Second Annual MIFE Conference Sheds Light on Financial Literacy in Times of Crisis

ConferencesThe second MIFE annual conference focused on financial education in the current crisis and reflected on the existing challenges. The conference of the Mannheim Institute for Financial Education (MIFE), a joint initiative of the University of Mannheim and ZEW Mannheim, took place on 16 November 2022 and was followed by a two-day early career workshop. More than 90 international participants discussed recent scientific contributions on financial literacy, financial education and implications for policy and practical application, especially in the context of the current crisis. Five distinguished keynote speakers were invited to share their views on the topic.

The first keynote lecture was given by Gerrit Antonides, Professor of Economics of Consumers and Households at Wageningen University in the Netherlands. In his keynote, he discussed mental budgeting and its role for financial management, consumption behaviour, and taxation. Based on findings from his unique survey studies, he illustrated that mental budgeting can improve financial management, encourage consumers to save money, and lead to higher tax compliance.

The importance of financial literacy

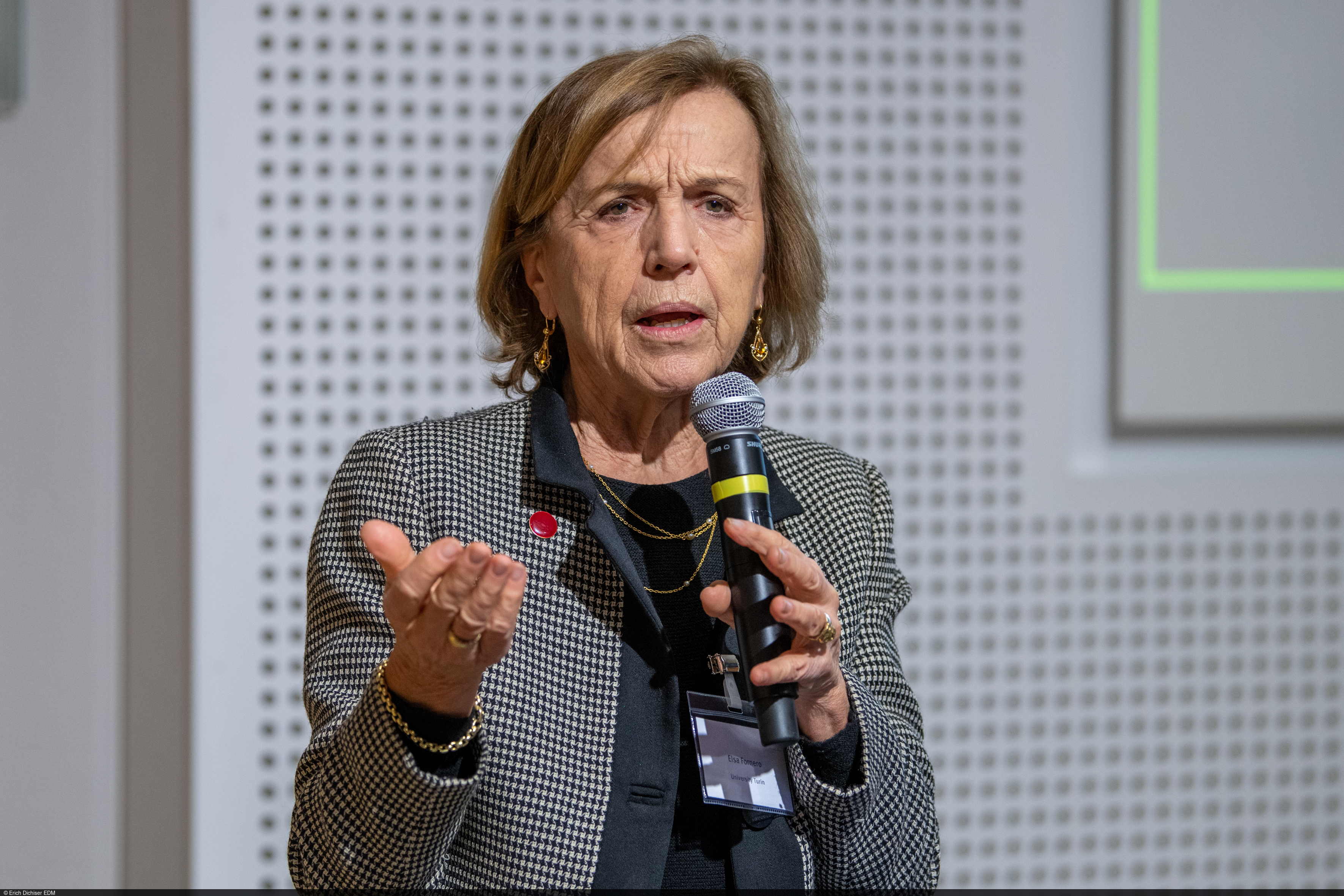

In her keynote entitled „Now More than Ever: Why Financial Literacy Is a Key Element of Post-COVID-19 Recovery”, Professor Elsa Fornero from the University of Turin’s Center for Research on Pensions and Welfare Policies (CeRP) argued that financial literacy is an important dimension of civic engagement and a key element for better democracies. Financial literacy can be achieved by investing in education and should be tackled in every part of the human life cycle, beginning with youth. Furthermore, financial literacy contributes to women’s economic independence, which in her view bears a high social value. In view of the growing problem of fake news and bad sources of information, Fornero recommends clear institutional communication.

In his keynote, Professor Martin Brown (Study Center Gerzensee and University of St. Gallen, Switzerland) presented research on digitalisation of payment processes and its influence on consumer spending behaviour. Analysing data from the Swiss National Bank in combination with survey data, he showed that cashless payment methods are associated with higher spending by present-biased consumers.

Solid financial knowledge as a key qualification

