Eurozone Economy Back on the Growth Track

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomic Experts Confirm Last Month’s Forecast

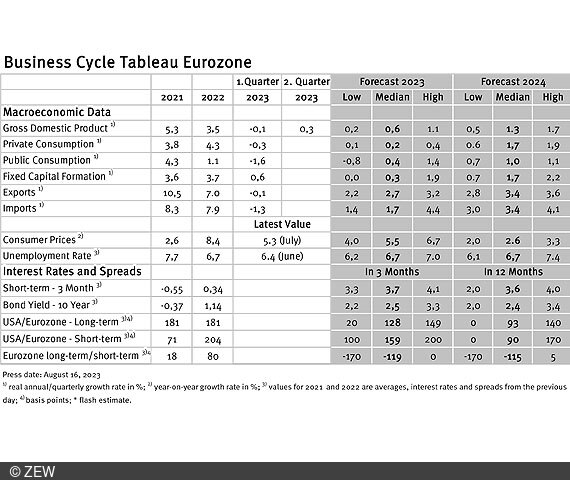

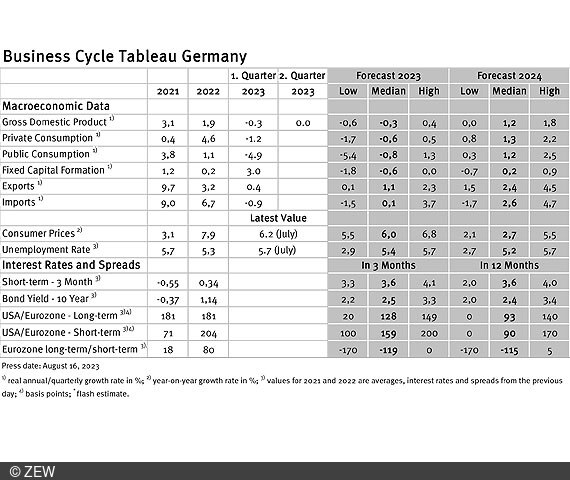

According to economic experts, unlike in Germany, the eurozone’s economy appears to be making a recovery from recession and picking up momentum once again. However, the forecasts for this year and the next remain unaltered. Despite a dip in inflation, there are currently no signs of an imminent easing of monetary policy. These are the results of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

Preliminary figures from Eurostat suggest that the recession in the eurozone seems to have been overcome. Eurozone real gross domestic product (GDP) recorded a solid 0.3 per cent quarter-on-quarter increase in the second quarter of 2023. However, the figures for real GDP were revised downwards after the preliminary values for the fourth quarter of 2022 and the first quarter of 2023 were announced. There is a certain probability that the same revision may also apply to the figures for the second quarter.

It is noteworthy that in the second quarter of 2023, growth in the 27 EU Member States, in contrast to the 19 Euro Member States, merely stagnated. According to preliminary data from the Federal Statistical Office, this also holds true for the German economy. Nevertheless, the forecasts for 2023 and 2024 remain unchanged for both the eurozone and Germany.

Inflation and unemployment experience slight declines

The latest data for the eurozone point to a slight decline in inflation. In July, the inflation rate stood at 5.3 per cent, down from 5.5 per cent in June. Despite the relatively subdued economic conditions, the unemployment rate has decreased from 6.5 per cent in June to the current 6.4 per cent. However, the forecasts for inflation and unemployment rate remain largely unchanged. Only the inflation projection has marginally decreased from 5.6 per cent to 5.5 per cent on average for the year 2023.

No shift in monetary policy

In terms of monetary policy, experts foresee a minor rise in short-term interest rates later this year. The annual average value is now estimated at 3.7 per cent, up slightly from the previous month’s 3.6 per cent. In essence, this forecast implies no significant shift towards tighter monetary measures. However, as the inflation rate for 2024 is expected to average 2.6 per cent – well above the European Central Bank’s (ECB) target –, they also do not foresee any easing of policy measures.

Business Cycle Tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.