Uncertainty About Inflation Development in the Eurozone

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomic Experts Do Not Yet Expect a Major Turnaround in Monetary Policy

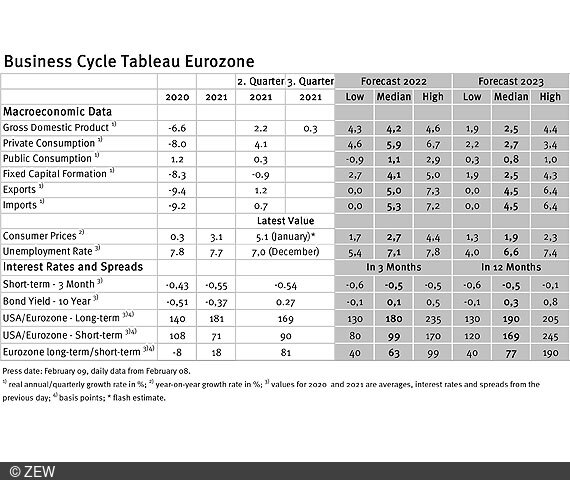

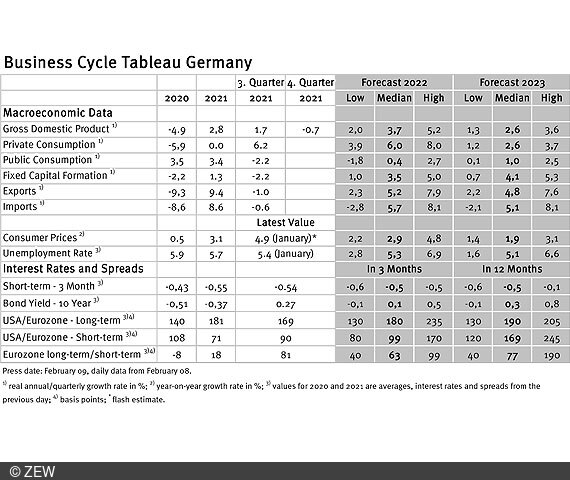

Economic experts are forecasting somewhat lower real gross domestic product (GDP) growth in the eurozone, and growth expectations for Germany are declining even more significantly. The inflation rate is hitting new highs, creating uncertainty about future developments. This is the result of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

The median forecast for eurozone GDP growth in 2022 has fallen very slightly since last month, from 4.3 per cent to 4.2 per cent. For Germany, the decline is much larger: the median forecast has fallen from 4.0 per cent in January to 3.7 per cent.

Peak inflation rate driven by energy prices

It will be particularly interesting to see how inflation will develop this year. In January, the inflation rate in the eurozone hit a new temporary high of 5.1 per cent, even surpassing the German inflation rate, which was 4.9 per cent in January. Eurostat continues to cite the rise in energy prices as the main reason for the strong increase in consumer prices in the eurozone. In January, the inflation rate for the energy sub-index was 28.6 per cent; without energy prices, the inflation rate would have been 2.6 per cent. Although this value is also above the European Central Bank’s (ECB) target value of 2 per cent, the core inflation rate (excluding the sub-indices energy, food, alcohol and tobacco) was only slightly above it at 2.3 per cent.

Inflation rate: uncertainty in forecasts increases

The median forecast for the inflation rate in the eurozone for 2022 was raised significantly compared to the previous month, from 2.4 per cent to 2.7 per cent, and thus roughly equals the current value of the inflation rate, which is calculated without taking energy prices into account. The highest forecast value, however, is 4.4 per cent; in January, the highest value of the forecasts was still 3.1 per cent. Uncertainty about how inflation will develop thus seems to have increased noticeably and some experts assume that the inflation rate will only fall slightly on average for the year. However, this has not yet had an impact on interest rate forecasts.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.