Recession Seems to Be Inevitable

ResearchBusiness Cycle Experts Expect Technical Recession

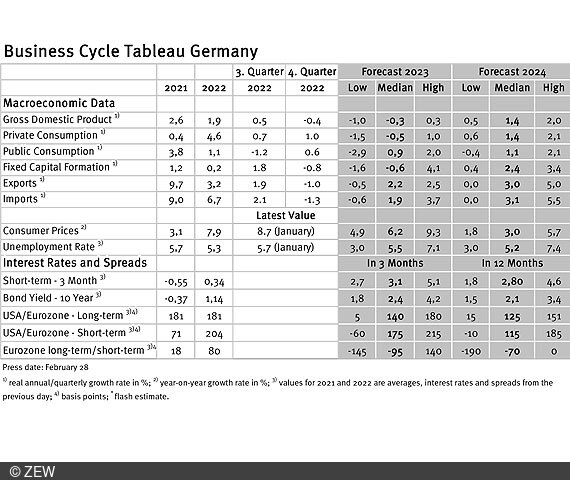

Although the business cycle experts are less pessimistic in their growth forecast for 2023, Germany’s real gross domestic product (GDP) will most likely end the first quarter in a technical recession. This is mainly due to weak private consumption caused by the high inflation rate. The forecasts for the eurozone are much better. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

Compared to the previous month, the growth forecasts have changed only slightly. For German real GDP in 2023, the experts expect to see a decline of “only” 0.3 per cent, compared to 0.5 per cent previously. For 2024, the median forecast has remained unchanged at 1.4 per cent.

Weak consumption slows economic growth

After a quarter-on-quarter decline of 0.4 per cent was recorded in the fourth quarter of 2022, a so-called technical recession has now become very likely. Technical in this context means that real GDP shrinks in (at least) two consecutive quarters compared to the previous quarter, but the negative impact on the overall economy is relatively small. Thus, according to current forecasts, unemployment is expected to remain at 5.5 per cent in 2023, only slightly higher than the year before, despite the expected negative GDP development. And for 2024, a decline to 5.2 per cent is forecast. Despite the expected small increase in unemployment, economic growth is predicted to be slow in 2023, driven mainly by weak private consumption. The significant loss of real wages due to the relatively high inflation rate is expected to have a negative impact.

Improved economic outlook for the eurozone

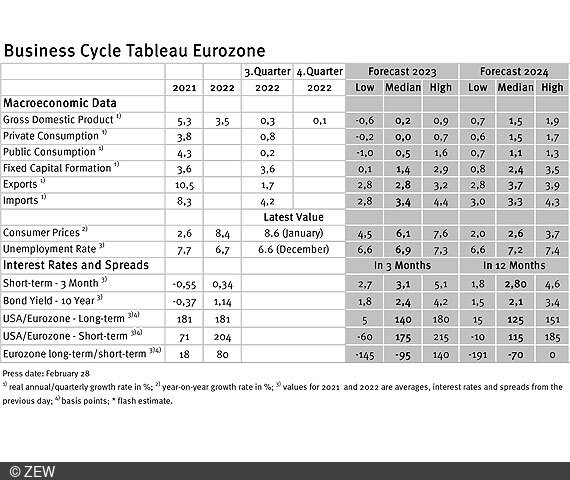

For the euro area, the growth forecast for 2023 remains at 0.2 per cent, while the median forecast for next year rises slightly from 1.2 per cent to currently 1.5 per cent. Compared to Germany, the economy in the eurozone is expected to develop somewhat better, as a recession is rather unlikely there according to the forecasts.

Slight optimism despite high inflation

With regard to the inflation trend in Germany, the forecasts are somewhat more optimistic than in the previous month, despite a currently still very high inflation rate of 8.7 per cent. The median forecast for 2023 has fallen from 7.0 to 6.2 per cent. At 3.0 per cent, the inflation forecast for next year is also lower than a month ago (3.6 per cent). At present, this does not seem to have any influence on the expectations regarding monetary policy. Based on the current 3.0 per cent for the ECB’s main refinancing rate, the experts expect an average three-month rate of 3.1 per cent this year. Next year it is expected to be only slightly lower at 2.8 per cent on an annual average.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.