Persistently High Inflation Rates for the Eurozone

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomic Experts Forecast High Rates of Price Increases for 2023 Again

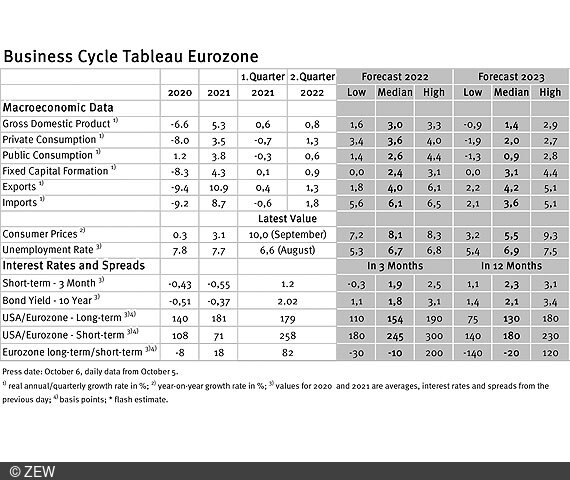

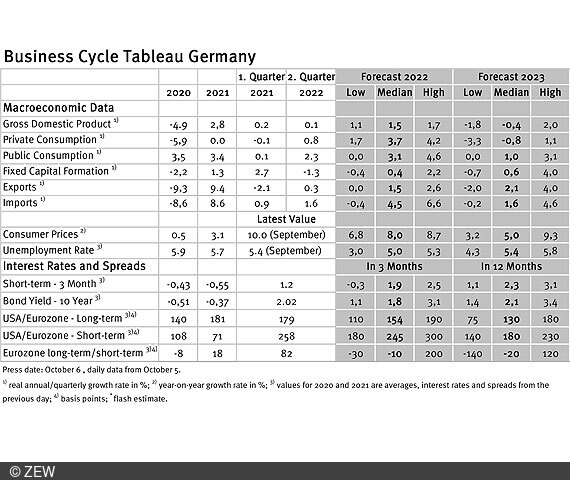

Economic experts expect a decline in Germany's gross domestic product due to the expected energy supply problems. Inflation forecasts are also influenced by this and are raised further for the eurozone. This is the result of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

While the growth forecasts for the eurozone have changed only marginally compared to the previous month, the forecasts for the German economy for 2023 decline very significantly. For the current year, the median forecast is unchanged at a real gross domestic product (GDP) growth rate of 1.5 per cent, but for 2023 a decline of 0.4 per cent. In the previous month, the forecast was still (plus) 1.3 per cent. The central trigger for the expected decline in German GDP is the considerable problems feared in the energy supply for industry and private households, especially for gas. However, the recession currently predicted for 2023 is still quite moderate and not comparable to the values that occurred in 2009 (financial crisis: minus 5.7 per cent) and 2020 (Covid19 crisis: minus 3.7 per cent).

Price increase rates significantly above the two-percent mark: Is a tighter monetary policy on the way?

Fears of energy shortages are also reflected in the inflation forecasts. For Germany, 8.0 per cent for 2022 and 5.0 per cent for 2023 are currently predicted; previously in September, these forecasts were still at 7.4 and 4.3 per cent, respectively. The experts are thus assuming a permanently high inflation rate in Germany. The situation is similar for the eurozone. The current forecasts for the inflation rate are 8.1 per cent (2022) and 5.5 per cent (2023). A month ago, 7.7 and 3.7 per cent were still assumed. In line with these high rates of price increases also forecast for 2023, which are far above the two per cent mark of the European Central Bank (ECB), the experts expect a further tightening of monetary policy. For 2022, a rise in the three-month interest rate to 1.9 per cent is assumed, in 2023 this rate is to rise to 2.3 per cent. In the previous month, they still assumed 1.0 and 1.6 per cent. Long-term interest rates, on the other hand, are not expected to rise much further. As a result, a flat or even slightly inverted yield curve is (implicitly) forecast, which is compatible with the sobering growth forecasts.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.