rates.

Later in the conference, researchers presented selected papers on the effect of demographic change on firms and banks, the design of pension systems and information provision regarding retirement savings, expectation formation, retirement planning, and the role of annuities and unexpected pre-retirement shocks. Among others, approaches to the following questions were discussed:

- How does demographic change affect the refinancing, lending and risk-taking of banks?

- What are short-term and long-term expectations of households in three highly welfare-relevant markets: the stock market, the labour market, and the housing market?

- What is the effect of defaults on public pension enrolment?

- Which methods can successfully increase longevity awareness?

- What is the effect of increasing retirement age on middle-aged households’ savings and consumption expenditures?

The conference provided both an outstanding opportunity to critically discuss current research in household finance and banking, and to interact with researchers from around the world.