German Economy Treads Water

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomic Experts Do Not Yet Give the All-Clear on Recession Risk

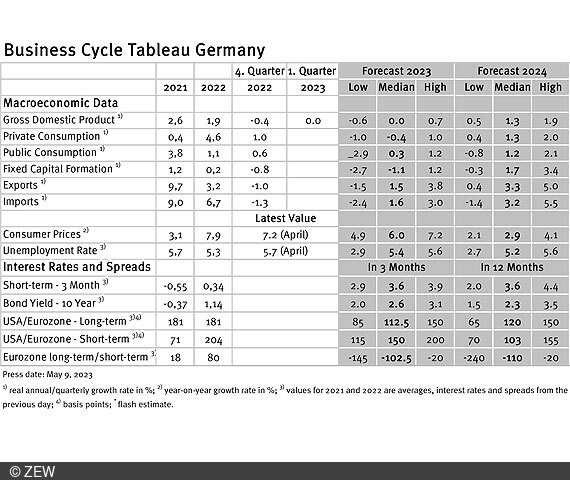

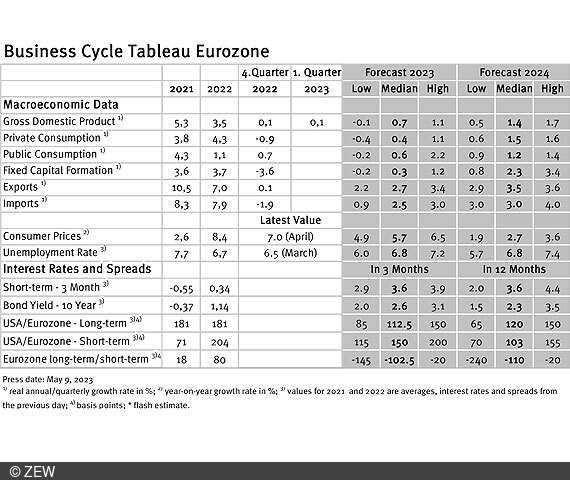

Once again, economic experts have given a rather unfavourable outlook for the German economy. It’s expected that real gross domestic product (GDP) will remain stagnant this year, with no growth anticipated. However, the forecasts for the eurozone are much brighter, with a significant decline in the inflation rate expected. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

The German economy experienced a period of stagnation during the first quarter of this year, while the eurozone saw very weak growth of just 0.1 per cent in the same period, compared to the previous quarter. The outlook for Germany’s economy for the entire year isn’t much better, with experts predicting that real GDP will remain stagnant. In fact, the previous forecasted growth rate of 0.1 per cent has now fallen to zero per cent, according to the latest expert projections.

German economy lags behind eurozone

Although the situation is far from ideal, things look much better for the euro area. The experts expect that real GDP will increase by an average of 0.7 per cent compared to the previous year; last month, the forecast was still at 0.8 per cent. According to these forecasts, the German economy will perform significantly worse than the rest of the euro area this year. In fact, a longer-lasting but rather weak recession is quite possible in 2023. This is mainly due to reduced private consumption and strongly declining fixed investments by companies.

Looking ahead, growth rates are expected to converge in the coming year, with forecasts of 1.3 per cent for Germany and 1.5 per cent for the eurozone.

Inflation receding

The rate of consumer price inflation in Germany slightly declined from 7.4 per cent in March to 7.2 per cent in April. The forecast for the entire year of 2023, however, remains unchanged at 6.0 per cent. In order for this forecast to turn reality, the inflation rate would have to average around 5 per cent from May to December, which is a considerable decline in the coming months but still possible. Additionally, a further drop in the inflation rate to an annual average of 2.9 per cent is projected for 2024.

ECB target not reached in 2024 either

The inflation forecasts for the eurozone are very similar, but according to the latest expert projections, the European Central Bank’s (ECB) target of 2.7 per cent is still not likely to be reached again in 2024. As a result, there should be no easing of monetary policy in that year. The 3-month interest rate forecasts are slightly higher than the previous month’s projections, with experts forecasting 3.6 per cent for both 2023 and 2024, compared to 3.3 per cent for 2023 and 3.4 per cent for 2024. Meanwhile, the projections for 10-year government bond yields remain unchanged at 2.6 per cent for 2023 and 2.3 per cent for 2024, which suggests that the interest rate structure will become more inverted in the coming years.

Business Cycle Tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.