Economic Forecasts for 2021/22 Raised

Business Cycle Tableaus by ZEW and Börsen-ZeitungEconomists More Optimistic Again

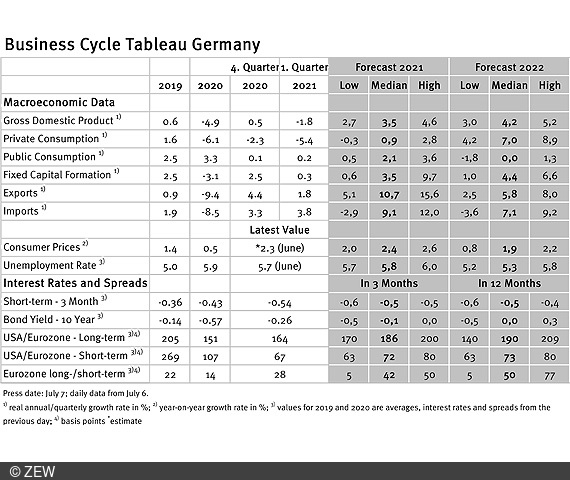

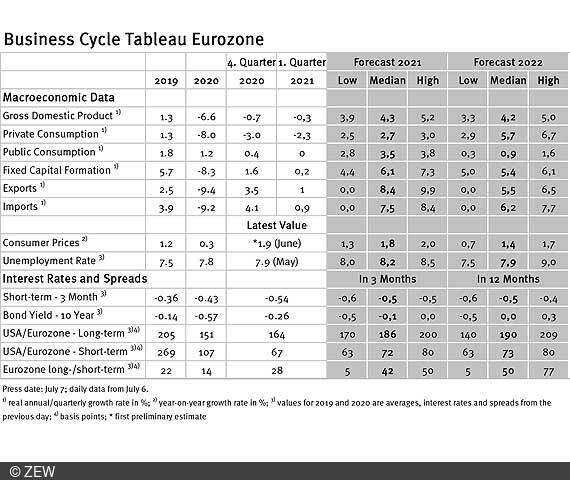

Economic experts assess the inflation risk as low and expect the current high rate of price increases to be only short-lived. The forecasts for economic growth in Germany were raised, while the estimates for the euro area remained virtually unchanged. This is the result of the business cycle tableaus by ZEW Mannheim and the German daily newspaper, Börsen-Zeitung.

Due to the progress made in the fight against the pandemic in Germany, economic forecasts have improved. The median forecast for real gross domestic product (GDP) in the current year is now 3.5 per cent, an increase of 0.2 percentage points compared to the previous month. The forecast for 2022 was raised from 3.9 to 4.2 per cent. This year, experts see exports and recovering capital investments as the main economic drivers. Next year, growth is expected to be driven mainly by private consumption and corporate fixed investments. The situation is quite similar for the euro area, even though the GDP forecasts have changed only slightly compared to previous month’s values. The main factors boosting the economy in 2021 are fixed capital formation, exports and public consumption. In 2022, it is mainly private consumption and fixed investments that are expected to drive economic growth.

Risk of inflation remains low

What is of particular interest at the moment is whether the inflation forecasts have changed noticeably. The inflation rate in Germany fell from 2.5 per cent in May to 2.3 per cent in June, while the annual forecast remains unchanged at 2.4 per cent compared to the previous month. For 2022, it is revised up from 1.7 per cent in June to currently 1.9 per cent. Nevertheless, the inflation rate is still expected to fall in 2022. Inflation risks are therefore still considered to remain low and the current comparatively high rates of price increases are regarded to be only short-lived. The situation is quite similar for the euro area. The inflation rate of 1.8 per cent forecast for this year (previous month: 1.7 per cent) already marks the upper turning point. Already for 2022, the inflation rate of 1.4 percent is expected to return to the low level seen for years. Accordingly, experts do not expect the ECB to adjust its very loose monetary policy. Even long-term interest rates are expected to barely deviate from zero per cent on an annual average in 2022.

Decline in the unemployment rate

Good news is coming from the labour market both in Germany and the euro area. The unemployment rate in Germany was only 5.7 per cent in June 2021 (previous month: 5.9 per cent). For the entire year, the unemployment rate is forecast at 5.8 per cent, which would be only a slight decline compared to 2020. In 2022, the unemployment rate is expected to decrease even more rapidly, falling to an annual average of 5.3 per cent. The outlook for the euro area is not quite as good, although unemployment is also expected to fall discernibly until the end of 2022. For 2021, the projected unemployment rate in the eurozone has been lowered to 8.2 per cent (previous month: 8.5 per cent). Next year it is expected to fall further, to an average of 7.9 per cent.

Business cycle tableaus by ZEW and Börsen-Zeitung

In cooperation with Börsen-Zeitung, ZEW has been publishing monthly business cycle tableaus for Germany and the eurozone with economic key figures and forecasts since 2013. Numerous banks and institutes publish reports on the current and prospective economic situation at different intervals. The information relevant for the tableau is filtered out of these publications to compute a median, minimum and maximum of the available forecasts for the current and subsequent year.

The monthly tableaus show current GDP forecasts, its main components, consumer prices, industrial production, unemployment rate, short- and long-term interest rates, and interest rate spreads. The focus of the tableaus lies on national business cycle reports, which are complemented with forecasts from international banks and institutes. The tableau for the eurozone is enhanced by data from European banks and institutes.