ZEW-ZEPHYR M&A Index - Fresh Impetus for Worldwide M&A Activities

M&A IndexFollowing first signs of recovery in worldwide mergers and acquisitions (M&A) in autumn 2013, the positive trend has now become a considerable upswing. This is the result of calculations by the Centre for European Economic Research (ZEW) based on the database of Bureau van Dijk (BvD).

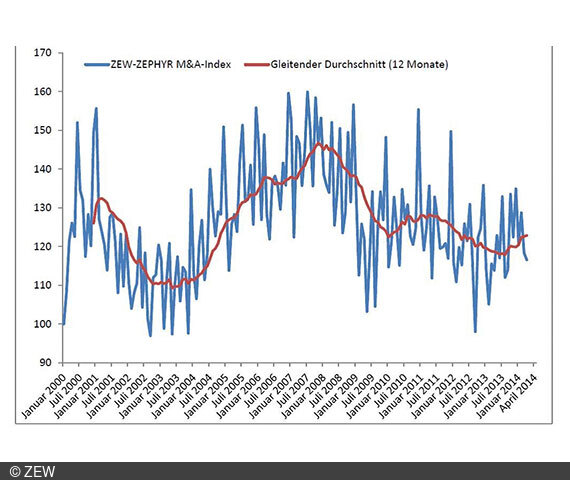

At the end of 2013, the ZEW-ZEPHYR M&A Index, which reflects the number of mergers and acquisitions realised worldwide, climbed to 135 points, its highest value since December 2012. The start into 2014 was a success as well. Compared to the weak first four months of 2013, the aggregate number of M&A transactions completed in the first four months of 2014 has grown by 10 per cent (by four per cent compared to the first four months of 2012). Upon consideration of the accumulated transaction volume adjusted for price, the increasing dynamics of worldwide M&A activities becomes even more visible. In the first four months of this year, the accumulated volume was 43 per cent higher than in the same period in 2013 (38 per cent higher than in 2012).

The recovery of the global M&A market is also reflected in the twelve-month moving average of the M&A Index. Since autumn 2013, the twelve-month average has reversed the trend and is now growing continuously. It currently stands at 123 index points. This is the highest value recorded in more than two years, since February 2012.

Rumours about impending mergers and acquisitions are considered a good indicator for future developments on the M&A market. The unusually high number of rumours about M&A deals indicates that the momentum for worldwide M&A activities will persist in the near future.

For further information please contact

Sven Heim, Phone +49/621/1235-183, E-mail heim@zew.de

Information to the ZEW-ZEPHYR M&A Index

The ZEW-ZEPHYR M&A Index is calculated monthly by the Centre for European Economic Research (ZEW) and Bureau van Dijk (BvD) and has been tracking the development of mergers and acquisitions completed worldwide since the beginning of 2000. The ZEW-ZEPHYR M&A Index is based on the number and the volume of global mergers and acquisitions recorded in BvD’s ZEPHYR database. The index uses the monthly rates of change of both the volume and the value of M&A transactions, which are combined and adjusted for volatility and inflation. As a result, the index provides a much more precise picture of the level of worldwide M&A activities than a simple observation of transaction volumes. The reason for this is that a company's stock market valuation has a strong influence on the transaction value, the more so because many acquisitions are paid for through an exchange of shares. Consequently, the share price would have a disproportionately strong influence on the assessment of transactions. If the total transaction volume is attributable to a larger number of transactions within one month, the value of the M&A Index increases even though the aggregate transaction value remains unchanged.