Outlook for 2023 Has Worsened

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomic Experts Are Anticipating a Persistent High Rate of Inflation and a Decline in GDP

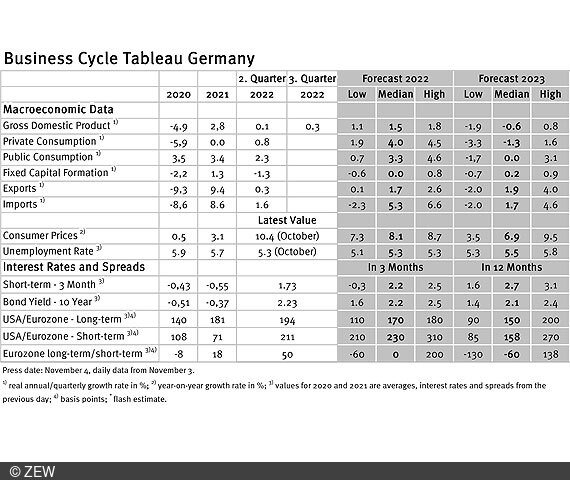

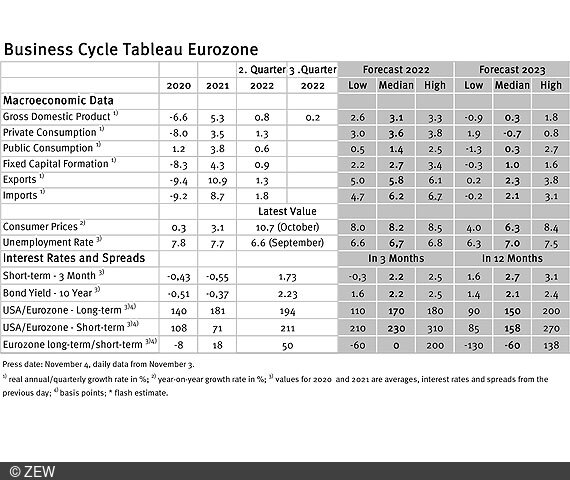

Business cycle experts are expecting a decline in German gross domestic product (GDP) owing to reduced household consumption, which is partly due to the high inflation rate. In 2023 the inflation rate in the eurozone is predicted to be somewhat lower than in Germany. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

Third quarter growth in the German economy is somewhat better than expected. Up 0.3 per cent on the previous quarter, real GDP in Germany grew slightly more than the eurozone average, which stood at 0.2 per cent for the third quarter.

Decline in private consumption and minimal growth in private investment expected

Prospects for 2023 have, however, further deteriorated. The median forecast for 2023 puts the decline in real GDP at 0.6 per cent, in the previous month this estimate stood at minus 0.4 per cent. The experts see trends in household consumption as particularly bleak. In 2023 this is expected to decrease 1.3 per cent on average and therefore contribute significantly to the decline in real GDP. Private investment is also expected to increase only marginally at 0.2 per cent. According to the experts, public spending, which made a significant contribution to this year’s growth, is likely to remain unchanged from the preceding year in 2023 and thus no longer act as a growth factor. On a positive note, there is no sign of a turn for the worse in the labour market. The unemployment rate in Germany is expected to rise only marginally to 5.5 per cent, from the current rate of 5.3 per cent.

Annual inflation rate for 2023 higher than so far expected

Inflation projections for 2023 have once again been considerably raised. Experts now expect a significant increase in the annual rate of inflation to 6.9 per cent, as last month’s projection put predicted inflation at just 5.0 per cent. The expected decrease in the rate of inflation from this year to the next also looks rather moderate. With 8.1 per cent in 2022 and the aforementioned 6.9 per cent in 2023, the two values have now converged to a high level.

The inflation rate in the eurozone remains significantly above the target level of the ECB

For the eurozone the projections generally look similar. The rate of inflation in the eurozone in 2023 is expected – as in the current year – to be slightly lower than the inflation rate in Germany, at 6.3 per cent. It would therefore certainly still far surpass the European Central Bank’s target level. Accordingly, the experts surveyed assume that short-term interest rates will continue to rise next year and reach 2.7 per cent at the end of 2023. This means a further increase in three-month interest rates by around 100 basis points. As the long-term interest rates are expected to stay put at their current level, this should lead to a yet further inverted yield curve, with a median of minus 60 basis points. This means in 2023 long-term bonds should exhibit lower yields than short-term bonds of the same credit quality.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.