Burkhard Balz, member of the Executive Board of the Deutsche Bundesbank and responsible for economic education, underlined the importance of financial literacy for price stability and economic well-being in his keynote. Solid financial knowledge is a key skill both for households to navigate through the rising uncertainty in times of crisis as well as for the Bundesbank to achieve its key objective of price stability. Both his keynote and the discussion with the audience reflected upon strategies for making financial education accessible to a wider audience and the role of researchers, practitioners, public institutions, and businesses in implementing them.

Bundesbank Early Career Research Prize on Financial Literacy 2022

In order to foster exchange between these stakeholders and promote basic research on financial education, the Deutsche Bundesbank is awarding the Bundesbank Early Career Research Prize on Financial Literacy 2022, endowed with 5,000 euros. The scientific committee selected the two outstanding contributions by Dongni Duan, a PhD student at the University of Glasgow, and Andrea Hofer, a post-doctoral researcher at the Swiss National Bank and the University of Zurich, from all the contributions submitted to the MIFE Early Career Workshop. In their paper “Growing up with Finance: Special Economic Zoning and Household Finances in China”, Duan and her co-author aim to identify whether early-life exposure to special economic zoning reforms exerts an impact on formal financial market participation, equity, and other assets market participation after the reform. In her paper “A Purse of Her Own: Married Women’s Access to Financial Services and Female Labor Supply”, Hofer examines the effects women’s financial inclusion in the US. Her aim is to understand the impact of the Equal Credit Opportunity Act (ECOA) anti-discrimination legislation in the 1970s on married US women’s ownership of a bank account, credit card or taking out a loan, and on their labour market choices. Both winners proposed innovative and interesting research questions relevant for financial stability.

MIFE Early Career Workshop

The annual conference was followed by the two-day MIFE Early Career Workshop, where young researchers from around the world presented and discussed thirteen research papers on financial literacy and financial education. Presenters and discussants came from different fields, including economics, household finance, economics and business education, psychology, and related disciplines. In addition to the outstanding presentations and fruitful discussions, Professor David Leiser from Ben-Gurion University of the Negev’s Center for Pension, Insurance and Economic Psychology in Israel held a keynote on the way people (mis)understand economic phenomena and the cognitive causes of these (mis)understandings. He also pointed out the relevance of this (mis)understanding for practice, policy, and research.