Reliable Monetary Policy in Uncertain Times

EventsPresident of Deutsche Bundesbank at “First-Hand Information on Economic Policy” Event in Mannheim

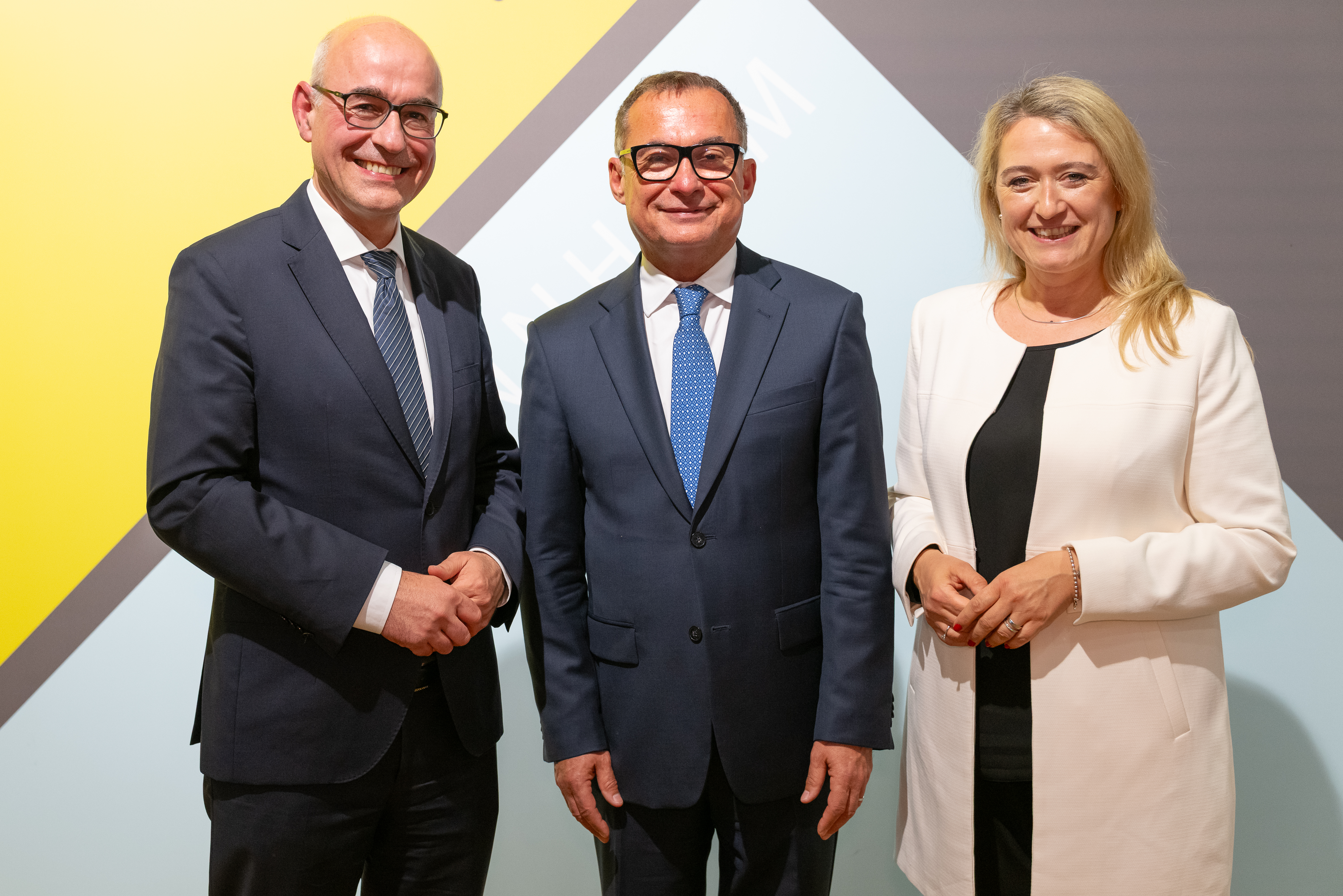

The tensions in international trade policy, the new geopolitical realities and their financial policy implications pose challenges for Europe. How should the central banks of the Eurosystem deal with the high level of uncertainty? How can a robust monetary policy maintain its function as an anchor of stability in these turbulent times? The President of the Deutsche Bundesbank, Dr. Joachim Nagel, discussed these questions with ZEW President Professor Achim Wambach, PhD at a lecture event at ZEW Mannheim on 27 May. The event was organised as part of the event series "First-Hand Information on Economic Policy", supported by the ZEW Sponsors' Association.

Monetary policy must remain consistent

The Bundesbank president emphasised that the European Central Bank should not decide lightly on interest rate cuts under any circumstances. On the contrary, in view of the existing data and modelling uncertainties, each action required careful consideration and caution. In Nagel’s opinion, an easing of monetary policy could be a useful strategy to provide economic stimulus, especially in times of crisis. On the other hand, Nagel also pointed out that inflation had proved to be stubborn. Monetary policy response therefore had to be firm – a balancing act.

According to Nagel, the current high level of economic and political uncertainty somewhat dampens the joy over a positive development, although the inflation rate in the euro area has fallen from 2.5 per cent early in the year to 2.2 per cent in April. This means that the European Central Bank's inflation target is finally within reach, according to Nagel. Nevertheless, the road ahead remained rocky, as core inflation in particular had recently risen again significantly, touching the four-per cent mark. Nagel emphasised that for this reason, he would continue to advocate a monetary policy course in which the inflation rate settles at a sustainable two per cent.

Credibility is a crucial factor for fiscal policy

ZEW President Achim Wambach emphasised the importance of stable and credible fiscal rules to counter inflation. He argued that location factors such as increased wage costs were an acute driver of inflation in Germany. If financial flexibility were to be maintained for future challenges, it would be essential to ensure sound financial management.

Wambach pointed out that despite the European Central Bank's interest rate cuts, the economic situation in Germany had hardly improved recently. Hopes of a rapid economic recovery were fading, as key industries in particular were under pressure. With regard to the indebtedness of the EU Member States, Wambach said that it was becoming increasingly difficult to solve this problem through economic growth.

Protectionist measures could have a significant negative impact on the European economy

Nagel expressed his concern about the economic impact of the tariffs announced by US President Donald Trump. Warning of a possible turning point for the international trade order as a result of such protectionist stance, he emphasised that these measures could place a considerable burden on both the German and European economy.

Wambach stressed that the United States’ tariff policy and the resulting uncertainties also presented an opportunity for the European Union. In particular, new free trade agreements appeared more feasible than in the past. In the subsequent Q&A session with the audience, Nagel stated that monetary policy must remain steadfast in the face of external political pressure and that the decisions to be made should continue to be substantiated by solid data wherever possible.